Published date: January 12, 2026 22:34

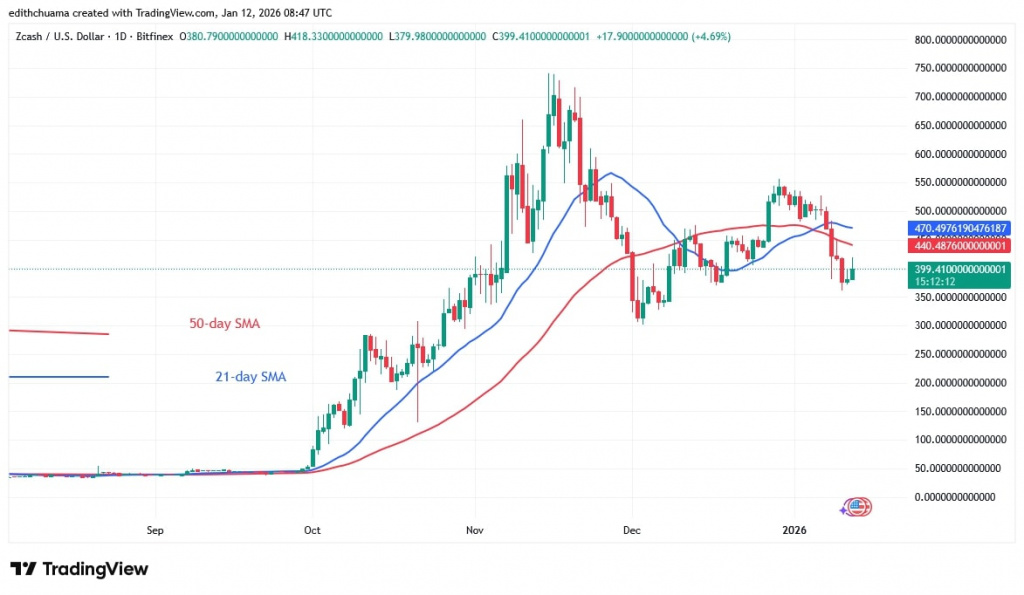

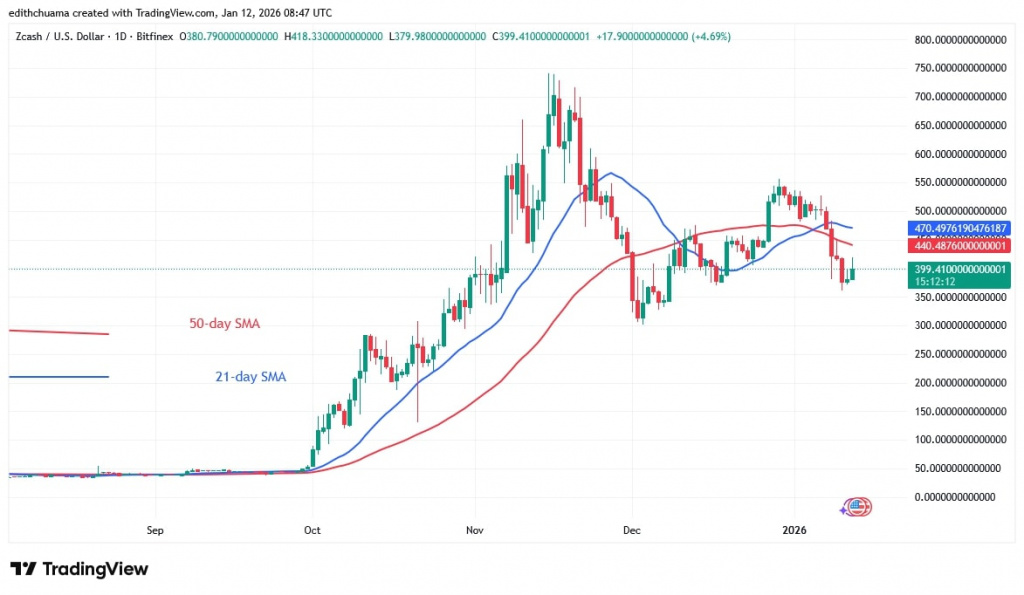

Zcash price is below its moving average after a bullish rally ended at a high of $556.

ZEC price long-term prediction: bearish

On December 29, 2025, buyers pushed the altcoin to a high of $556, but were rejected. This is the second time that the cryptocurrency’s rally has been blocked by the $600 resistance level. During the initial rejection, the altcoin fell to a low of $305.

Currently, ZEC is trading sideways, above the $300 support but below the $600 resistance. Price is currently correcting upwards and may encounter resistance at the moving averages. If buyers maintain the price above the moving average, ZEC will return to its previous high of $600. ZEC costs approximately $399.37.

technical indicators

-

Key resistance zones: $700, $750, and $800 -

Major support zones: $400, $350, and $300

ZEC price index analysis

The price bar is below the 21-day moving average and the 50-day moving average. While in a bearish trend zone, altcoins can fall.

On a 4-hour chart, the price bar is located between the downward moving averages. The bears are trying to push prices lower. If the 21-day SMA support is broken, ZEC will fall.

What’s ZEC’s next move?

On the 4-hour chart, Zcash price has been flat since the decline on January 8th. For the past five days, the altcoin has been trading above the $360 support and below the $440 resistance.

Currently, the cryptocurrency is falling and approaching the existing support level. If ZEC falls below the current support, further declines are possible It rose to an all-time low of $305.

Disclaimer. This analysis and forecast is the author’s personal opinion. The data provided was collected by the creator and is not sponsored by any company or token developer. This is not a recommendation to buy or sell cryptocurrencies and should not be considered an endorsement by Coinidol.com. Readers should do their research before investing in a fund.