The fear of the US recession is in the air following President Donald Trump’s tariff plans, with forecasting platforms multinationals and calci showing growing concerns that the economy will be hit.

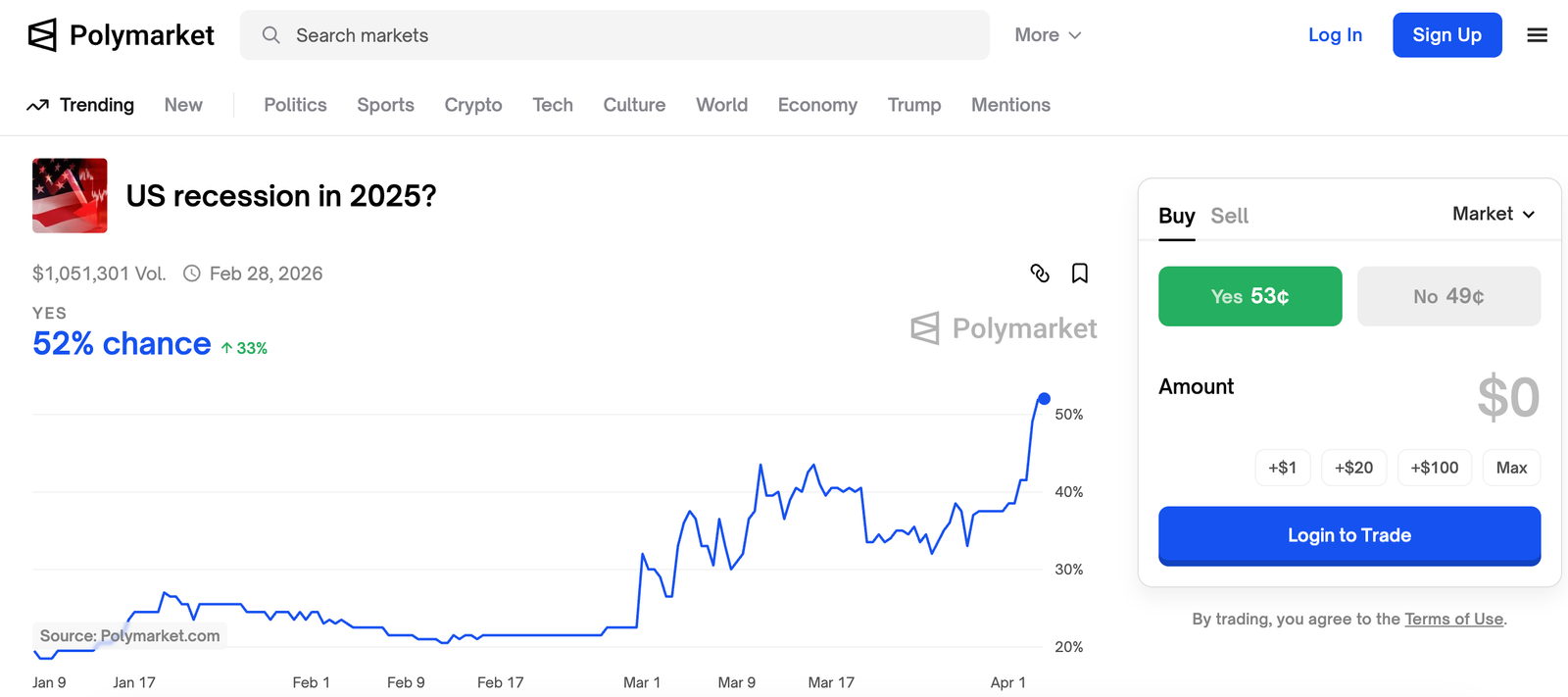

Polymarket, a decentralized forecasting platform, has been 50% of the time since this year’s betting contract, the 2025 US recession, began trading earlier this year. YES shares on the contract surged from 39 cents to over 50 cents within 24 hours.

If the National Economic Research Bureau (NBER) confirms a recession at any time prior to December 31st, the contract will be settled to YES. Other conditions require consecutive quarterly contractions in GDP.

Kalshi, a US-based, regulated forecast market, points to a growing economic concern among traders as the 2025 recession is likely to rise from 40% to 54%.

Financial markets tend to look ahead and can respond to the potential US recession by sending low risk assets such as Bitcoin (BTC) and other cryptocurrencies. At publication, the S&P 500 futures traded 3% lower, referring to severe risk aversion on Wall Street, providing bearish cues to Bitcoin, changing hands at $83,100, 1.5% lower in 24 hours.

The sweeping tariffs announced Wednesday set a 10% base rate on all imports and even higher taxes from 60 countries identified as the worst offenders. China, which was hit hardest, guaranteed 34% collection in addition to its existing 20% bill, bringing it to a total of 54%. Basic tariffs will come into effect on April 5th, and high mutual fees will come into effect on April 9th.

The Trump administration expects tariffs to correct a massive, permanent US commodity trade deficit, but in the short term it can increase domestic inflation and global instability. The latter could soon arise if China, the European Union and others fight back with higher tariffs and launch a full-scale world trade war.

Risk off short-lived?

Still, some observers say tariff uncertainty could only lead to a slowdown in the economy, not a full-scale recession.

“While the threat of further tariff escalation remains an important concern, our economic forecasts do not require a recession in the US,” UBS said in a blog post. “In our basic case, broad selective tariffs and retrograde could slow economic growth compared to last year, but should not prevent the US economy from expanding by around 2%.

When it comes to financial markets, some observers say tariffs are difficult. This means that the initial risk-off reaction is short-lived and could be quickly reversed by the Federal Reserve’s expectations of interest reductions.

“Remember – tariffs are on the way, and the big tariffs are incredibly incredible,” Joseph Wang, operator of research portal FedGuy.com, talks about X and details the tariffs will lead to more interest rate cuts, referring to a November post.

Wang argued that tariffs are inflation, but can be reduced through foreign exchange rates and are ultimately temporary. On the other hand, business sentiment damage can last long, leading to unemployment the Fed wants to avoid.

Rate traders have already priced the Fed as likely to cut benchmark borrowing costs in June, and have resumed the so-called easing cycle that began last September.