Permanent loss in cryptocurrencies is a temporary reduction in the value of an asset when you deposit it into a liquidity pool compared to simply holding the same asset in your own wallet. Therefore, there is a direct impact by reducing potential returns for liquidity providers (LPs), with research showing that for more than half of LPs in some major pools, losses are greater than the actual trading fees earned. To compensate liquidity providers, many DeFi protocols distribute additional token rewards or transaction fees.

To minimize temporary losses in DeFi, you should use strategies such as choosing a stablecoin pool (ETH/WBTC), using correlated asset pairs, or choosing a non-uniform liquidity pool. This guide explains what temporary losses are, how liquidity pools work with price divergence and token ratios, and the exact formula and calculator you can use to calculate it.

What is cryptography Permanent loss?

Temporary losses are essentially the risks you take on when you decide to provide liquidity to a decentralized exchange’s liquidity pool. As you know, when you deposit your crypto tokens into a pool, you primarily become a liquidity provider (LP) there. This is how DeFi works, allowing people to trade tokens without the need for traditional intermediaries such as banks or central exchanges.

So what is permanent loss? Now, the core of permanent loss is simply; The difference in value between the two scenarios: providing liquidity and owning the assets. The reason this is called “permanent” is because, in theory, if the price of your token eventually returns to the price it was at when you first deposited, your losses would be gone. However, as you know, the price of cryptocurrencies is highly volatile, so this is not always guaranteed.

Generally, this loss will only become permanent if you decide to withdraw your tokens from the pool before the price corrects. Also, many studies have shown that in some pools, especially popular platforms like Uniswap V3, more than 50% of LPs do not actually make a profit because the temporary losses were greater than the transaction fees earned.

How does permanent loss in cryptocurrencies work?

Temporary losses occur primarily because automated market makers (AMMs) are designed to keep the pool balanced. Fundamentally, all changes to a liquidity pool depend on maintaining constant and equal values of the two assets held by the pool.

Currently, the most common type of pool used on platforms such as Uniswap V2 uses a simple formula to manage this balance…

X * Y = K

Here, this formula means that the amount of token A (X) multiplied by the amount of token B (y) must always equal a constant value (K).

And you need to know that that constant value K is the reason why the pool is automatically adjusted. Therefore, when an actual transaction occurs, the ratio of the two tokens in the pool changes. For example, when someone buys a large amount of token A, the supply of token A in the pool decreases and the supply of token B increases.

Now, to keep the product (K) the same, the price of token A in the pool must increase and the price of token B must decrease.

This is where arbitrage traders come in. In fact, they are basically the ones who are causing the loss. They constantly monitor the price of the tokens in their pool compared to external market prices on exchanges like Coinbase and Binance.

Therefore, when the price of Token A increases on the external exchange, it becomes cheaper within the liquidity pool. Now, the arbitrage trader buys cheaper token A from the pool and brings in more token B until the price ratio in the pool again matches the external market.

You (LP) will have more tokens that haven’t changed much in value and fewer tokens that have just increased in value. This automatic rebalancing will therefore result in a difference or loss compared to if you had held both tokens.

Price deviation and token ratio

The amount of temporary loss depends on how far apart the token price changes. As we know, small fluctuations generally make only small differences, but large deviations are very serious.

Losses grow faster than price changes, so a doubling in price hurts more than a 50% increase. Therefore, the effect is symmetrical. A 2x increase or a 50% decrease both lead to the same percentage loss.

Example scenario: ETH/USDT pool

Let’s look at a simple example to see exactly how permanent loss works in real life.

Initial state

- You deposit: You decide to deposit equal amounts of ETH and USDT. So let’s say the price of ETH is $2,000.

- Your deposit totals $4,000: Deposit 1 ETH (worth $2,000) and 2,000 USDT (worth $2,000).

- HODL value: Now, if you just held the token, your value would be $4,000 (but due to market volatility, that will never happen)

Scenario after price change

- Let’s say the price of ETH doubles on an external exchange, going from $2,000 to $4,000. However, the price of USDT remains at $1.00.

- Now, the arbitrage trader has noticed that ETH in the pool is still cheap. Therefore, they will start buying ETH from your pool and depositing more USDT until the new price of ETH in the pool approaches $4,000.

Relationship between final pool ranking and HODL value

- If you HODL your original 1 ETH and 2,000 USDT, your holding is actually worth $6,000 (1 ETH is worth $4,000 + 2,000 USDT)

- However, in a liquidity pool, your shares are automatically rebalanced. Therefore, you will end up with less ETH (about 0.707 ETH) and more USDT (about 2,828 USDT).

- Pool Value: The value of the pool’s new holdings is: ($4,000 * 0.707) + ($2828) = $5,656.

permanent loss

- The difference between the HODL ($6,000) and the pool value ($5,656) is $344.

- Now, divide $344 by $6,000, which is approximately 5.7%.

Well, that 5.7% difference is a permanent loss.. By the way, this loss rate only applies to twice the price movements up and down in a standard 50/50 pool. There may also be different scenarios.

Estimation of non-permanent loss Within the crypto liquidity pool

Estimating temporary losses can help you decide whether it’s worth providing liquidity. The simplest approach is to compare the transaction fees you expect to collect to the potential shortfall. Obviously, assume the standard pool ratio is 50/50.

The approximate loss rates at various levels of price divergence are:

| Price trends (new price/old price ratio) | Temporary loss (vs. HODL) |

| 1.25 times (25% change) | 0.6% loss |

| 1.5 times (50% change) | 2.0% loss |

| 2x (100% change) | 5.7% loss |

| 3x (200% change) | 13.4% loss |

| 4x (300% change) | 20.0% loss |

| 5x (400% change) | 25.5% loss |

As you can see, a 5x price change essentially means you lose more than a quarter of the value you would have had if you had just held the token. Well, you’re taking on a pretty big market-making risk, so you’ll want to make sure you’re adequately compensated by trading fees.

How do I calculate permanent loss?

The easiest way to calculate permanent loss is to compare the final token value to the original HODL value, as we did in the example, but there are also standardized formulas.

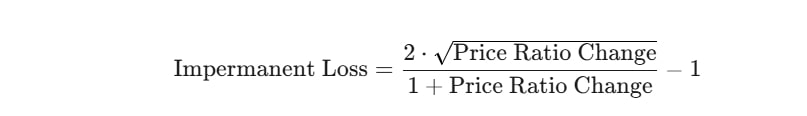

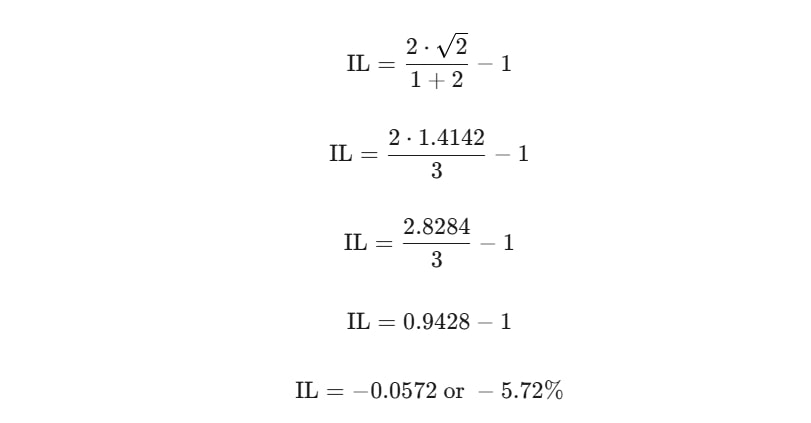

permanent loss formula

The official formula used by many protocols assumes a standard 50/50 split of the pool and is based solely on changes in price ratios. Basically, all you need is the size of the price difference.

So how do we calculate permanent loss?The formula for permanent loss is as follows.

Now, let’s apply the numbers from our example of ETH doubling in price…

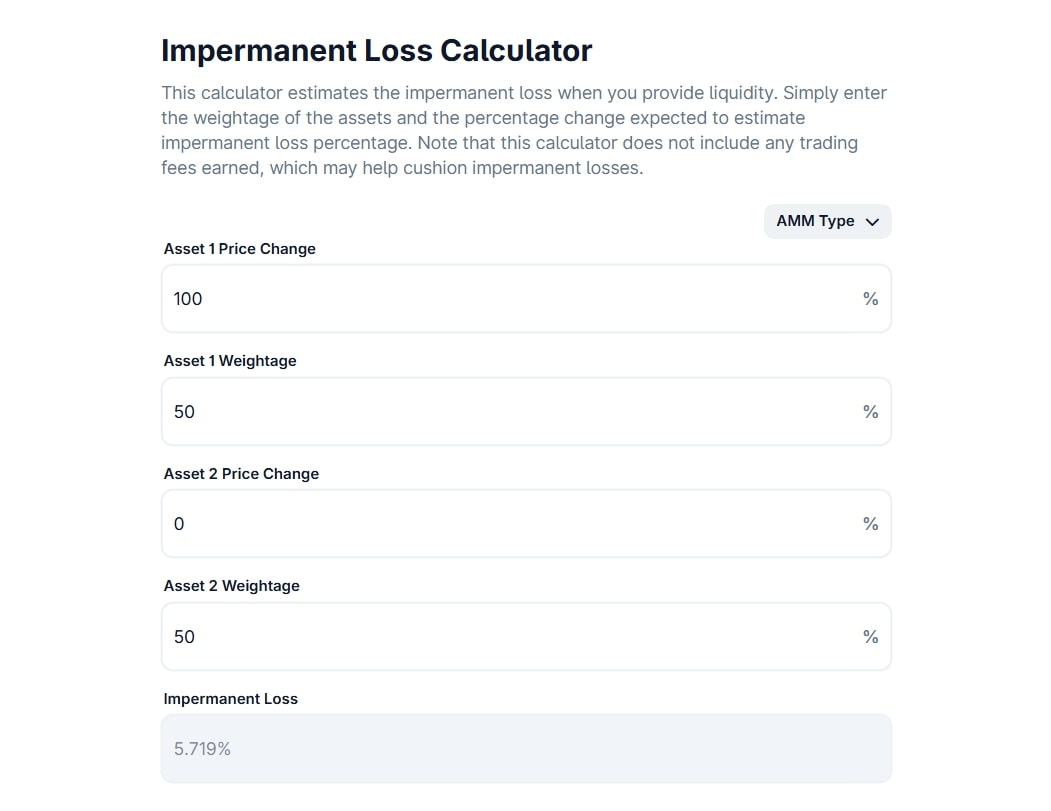

Using the Impermanent Loss Calculator

The easiest method for everyday users is to skip the manual calculations and use one of the many online permanent loss calculators. The best permanent loss calculators are: Coingecko calculator and dailydefi.org.

Mainly, these calculators usually give a breakdown of the final amount of tokens in the pool and the original amount of tokens. However, a quick warning: many simple calculators only show you the temporary loss itself, not the total profit or loss. Therefore, you must include any trading fees earned while your funds are in the pool.

Below is an example from the CoinGecko calculator.

How to minimize permanent losses?

Although temporary losses cannot be avoided in most liquidity pools, it is definitely possible to choose strategies that minimize exposure to losses.

- Choose a stablecoin pool: This is the best approach. When providing liquidity to stablecoin pairs such as USDC/DAI or USDT/USDC, the price divergence will be very minimal as both tokens are pegged to the same dollar value. In this case, permanent losses are almost non-existent. However, the trading fees for these pairs are always lower, so the commission rewards are usually lower.

- Using correlated asset pairs: You can wisely choose tokens that move in correlation, such as ETH/WBTC. Risk is also reduced as the prices of these tokens usually follow similar market trends. Therefore, the ratio between them does not change as dramatically as in the case of altcoin and stablecoin pairs.

- Uneven liquidity pool: Some platforms allow you to create pools that are not a regular 50/50 split. It could be 80/20 or 60/40. In general, you can hedge your pool to less volatile assets. Therefore, a pool of 80% stablecoins and 20% volatile tokens is less sensitive to token price fluctuations.

- Concentrate liquidity: Some of AMM’s newer models, such as Uniswap V3’s centralized liquidity, can only provide liquidity within a certain price range. Therefore, if the price of the token stays within the set range, you will earn significantly more fees with less temporary losses.

conclusion

In a nutshell, permanent loss is the gap between the value of your liquidity position and the value you would receive if you simply held the coin. This primarily occurs because the AMM rebalances the proportion of its tokens in response to price fluctuations, leaving more assets that decline in value and fewer assets that increase in value.

And by understanding how price spreads, fees, and time horizons interact, you can easily see whether providing liquidity is appropriate or too risky. So, with a little research and using the strategies discussed here, you can definitely manage your risk and make your liquidity offering profitable.