Important takeouts:

- Toyota Blockchain Lab introduces it Mobility Orchestration Network (Mon)built on avalanches (avax) and bridges data, regulatory and industrial silos in mobility.

- The system combines institutional, technical and economic proofs into the vehicle’s blockchain-based identity, allowing for funding, insurance, and cross-border use.

- If deployed beyond the prototype stage, Mon can transform the way automakers, regulators and service providers coordinate globally, facilitating the real adoption of Avax.

Toyota, the world’s largest automaker with over 10.8 million vehicles sold in 2024, Enlarge your blockchain footprint. Through Toyota Blockchain Lab, an R&D ARM, the company has unveiled a new framework. Mobility Orchestration Network (Mon)The purpose is to create a trust first digital layer for global mobility systems.

Toyota Blockchain Push: From cars to crypto infrastructure

The mobility business is evolving at an incredible speed. Electric vehicles (EVs), automated drivers, and increased costs are driving industry rethinking how value is captured and shared among automakers, insurance companies and regulators. The motivation behind Toyota using blockchain is to combine what was once a shattered ecosystem using the lack of trust in blockchain.

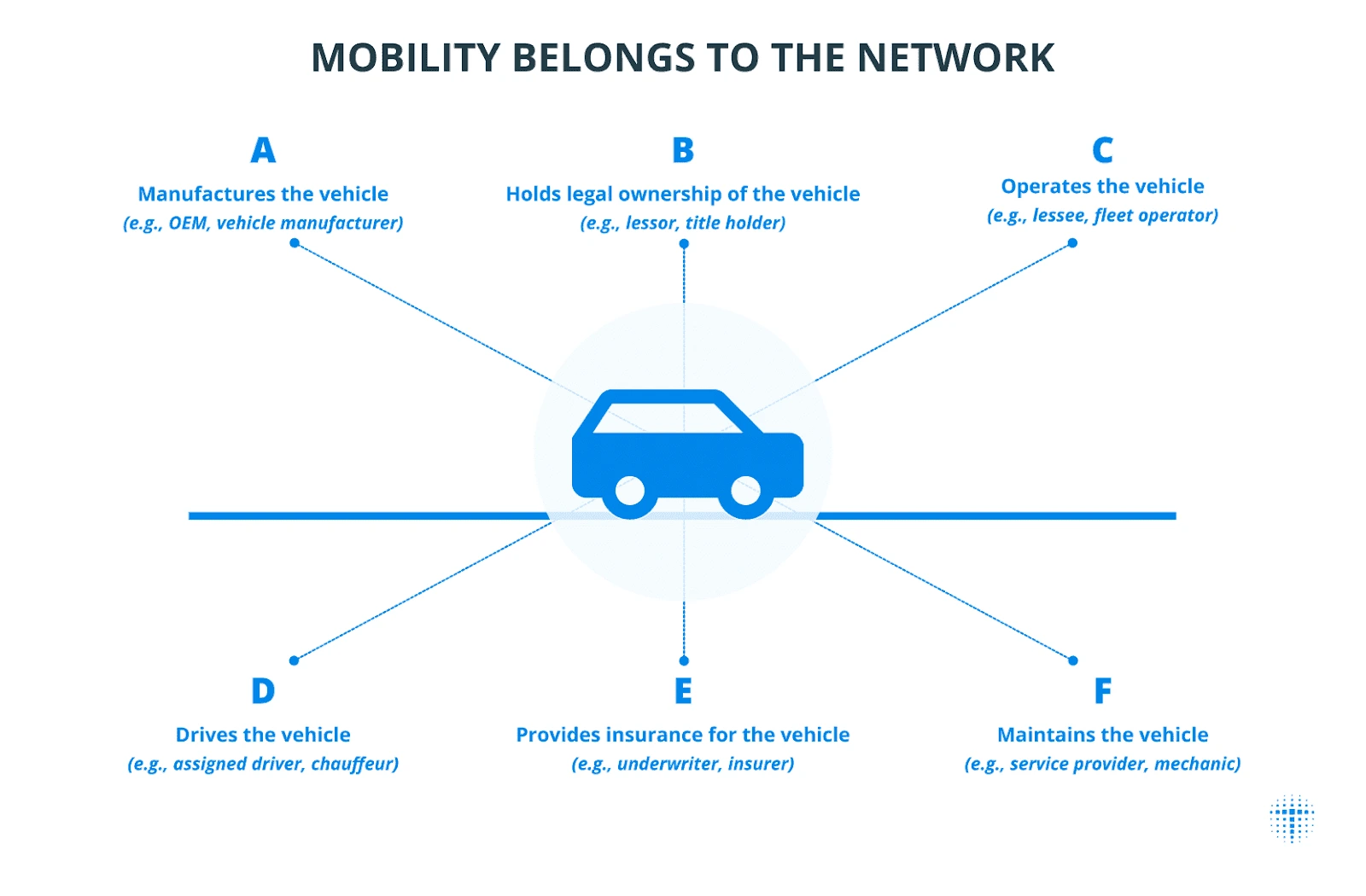

On the day of the announcement on August 20, 2025, Prototype Mon is conceptualized to mediate relationships supporting vehicle mobility ownership, insurance compliance, taxation, safety audits, and operational data. Rather than treating cars as isolated objects, Mon Frames Mobility acts as a network of verifiable relationships between multiple stakeholders.

This system is more than just an experiment. Toyota emphasizes the moon as a response to three structural challenges in its moniility.

- Organizational gaps – Vehicle data is locked into separate silos between agents and businesses.

- Industrial gap – There is no open, interoperable network to connect automakers, insurance companies, investors and service providers.

- National gap – Regulations, tax and insurance systems vary from country to country, complicating cross-border asset recognition.

Aiming to automate vehicle-service interactions, Toyota aims to digitize relationships using a blockchain-driven implementation of “Chain of Trust: Minimizing Paper-based Procedures and Invisible Database Use.”

Why an avalanche? Speed, scale and multi-chain flexibility

Toyota has chosen Avalanche (Avax) as its blockchain. Under that, “Mon” is built for low-latency consensus, multi-chain structures, and built-in interoperability solutions. In contrast to Ethereum’s single-chain congestion model, avalanches can create layer-1 (L1) networks specific to the needs of the use case.

For the Mon prototype, Toyota outlined four interconnected L1s.

- Security Token Network – To issue securitized assets backed by mobility portfolios.

- Mobility Trust Network (Month itself) – For ownership and certification aggregation.

- Utility Network – For daily mobility services such as riding, EV charging, and access rights.

- Stablecoin Network – Payments, service charges, revenue sharing.

This design makes financial flows, surgical data and regulatory proofs synchronized modular. These networks are connected through Interchain Messaging Protocol (ICM) Created by Avalanche, allowing secure cross-chain messages, and atom delivery-VS-Payment (DVP) settlements.

Read more: SEC pushes back Grayscale avalanches and Cardano ETF decisions

How a mobility orchestration network works

Essentially, Mon digitizes the trust in the car in three areas of proof.

- Institutional evidence – Title, registration, insurance compliance, taxation status.

- Technical evidence – Vehicle Identification Number (VIN), OEM manufacturing data, firmware proof, and verified maintenance records.

- Economic evidence – Utilization, revenue performance, activity records.

The aggregation of these proofs Mobility-Oriented Account (MOA). Mon creates the identity of vehicles that grow wild on the blockchain

Facilability Ladder – Turn your car into a tradeable asset

To free the finances, Mon employs the “facilitation ladder.”

- Ownership as an NFT – Each vehicle’s MOA is tied to an inappropriate token.

- portfolio – Bundle multiple vehicles into a semi-fan-formable portfolio for risk assessment.

- Security token – Issuance of financial products backed by these portfolios that are easy to rely on and comply with regulations.

What this transformation means is that we can reduce capital costs by securitizing a fleet of electric vehicles, robot taxes, or logistics vehicles and trading in a simple and transparent way.

Read more: Best NFT Marketplace: Top 11 Platforms to Buy and Sell NFTS in 2025

Mobility and Finance-wide Applications

Toyota foresees that Mon will overcome many real-life mobility financing obstacles:

- EV fleets in emerging markets – Provides verifiable on-chain records to attract foreign investments in high-cost EV adoption.

- Autonomous taxi – Provide investors with transparent management and safety records to fund deployments.

- Vehicle-to-Grid (V2G) Service – Monetize the BEV Fleet as a distributed energy storage asset with battery health and green energy proof.

- Green Logistics – Bundle the fleet and its verified emissions data to issue ESG-themed security tokens.

The scenario illustrates how Mon reduces due diligence costs and provides standardized data in cross-border financing.