Tether, the world’s largest player in the digital asset sector, has stepped deeper into the cryptocurrency-backed credit market with a new investment in Ledn, one of the most established providers of Bitcoin-backed loans.

The move comes amid a new wave of activity across the lending sector, which has already surpassed $1 billion in loan originations this year and is now showing signs of a broader revival after a deep collapse in 2022-2023.

Ledn’s Bitcoin loans surpass $2.8 billion as crypto lending market recovers

Since its launch, Ledn has originated over $2.8 billion in Bitcoin-backed loans, solidifying its position as a leading lender in the crypto credit market.

The company has already issued more than $1 billion in 2025 alone, its best year on record, and in its most recent quarter, it had nearly as many loans as all of 2024, at $392 million in the third quarter.

Its annual recurring revenue currently exceeds $100 million, and we see growing demand from both individual and institutional borrowers seeking liquidity without selling their Bitcoin.

Tether said the investment reflects its long-term vision to build a financial infrastructure that allows users to unlock credit while continuing to hold their digital assets.

CEO Paolo Ardoino said the partnership strengthens the role of digital assets in real-world finance and supports the self-custody model that many cryptocurrency users rely on.

Ledn’s platform includes custodial safeguards, risk management, and clearing systems designed to protect users’ collateral throughout the life of each loan.

The investment arrives as the Bitcoin-backed loan market begins to expand again. The broader cryptocurrency-backed credit sector is projected to grow from $7.8 billion in 2024 to more than $60 billion by 2033, according to a DataIntelo outlook.

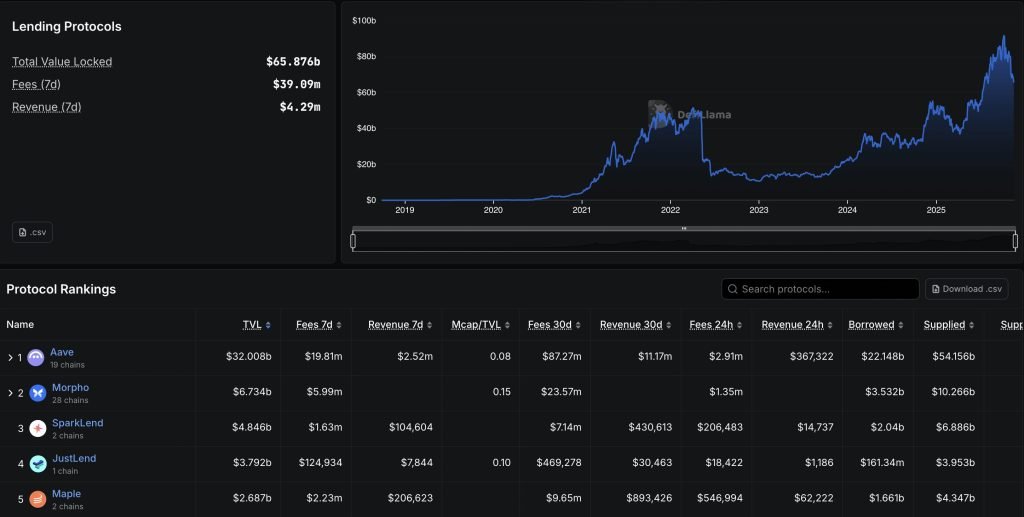

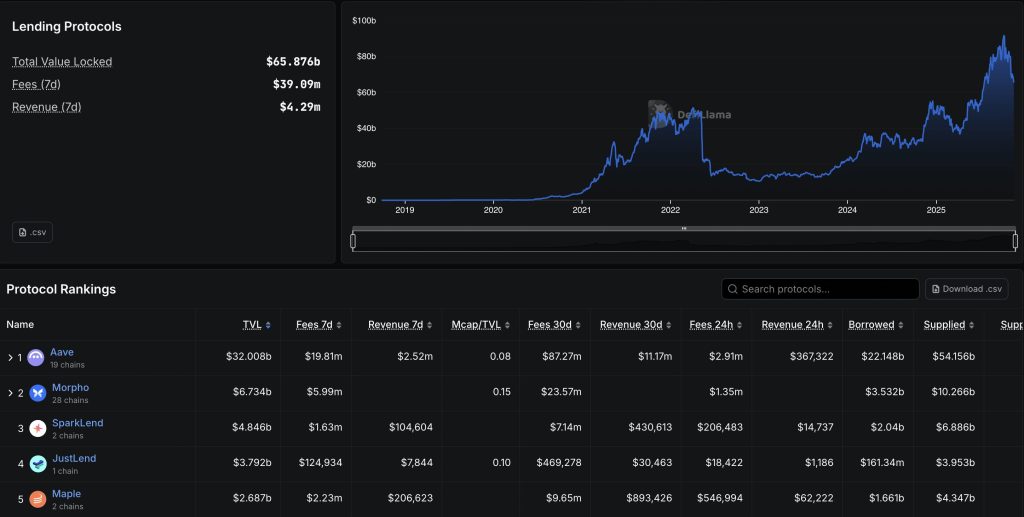

The sector had already reached $90 billion in October and now stands at $65.87 billion.

Much of the industry’s recovery has been shaped by the tightening of risk practices following the collapse of Celsius, Voyager, BlockFi, Genesis and other lenders in the last bear market, caused by reckless lending, toxic collateral and unsecured loans.

Ledn’s decision to double down on Bitcoin-backed products is strengthened by this move to a more secure structure.

Co-founder and CEO Adam Reid said the company’s outstanding loans are on track to nearly triple from 2024 levels, and demand for Bitcoin financial services is rapidly increasing as investors seek more predictable forms of credit access across both centralized and decentralized platforms.

Tether’s investment also aligns with the company’s broader strategy to expand its presence across global financial markets.

In the latest testimony prepared by BDO, Tether reported year-to-date net income of more than $10 billion and excess reserves of $6.8 billion.

The company issued over $17 billion in new USDT during the third quarter, and the circulating supply of stablecoins exceeded $174 billion. Tether’s exposure to U.S. Treasuries has reached a record $135 billion, making it one of the world’s largest foreign holders of U.S. Treasuries.

Lending activity rekindles as major platforms expand services and regulators tighten regulations

There are new developments across the lending sector.

Crypto.com recently began integrating Morpho, the second largest DeFi lending protocol, into its platform, allowing users to borrow stablecoins directly against Bitcoin and Ether wrapped on the Cronos chain.

Morpho’s services, which already hold more than $7.7 billion in value, will be available to US users despite new restrictions on stablecoin yield payments under the GENIUS Act.

Regulators are also adjusting to the increased activity. In September, South Korea introduced sweeping guidelines that limit loan interest rates to 20% a year and ban leveraged products that exceed the value of collateral.

The rules were enacted in response to concerns about aggressive lending programs at major exchanges, where companies began setting unusually high borrowing limits before regulators intervened.

Tether enters Bitcoin-backed lending as market loan volumes soar past $1 billion This article was first published on Cryptonews.