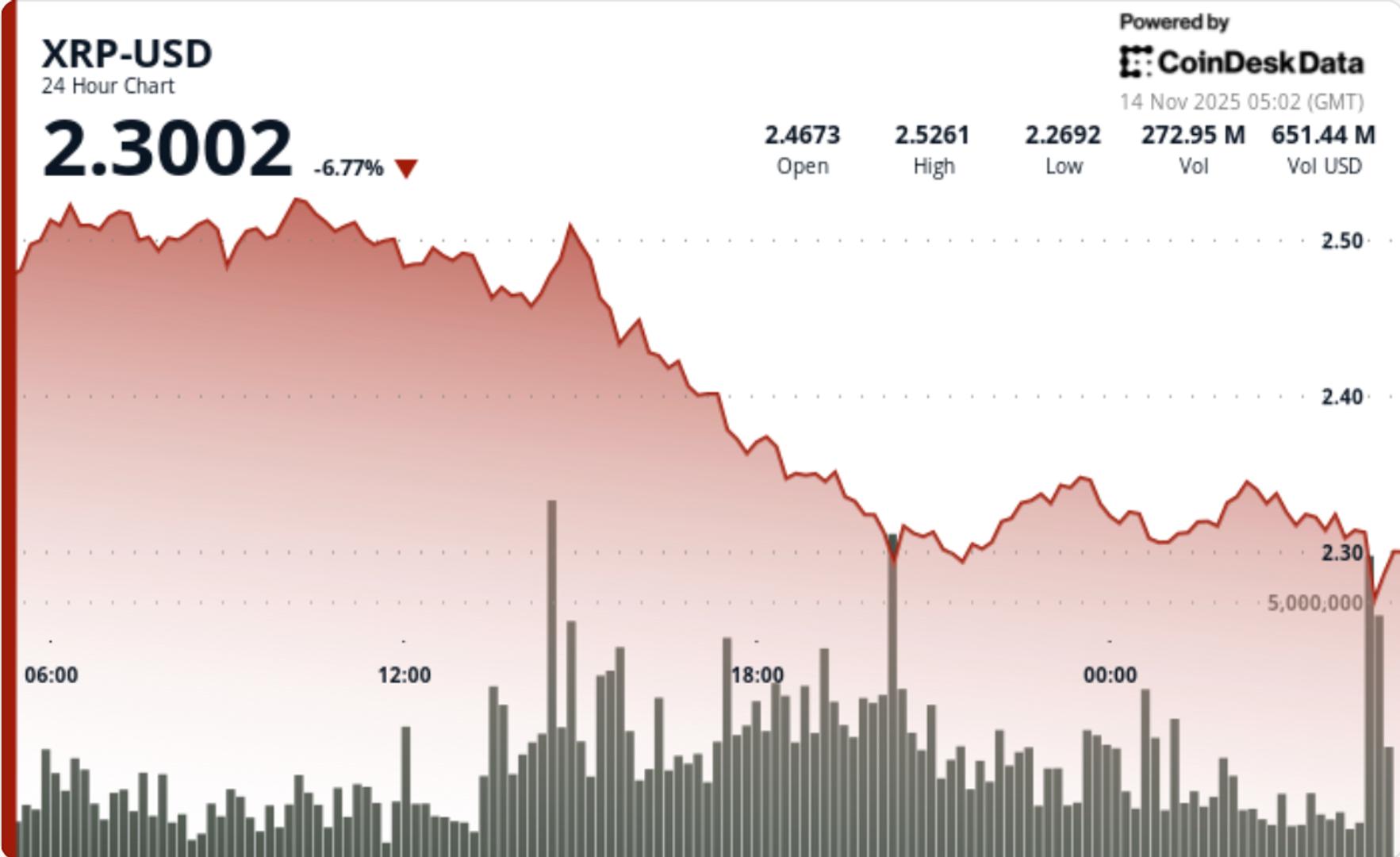

The brutal drop breaks through the psychological $2.30 floor and erases recent gains as circulation dwarfs the historic XRPC debut.

news background

- XRP’s worst intraday drop in recent weeks coincided with a major industry milestone. It was the launch of Canary Capital’s XRPC, the first spot XRP ETF in the U.S., which officially went into effect on the Nasdaq as of 5:30 p.m. ET.

- The listing marks a turning point for institutional access to XRP, but its debut comes as the broader crypto market extends a medium-term downtrend.

- emotions are still fixed fear As the macro risk-off trend continues.

- Analysts, including FxPro’s Alex Kupczykevich, have warned that the crypto situation still resembles a “short-term rebound within a deep decline” and that the market structure is vulnerable to a deeper retracement.

- Large token flows reflect that caution, with XRP on-chain data showing 110.5 million tokens moved between unknown wallets in the hours before and after the outage, amplifying uncertainty during times of peak volatility.

Overview of price fluctuations

- XRP fell 7.3% from $2.48 to $2.30 in 24 hours of trading, cutting through the key support levels of $2.46, $2.40, and $2.36.

- The decline was a blistering $0.23, and the transaction amount was 157.9 million XRP, 46% above the 24-hour average.

- The core breakdown unfolded during a four-minute liquidation cascade from 04:32 to 04:35 UTC, where the price plummeted from $2.313 to $2.295 on 6.6 million XRP volume, 254% above baseline.

- The one-minute spike of 4.06 million at 04:32 marked the selling climax of the session. Liquidity temporarily evaporated as trading leveled off between 04:35 and 04:36, indicating either that order flow had stopped or that there was a severe book decline.

- Attempts to stabilize above $2.31 failed, and XRP settled into a narrow consolidation around $2.30 to $2.32.

technical analysis

This session confirmed a complete technical failure with obvious structural damage.

Support/Resistance:

• $2.29–$2.30 Becomes the main support after breaking through the psychological nadir

• Previous support $2.36, $2.40and $2.47 Now works as a stacked resistor

• Nullification of bulls requires decisive recovery of rights. $2.36

Volume profile:

• Total session volume 157.9 million (+46%) Check the distribution at educational institution level

• Show disassembly sequence 254% Hourly volume spike, typical liquidation-driven movement

• No meaningful recovery volumes were visible during post-crash consolidation.

Chart structure:

• Descending triangle support failed definitively, invalidating previous inversion setup

• A new lower range is formed between $2.29–$2.33

• The breakdown is consistent with the medium-term downward trend of broader crypto indexes

Momentum indicator:

• Oversold signals are emerging during the day, but no trend reversal is confirmed.

• Breakdown occurs below major EMA. 50D/200D cross remains bearish

What traders should pay attention to

XRP is currently at a pivotal inflection point.

• Holds $2.29 is essential — failure exposes a rapid transition to: $2.00–$2.20 demand zone

• Any recovery must be reused first $2.36 Before the bull regains technical control

• ETF inflows act as a catalyst for subsequent volatility. Initial XRPC volumes while the market is open will indicate whether financial institutions treat the listing as an accumulation opportunity or a liquidity event.

• On-chain flow 110.5M XRP Whale transfers remain a wildcard – currency inflows will underpin further downside risks

• Sentiment remains fragile across the majors. Beta-sensitive assets like XRP react disproportionately to broad market downturns