Key takeout

- The U.S. housing finance regulators want Fannie May and Freddie Mac to draft a plan that will treat the crypto as part of borrowers’ assets for mortgage reviews.

- Crypto-holdings can be counted directly into mortgage underwriting if the proposal is approved.

Please share this article

The Federal Housing and Treasury Agency (FHFA) has directed mortgage giants Fanny May and Freddie Mac to develop and submit proposals that will allow crypto assets to be included in mortgage underwriting without forcing conversion.

The directive signed by FHFA director William Pulte on June 25 came shortly after Pulte said Monday that the housing finance regulator would explore the possibility of including Crypto as part of its mortgage eligibility asset valuation.

Michael Saylor, executive chairman of Strategy, offered to share the company’s BTC credit model. This was created to assess creditworthiness based on the loan period, collateral, Bitcoin price fluctuations, and Bitcoin assets that address risk forecasts.

In response, Pulte said he would review the model of the strategy.

Under the new order, government-sponsored companies should only consider crypto assets that can be verified and held in a US regulated central exchange that operates within appropriate legal frameworks.

The order also requires both companies to incorporate risk mitigation measures, such as adjusting market volatility and changing appropriate risk-based changes to the portion of reserves held in crypto assets.

The proposed changes must be approved by the board of directors of each company before they can be submitted to FHFA for review. This directive will take effect immediately and requires implementation “rationally practical.”

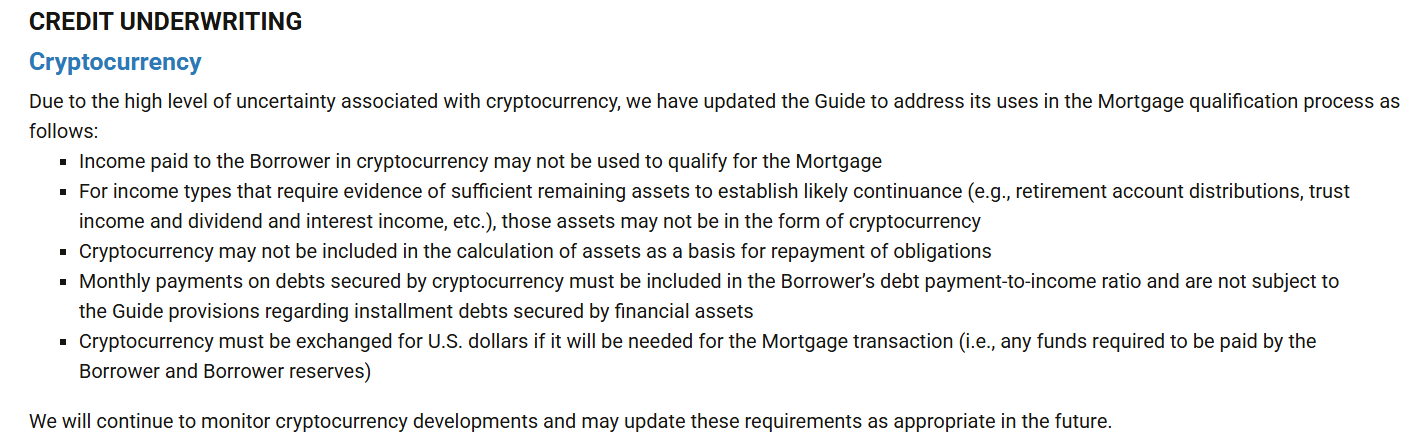

Cryptocurrencies are generally not accepted as mortgage reserves unless converted to US dollars. In the 2021 guidance, Freddie Mac explicitly stated that the crypto may not be included in the calculation of assets as the basis for mortgage repayments and should be exchanged for US dollars in mortgage transactions.

Similarly, lenders are usually required to convert crypto assets into cash or cash equivalents, counting them as reserves and counting them due to volatility and regulatory uncertainty.

If approved, this move will help cryptocurrencies fully integrate with traditional mortgage financing and make it easier for crypto holders to borrow.

Please share this article