Michael Saylor moved quickly on Friday to quash new speculation that his bitcoin acquisition vehicle, Strategy, secretly sold tens of thousands of coins during this week’s market downturn.

The executive chairman called this claim “false” and maintained that the company is still accumulating Bitcoin despite the volatile situation where the price of Bitcoin has fallen below $95,000 for the first time in six months.

The rumor exploded after cryptocurrency analysis platform Arcam reported that Strategy’s Bitcoin holdings had dropped from 484,000 BTC to 437,000 BTC, a difference of approximately 47,000 BTC, which was worth about $4.6 billion at the time.

The report went viral as Bitcoin fell more than 4% in less than 24 hours, dropping from more than $100,000 to less than $95,000. Saylor denied the speculation in a post about X, writing that there was “no truth” to suggestions that the company had downgraded its position.

Saylor denies sale rumors, confirms strategy to add 487BTC this week

He later doubled down on CNBC, saying that Strategy is not only not selling, but accelerating its acquisitions. “We’re buying,” Saylor said. “I will report on the next purchase on Monday morning.”

He added that current price trends do not shake up the company’s strategy. “If you’re going to be a Bitcoin investor, you need a four-year time horizon and you need to be prepared to deal with volatility.”

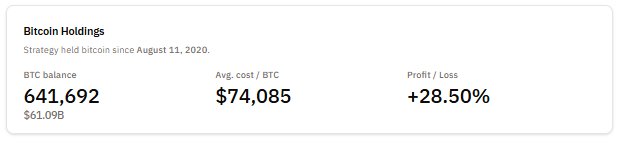

Strategy’s internal data appears to support his comments. The company’s dashboard shows its total Bitcoin holdings as of Monday at 641,692 BTC, which is consistent with previous disclosures, and the company’s SEC filings confirmed continued accumulation through early November.

The coin’s sudden fluctuations earlier in the day added new uncertainty to an already fragile cryptocurrency market.

On-chain analysts reported that Strategy transferred over 58,000 BTC to the new wallet, and this change triggered algorithmic trading activity and accelerated the sell-off.

Analysts later pointed out that the move was due to a custodian reorganization rather than a liquidation, but the clarification did little to allay widespread concerns.

Market pressures quickly spread to Strategy’s financial base. Shares of Nasdaq-listed MSTR fell below $200 in pre-market trading on Friday, the lowest since October 2024.

The company’s book value multiple briefly fell below 1 for the first time, indicating that investors value the company less than the value of its Bitcoin holdings.

The multiple has since recovered to 1.09x, a change that marks a break from several years in which Strategy consistently traded at a premium.

This reversal reflects investors’ calm expectations. Strategy’s equity premium has shrunk by $79.2 billion since November 2024, according to K33 Research.

The company raised more than $31 billion through stock issuance during the same period, but analysts estimate that nearly $48 billion of implicit Bitcoin demand was not translated into actual BTC purchases.

Some market watchers say investors are no longer using MSTR as a direct proxy for Bitcoin exposure.

Some dismissed concerns about liquidation. Analyst Willy Wu said Strategy is unlikely to face any selling pressure before 2027 as long as MSTR trades above the $183.19 threshold related to the company’s debt structure. He noted that only a downturn in the 2028 Bitcoin cycle could force a partial sell-off.

The controversy comes amid widespread turmoil across digital assets and the US market. Bitcoin briefly soared above $106,000 after lawmakers ended a record 43-day government shutdown, but the gains faded as hopes for a Federal Reserve interest rate cut in December faded.

Despite the volatility, Strategy remains the largest corporate holder of Bitcoin. However, as more companies added BTC to their treasury, its market share declined from 75% to 60%.

The post Michael Saylor slams rumors of 47,000 BTC sale and teases new purchases as a “pleasant surprise” appeared first on Crypto News.