While many are still focused on how high the price of Bitcoin will rise in the current bull market (although given the current price trend, that may not be the case!), it is equally important to be prepared for what happens next. Here we take a look at the data and math that can help us estimate where Bitcoin’s next bear market low will occur. Not as a prediction, but as a framework based on previous cycles, on-chain metrics, and even BTC’s fundamental valuation.

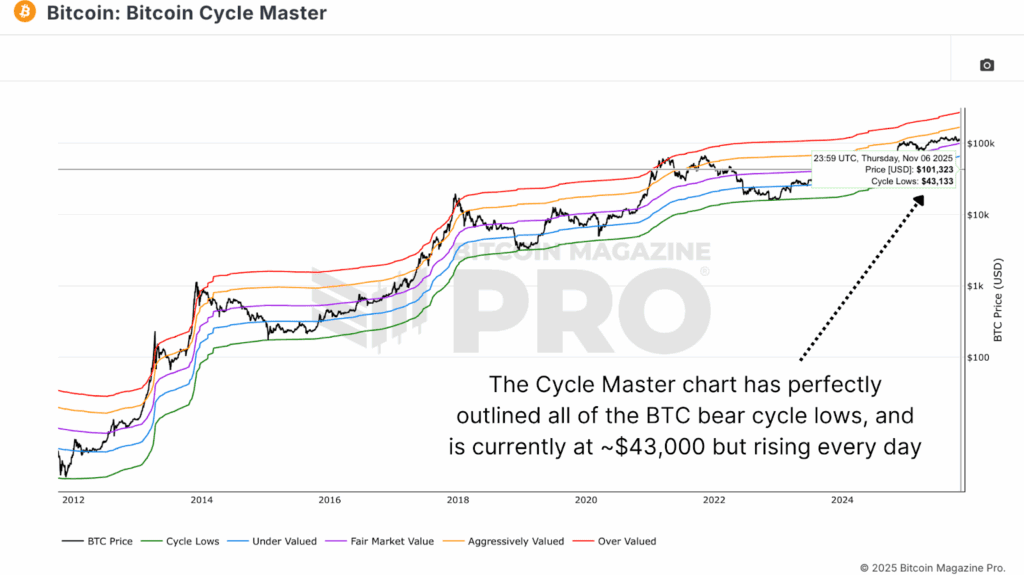

Cycle Master: Modeling historical Bitcoin price bottoms

One of the most consistently accurate models for identifying Bitcoin’s cyclical bottoms is something called the Bitcoin Cycle Master Chart. It matches a number of on-chain indicators to create a band around the price of a certain valuation level.

Historically, this green “cycle low” line has almost perfectly identified Bitcoin’s macro bottom. From $160 in 2015 to $3,200 in 2018 and back to $15,500 at the end of 2022. As of today, this range is around $43,000 and rising daily, making it a useful baseline for estimating how far Bitcoin could fall in the next full cycle.

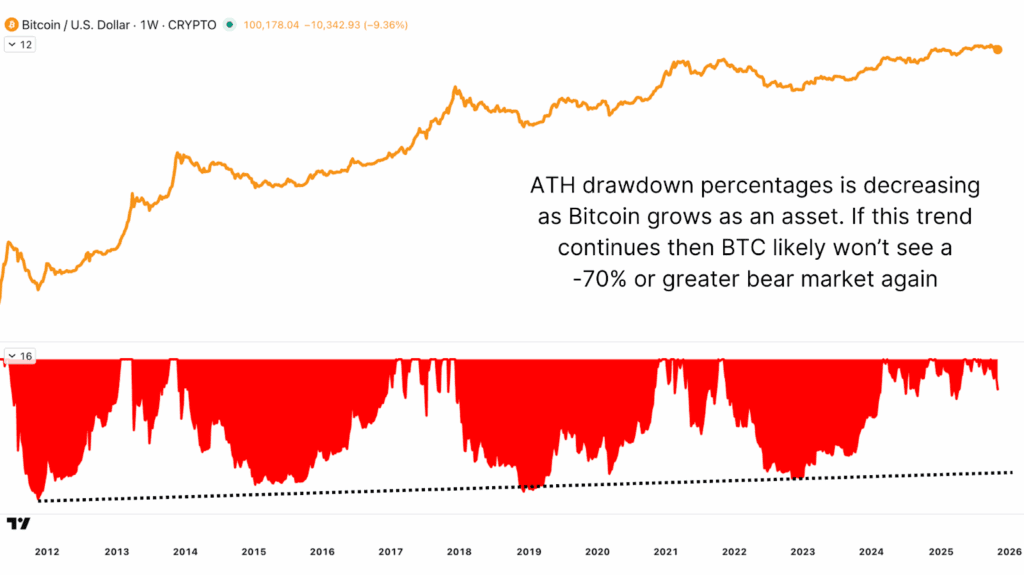

Reduced drawdowns: Why each Bitcoin price bear market is less damaging

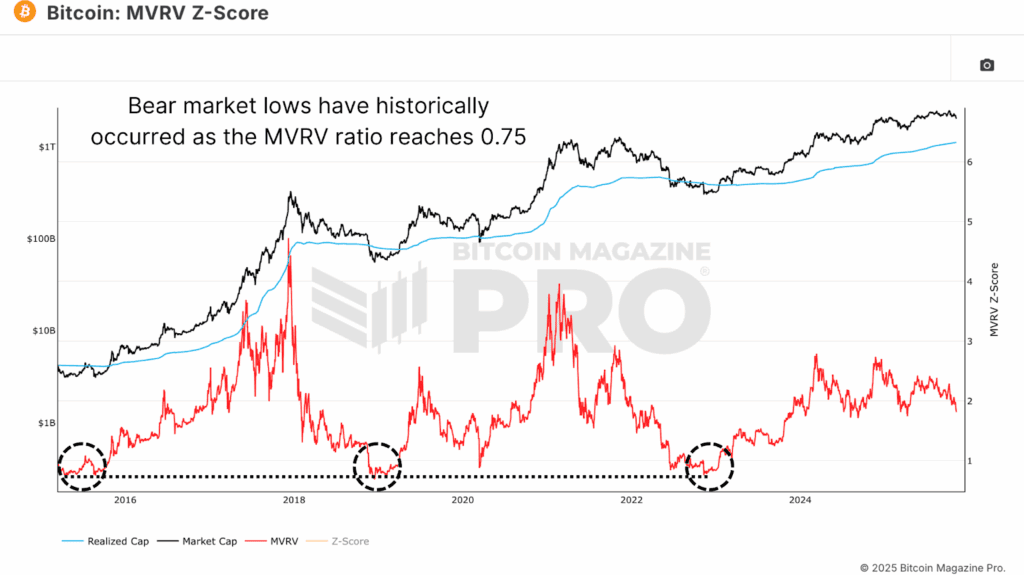

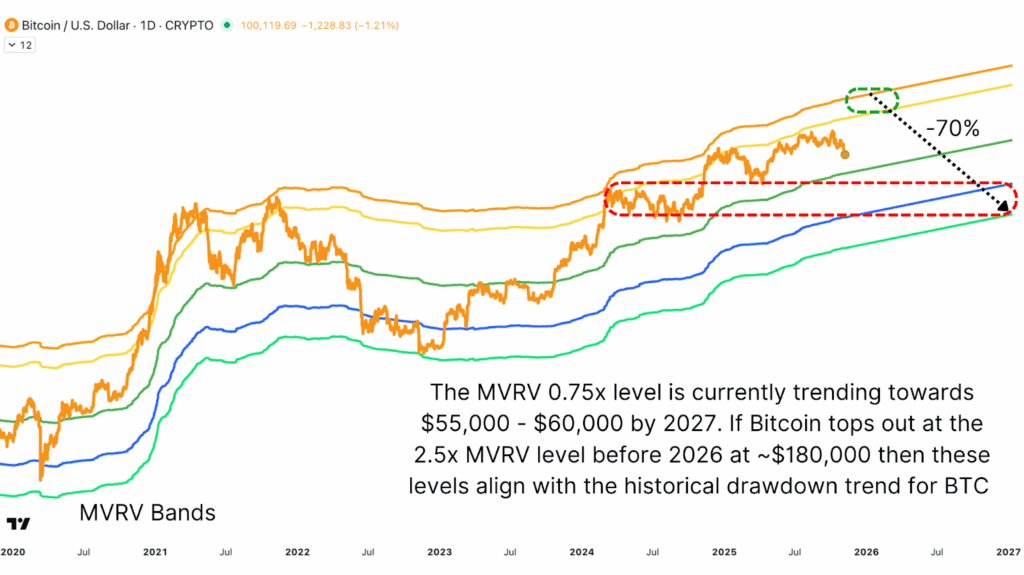

In addition to this, you can also see the raw MVRV ratio, which measures Bitcoin’s market price and realized price (based on the average cost of all coins). Historically, in severe bear markets, Bitcoin tends to fall to 0.75x its realized price. This means that the market price trades approximately 25% below the network’s total cost basis.

This reproducibility, combined with the downward trend in drawdowns, provides a strong anchor for estimating potential downside. Bitcoin’s early cycles saw declines of up to 88%, but that figure has been steadily compressing, to 80% in 2018 and 75% in 2022. Projecting the same trend into the future suggests that continued decline in volatility could result in the next bear market leading to a retracement of up to 70% from the cycle high.

Predict the next Bitcoin price rise or fall

Before estimating the next low, we need to make reasonable assumptions about where this bull market will peak. Based on historical MVRV multiples and slope trend realized price growth, Bitcoin has recently tended to top out at around 2.5x its realized price. If this relationship holds and realized prices continue to trend upward, it suggests a potential cap of nearly $180,000 per BTC in the second half of 2025.

If that is the case, and Bitcoin follows its historic one-year bear market lag through 2027, a 70% retracement from that level would put the next major cycle low around $55,000-$60,000, based on the current realized price trajectory at that point. These prices also align well with Bitcoin’s volatile consolidation range from last year, giving it a technical confluence.

Rising Bitcoin price and production costs

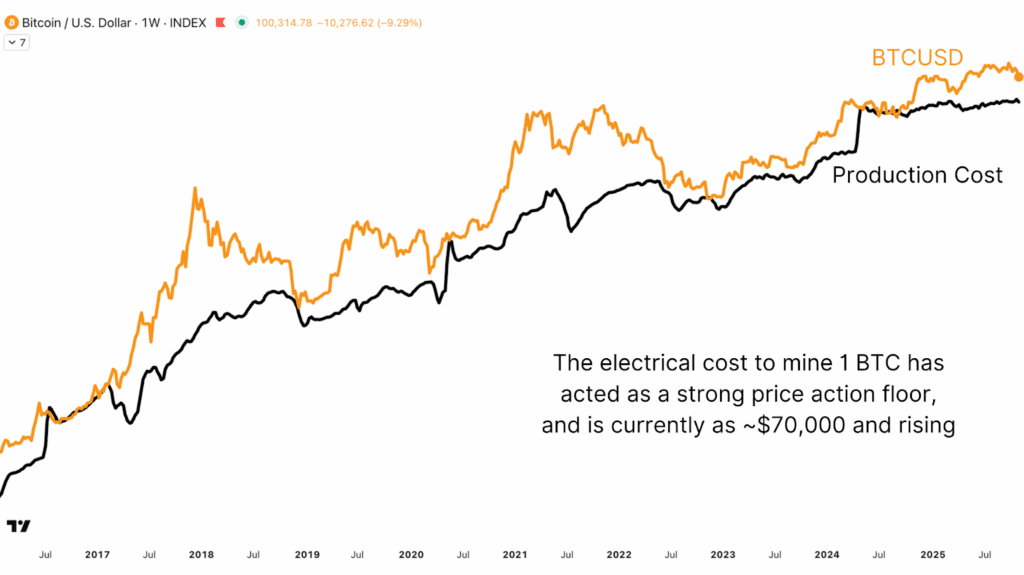

One of the most reliable long-term valuation metrics for Bitcoin is its production cost, or the estimated cost of electricity to mine one Bitcoin. This indicator has historically roughly matched the lows of Bitcoin’s deepest bear markets. Each halving doubles the cost of production, creating a structural floor below prices over time.

When Bitcoin trades below its cost of production, it indicates miner stress and usually coincides with an opportunity for intergenerational accumulation. At the time of the April 2024 halving, the new cost base rose sharply and has since marked a localized low followed by a sharp reversal every time Bitcoin has fallen near or slightly below the base. This value is currently around $70,000, but changes daily.

Conclusion: The next Bitcoin price cycle will likely be shallow

Each Bitcoin cycle brings a wave of euphoria: “This time it’s different.” But the data continues to show otherwise. Institutional adoption and broader financial integration have certainly changed the structure of Bitcoin, but it has not erased its circularity.

The data suggests that the next bear market is likely to be shallower, reflecting a more mature liquidity-driven environment. A retracement to the $55,000 to $70,000 zone is not a sign of a collapse, but would indicate a continuation of Bitcoin’s historic expansion-reset rhythm.

If you want to learn more about this topic, check out our latest YouTube video here: Predicting Bitcoin Bear Market Lows Using Math and Data

For more in-depth data, charts, and expert insights on Bitcoin price trends, visit BitcoinMagazinePro.com.

For more expert market insights and analysis, subscribe to Bitcoin Magazine Pro on YouTube.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Please be sure to do your own research before making any investment decisions.