Bitcoin dips below $99K amid global tensions and heavy liquidations. Catch today’s top crypto market insights, altcoin moves, and key regulatory headlines.

Bitcoin Drops Below $99K Amid Market Volatility

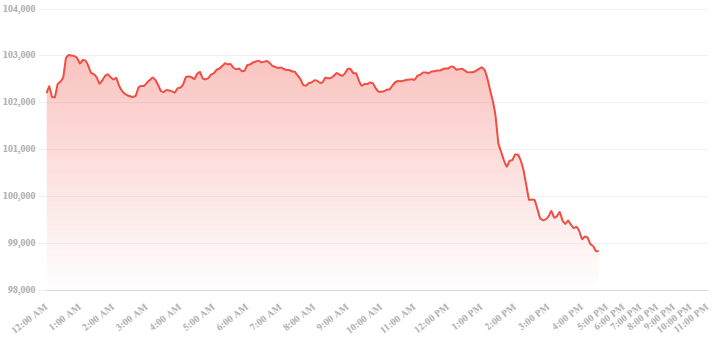

Bitcoin (BTC) slipped to $98,837 on Saturday, down approximately 4.8% over the last 24 hours. The world’s largest cryptocurrency shed nearly $4,800 as geopolitical tensions and profit-taking pressure weighed heavily on the broader market.

According to industry data, BTC reached an intraday high of $103,626 before falling to as low as $98,823, triggering over $1 billion in long liquidations across major exchanges. The sell-off came in response to reports of heightened tensions between the U.S. and Iran in the Strait of Hormuz, pushing traders into a risk-off mode.

This marks Bitcoin’s first dip below the psychological $100,000 support in nearly five weeks.

“We’re witnessing technical support levels breach one after another,” said Julian Fort, senior analyst at Luno Capital. “If $98K doesn’t hold, we may see Bitcoin test the $92K or even $81K zones in the coming sessions.”

Ethereum Slumps Alongside BTC, Down Over 8%

Ethereum (ETH) followed the downtrend, falling to around $2,199, marking an 8.5% intraday decline. The drop comes despite earlier bullish sentiment surrounding BlackRock’s Spot ETH ETF filing, which sent ETH above $2,400 earlier this week.

Analysts suggest the pullback is technical in nature and that the ETF speculation may continue to drive medium-term interest, pending comments from the U.S. Securities and Exchange Commission (SEC).

Altcoin Market Suffers Broad Sell-Off

Altcoins posted widespread losses as the market recoiled from overextended positions built during last week’s rally.

Biggest Decliners:

- Solana (SOL): -7.9%

- XRP: -5.4%

- Cardano (ADA): -6.1%

AI Tokens Hold Strong:

- SingularityNET (AGIX): +4.3%

- Render (RNDR): +3.6%

Investors showed relative confidence in AI-related assets, reinforcing the ongoing rotation toward utility and AI-integrated blockchain ecosystems.

Ripple Scores Major Legal Victory

In a long-anticipated decision, a U.S. federal appellate court upheld a lower ruling that XRP does not qualify as a security when traded on exchanges. Ripple Labs called the decision a “milestone moment” in crypto legal history.

XRP saw a short-term spike to $0.82, up 9% on the day, as traders speculated this could strengthen other crypto cases against the SEC, particularly involving Coinbase and Solana.

Binance Granted Conditional License in South Korea

Binance has received conditional regulatory approval to resume operations in South Korea, one of Asia’s most active crypto markets. The license allows Binance to operate under close supervision by the Financial Services Commission (FSC) and deploy AI-based monitoring tools to combat wash trading.

The announcement follows Binance’s aggressive compliance push across Asia, with similar applications pending in Japan, Malaysia, and India.

El Salvador Expands Bitcoin Bond Program

President Nayib Bukele confirmed a second round of Bitcoin-backed Volcano Bonds, aiming to raise an additional $1.5 billion. The bonds will pay up to a 6.5% yield in Bitcoin and are being positioned as an alternative global finance model for emerging markets.

Early response to the bond announcement has been positive, especially among Latin American crypto communities.

Hong Kong Launches Retail CBDC Pilot

The Hong Kong Monetary Authority (HKMA) launched a pilot for its retail e-HKD, integrating smart contracts, offline payments, and AI-based fraud protection. The initiative is part of Hong Kong’s broader digital finance framework and is being closely watched by central banks in Singapore, Japan, and the EU.

Market Outlook

As of this writing:

- Bitcoin (BTC): $98,837, ▼ 4.8%

- Ethereum (ETH): $2,199, ▼ 8.5%

- Global Crypto Market Cap: ~$2.34 Trillion, ▼ 5.1%

Analysts forecast a potentially volatile weekend, with key support levels to watch:

- BTC: $98K, then $92K

- ETH: $2,150, followed by $1,980

Market sentiment remains cautiously bearish, though AI and Layer 2 tokens show continued investor confidence.

Summary

- Bitcoin drops below $99K amid liquidation wave and global tension.

- Ethereum suffers, despite bullish ETF news.

- Ripple gains legal clarity; XRP up 9%.

- Binance re-enters South Korea under strict rules.

- El Salvador doubles down on Bitcoin bonds.

- AI tokens continue to shine despite broader red market.