- Bitcoin mining-backed token with transparent on-chain write vault.

- The 330+ wBTC reserve creates a price floor that will grow through token burn.

- Real infrastructure connects physical mining to verifiable cryptographic value.

Asuncion, Paraguay, December 19th – In a cryptocurrency market still subject to cycles of upswing and correction, projects with verifiable backing, real infrastructure, and clear operating rules are gaining traction. In this context, Ever Value Coin (EVA) has distinguished itself over the past year by developing an economic model supported by Bitcoin mining and on-chain transparency.

EVA is a token built on the Arbitrum network and its structural value is backed by Bitcoin, known as immutable and audited smart contracts. burn the vault. This on-chain vault only releases its reserves when the EVA token is burned forever, creating a direct relationship between supply, backing, and predictability.

Over the past 12 months, the project has expanded its mining operations, strengthened its Bitcoin backing, and increased its presence across exchanges, events, and organized efforts.

Burn Vault Growth and Bitcoin Lowest Price

One of the main indicators of EVA’s evolution is the continued growth of Burn Vault. The vault receives regular inflows of Bitcoin generated by the project’s own mining operations, which are converted into wBTC and deposited daily into smart contracts in a publicly and verifiable manner.

The Burn Vault currently stores: 330wBTCwhich acts as a unique on-chain liquidity system that goes beyond the liquidity of individual trading pairs on the Arbitrum network.

This growth is burn price — Minimum amount of Bitcoin that each unit of EVA can be redeemed upon burning. In reality, this structural price floor tends to strengthen over time, as the vault only releases Bitcoin if the token is destroyed.

Bitcoin mining as the basis of the model

The backbone of EVA’s model is the Bitcoin mining infrastructure. In 2025, the project will double its production capacity and currently operates five mining facilities with more than 1,000 mining facilities. 2,000 proprietary ASICsin addition to machines operated in partnership with third parties.

These operations produce: 15 Bitcoins per month Net profits are deposited into the Burn Vault daily. This flow connects physical world production activities with digital on-chain support.

Additionally, EVA integrates miners from different regions who can provide computing power in exchange for monthly payments in EVA calculated at market value, offering performance incentives compared to individual mining. This model allows us to scale Bitcoin inflows without relying solely on physical infrastructure expansion.

Community, rewards and liquidity

Another important pillar of the EVA ecosystem is the dynamics of reward for holders. The project frequently performs distributions, draws, and airdrops, many of which are related to the token writing mechanism. This contributes to both community participation and reduced circulating supply.

All fees generated from the liquidity pool provided by the team will also be burned, and the resulting wBTC will be deposited into the burn vault, where it will be backed over time.

At the same time, EVA expanded its presence across centralized and decentralized exchanges, trading on platforms such as: BingX, BitMart, Weex, Mercado Bitcoinwhile also maintaining active liquidity of the DEX within the Arbitrum ecosystem. In this project, public dashboard This allows users to check their liquidity and their on-chain allocation.

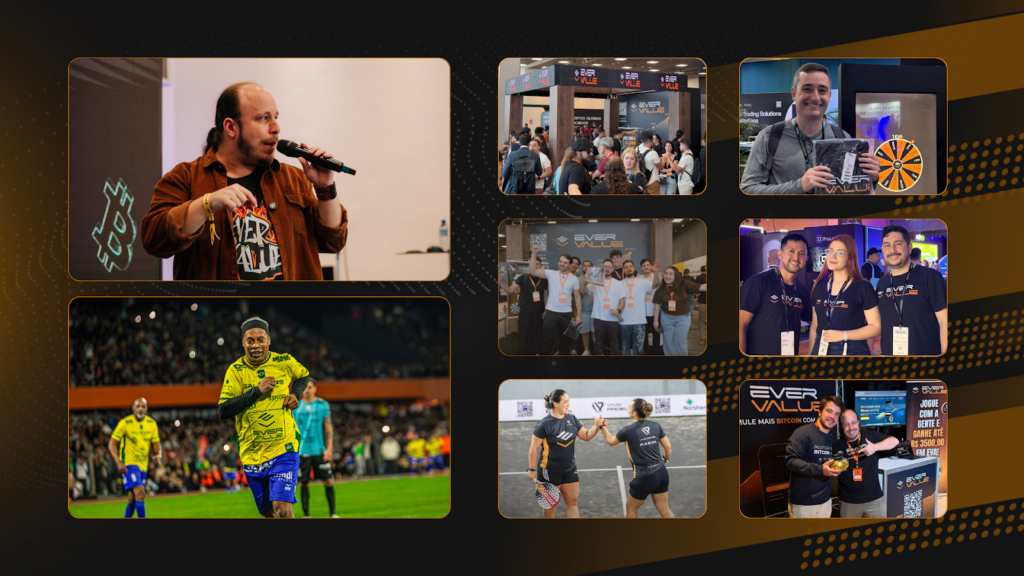

Institutional presence, events and sports sponsorship

Over the past year, EverValue Coin has consistently expanded its presence within the organization through participation and sponsorship of crypto industry events, strengthening its visibility and connections with the community and influencers.

In parallel, EVA has expanded its activities beyond the crypto space by sponsoring sports areas such as: Table tennis, padel, soccer, triathlon. These efforts strengthen the project’s narrative around consistency, discipline, and long-term vision.

Operational transparency and mining site visits

As part of our commitment to transparency, EVA has opened up its physical operations to the community. Partners and guests have already visited the project’s mining facilities in person, strengthening the connection with the real infrastructure and on-chain support.

A documentary featuring footage of these visits is YouTubeand a new visit is planned for January with the participation of Latin American influencers.

what happens next

With a stronger operational foundation and growing support for Bitcoin, EverValue is entering a new stage of maturity, with further announcements expected in the coming months.

Who wouldn’t want a token whose intrinsic value increases every day? The answer is obvious when that value is verifiable, transparent, and 100% redeemable.

Precisely due to the huge success of the token and growing demand, its market price has increased beyond its intrinsic backing. In response, EverValue is preparing a new backing vault that will allow tokens to be redeemed at prices much closer to market value. Its price increases daily in parallel with the core Burn Vault (original version).

Details on how this mechanism will be implemented will be shared by the team as development progresses.

About Ever Value Coin (EVA)

Ever Value Coin (EVA) is a blockchain-based digital asset developed on the Arbitrum network, focused on combining on-chain transparency with a structured economic framework. The project is supported by real-world infrastructure, including a Bitcoin mining operation, and utilizes smart contracts to provide support, supply mechanisms, and liquidity In a verifiable way.

Media inquiries

Flor Ayala

CEO

(email protected)

This article was written by a third party, and CoinJournal does not endorse or take responsibility for its content, accuracy, quality, advertising, products, or materials. Readers should conduct their own investigation and due diligence before making any decisions related to the companies mentioned.