Dubai Virtual Asset Regulatory Authority (VARA) has authorized 19 crypto companies for operating unauthorized virtual asset management and violating VARA’s marketing regulations.

The penalties included suspension and assumption orders along with fines between AED 100,000 ($27,300) and AED 600,000 ($163,000) adjusted according to the severity and scope of each violation.

An official statement on Tuesday confirmed that sanctions serve as public warnings to consumers, investors and institutions, and involvement of unauthorized operators presents substantial financial, legal and reputational risks.

“Enforcement is a key component of maintaining trust and stability in Dubai’s virtual asset ecosystem.”

VARA has strengthened marketing rules and licensing requirements

These measures support Vara’s mission to ensure that only companies that meet the highest compliance and governance standards can operate.

All companies that have been penalized are ordered to immediately suspend operations and suspend promotions to unlicensed virtual asset services in Dubai.

The action follows a similar execution in October 2024, when regulators fined seven licensed crypto companies.

In that previous round, it ranged from AED 50,000 ($13,612) to AED 100,000 ($27,225) based on the nature and severity of the violation.

In 2024, VARA strengthened its crypto marketing requirements and mandated a disclaimer on promotional materials.

Regulators also required prior permission before selling products or services to citizens and residents.

The updated regulations aim to prevent the spread of misleading information and prioritize consumer protection.

The regulations address a variety of aspects of marketing communications, including the importance of providing proper use of the language and the full and clear disclosure.

The aim is to help consumers understand the risks and opportunities associated with virtual assets.

Violation of marketing regulations could result in fines of up to AED 10,000,000 ($2.7 million).

Beyond marketing, entities providing virtual asset services in Dubai must secure a VARA license.

This applies to activities such as virtual asset issuance, trading platforms, and custody services. This process begins by applying for initial approval to establish operations and then proceeding to a full VASP (Virtual Asset Service Provider) license.

With provisional approval from VARA, the Cryptocurrency platform, including Crypto.com, Bybit, Deribit and Hashkey Group, has complied with these requirements and is able to provide virtual asset exchange services to retail, institutions and qualified investors in Dubai.

Why has Dubai become the world’s most obsessed cryptocurrency?

These developments continue to establish the UAE as a regional centre for blockchain innovation and cryptocurrency, with clarity of regulations attracting key global players.

Remember that White House AI & Crypto Czar David Sacks met with top UAE officials in March to discuss deeper collaborations in emerging technologies and investment opportunities between the two countries.

Following the meeting, MGX of Abu Dhabi, a state-backed investment company, invested $2 billion in Binance using USD1, a stablecoin developed by World Liberty Financial, a crypto venture closely associated with the Trump family.

Recent research has revealed that in 2025, the UAE, which was first ranked among the world’s “most cryptography-obsessed countries” recorded an exceptional cryptography adoption growth of 210%.

The United Arab Emirates also won 98.4%, with the largest crypto ownership rate of 25.3%.

Dubai is now becoming a key destination for crypto and Stablecoin ventures in pursuit of alternatives to the EU’s newly implemented market in Crypto-Assets (MICA) regulations.

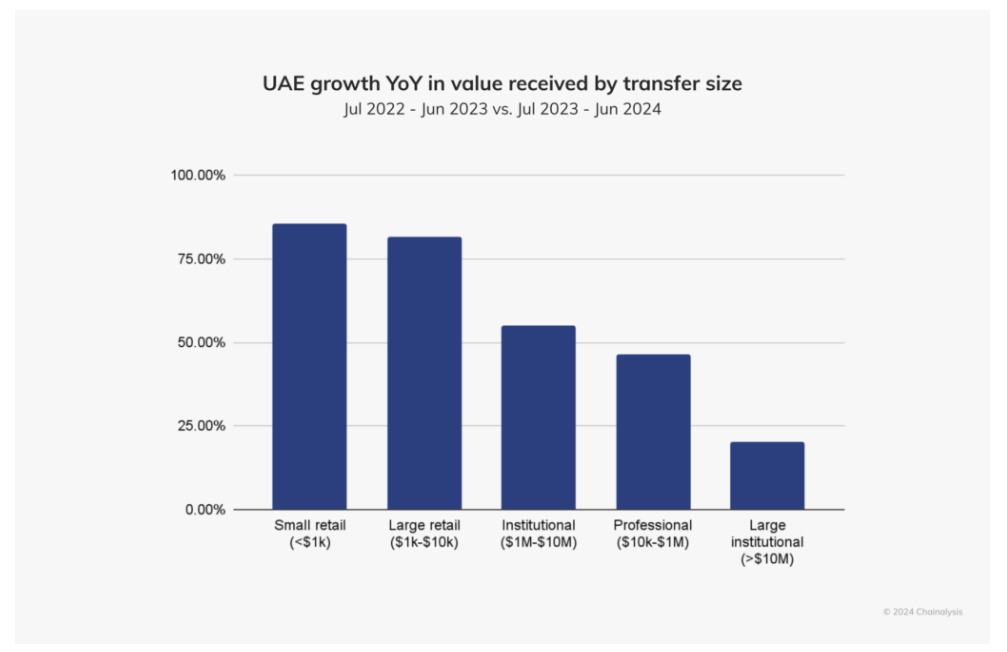

In the Middle East and North Africa (MENA), the chain dialysis report confirmed that the UAE is currently the third largest crypto economy in the region.

Between July 2023 and June 2024 alone, the UAE has received over $30 billion in crypto, ranking in the top 40 worldwide.

Cryptocurrency investment is also expanding rapidly. Many VC funds and blockchain businesses have established operations in the UAE, including chain analysis, which opened a regional headquarters in Dubai last year.

Tether, the publisher of the world’s most traded Stablecoin (USDT), has also recently announced plans to launch a stabled Stablecoin in Dirham.

Post-Dubai Regulator Vara Sanctions 19 Crypto companies operating without licenses – fines of up to $163,000 each first appeared on Cryptonews.

Dubai’s Virtual Asset Regulatory Authority (VARA) has updated its marketing regulations as part of the broader framework of VASP.

Dubai’s Virtual Asset Regulatory Authority (VARA) has updated its marketing regulations as part of the broader framework of VASP.