The fourth quarter of 2025 has been a turbulent and volatile period for Bitcoin. Bitcoin endured a tumultuous December, with its price down nearly 9% and volatility soaring to levels not seen since April 2025.

In the latest mid-December ‘ChainCheck’ report, VanEck’s digital asset analysts paint a mixed picture, with on-chain activity remaining weak, but liquidity conditions improving and speculative leverage appearing to be resetting, providing cautious optimism for long-term holders.

The company highlighted contrasting behavior between different investor groups. Digital Asset Treasury (DAT) has been actively buying this push, accumulating 42,000 BTC (the largest addition since July), bringing its total holdings to over 1 million BTC.

This contrasts with Bitcoin exchange-traded product (ETP) investors who have reduced their exposure, highlighting a shift towards corporate accumulation rather than individual-driven speculation.

VanEck analysts noted that some DATs are exploring alternative financing methods, such as issuing preferred stock rather than common stock, to finance purchases and operations, reflecting a more strategic and long-term approach.

On-chain data also reveals differences between medium-term and long-term holders. Tokens held for 1 to 5 years have seen significant movement, suggesting profit taking and portfolio rotation, but coins held for more than 5 years have seen little change.

VanEck interprets this as a signal that the oldest group remains confident about Bitcoin’s future while cyclical or short-term participants are offloading their assets.

Bitcoin miners face hashrate decline

Miners, on the other hand, face particularly difficult conditions. Van Eck said network hashrate fell 4% in December, the largest decline since April 2024, as high-capacity operations in regions such as Xinjiang reduced production amid regulatory pressure. Breakeven electricity costs for major mining rigs also fell, reflecting lower profit margins.

However, van Eck points out that historically, a decline in hashrate can act as a bullish contrarian indicator. A period of reduced network power often occurs before positive forward returns for 90-180 days.

The VanEck team frames their analysis within a GEO (Global Liquidity, Ecosystem Leverage, On-Chain Activity) framework designed to assess Bitcoin’s structural health beyond daily price fluctuations.

From this perspective, increased liquidity and accumulation through DAT provides a counterbalance to softer on-chain metrics such as stagnation of new addresses and lower transaction fees.

Broader macro trends further complicate the outlook for Bitcoin. Although the U.S. dollar has fallen to near three-month lows and precious metals prices have risen, Bitcoin and other crypto assets remain under pressure.

At the same time, an evolving financial ecosystem may provide new support. Market participants are pointing to the rise of Everything Exchange, a platform that aims to integrate stocks, cryptocurrencies and prediction markets using AI-driven trading and payment systems.

Just last week, Coinbase moved into something of an “everything exchange” and began expanding its platform to introduce stock trading, prediction markets, futures, and other features. VanEck said companies entering the space, from traditional brokerages to crypto-native companies, are competing for market share, potentially increasing Bitcoin’s liquidity and utility over time.

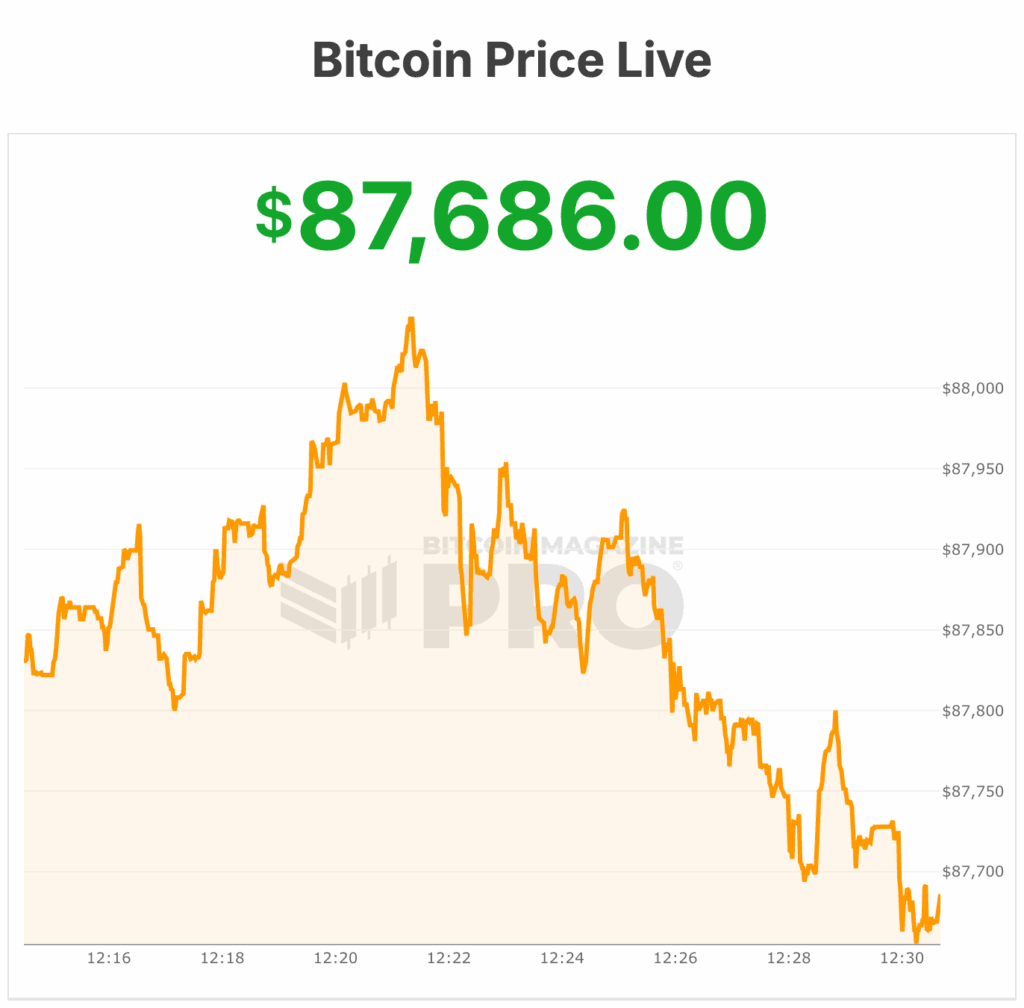

Bitcoin price fluctuation

Nevertheless, volatility remains a defining characteristic. Bitcoin’s value has doubled in the past two years and nearly tripled in the past three years, but the lack of extreme crashes or drawdowns has dampened expectations. Bitcoin’s future movement is likely to be more cautious, with intermediate-term investors likely to see smaller economic peaks and troughs rather than dramatic swings like in previous cycles.

VanEck said the overall market is in a correction. Short- to medium-term speculative activity has receded, long-term holders are holding steady, and institutional investor accumulation is increasing. Coupled with signs of miner capitulation, subdued volatility and macroeconomic trends, the company views the current environment as one of structural readjustment.

As 2025 draws to a close, VanEck said Bitcoin may be in a period of consolidation that reflects broader market maturation. This could lead to significant positive price movements in the first quarter of next year.