Crypto stocks surged on Tuesday, riding the momentum of a wider crypto rallies where Bitcoin (BTC) reignited risk appetite across digital assets of over $90,000.

During the session, shares in the largest company BTC holders, Strategy (MSTR), Crypto Exchange Coinbase (Coin), rose 8% to 9%.

The leading move is Bitcoin miners, many of which have double-digit profits, surpassing BTC’s 5% advance. Bitdeer Technologies (BTDR) scored around 20%, while BitFarms (BITF), CleanSpark (CLSK), Cipher Mining (CIFR), Mara Holdings (Mara) and Riot Platforms (Riot) surged between 10% and 15% during the session.

Meanwhile, the broader stock market also rebounded from yesterday’s decline, with the Nasdaq and S&P 500 up 2% and 1.7% respectively. The rally in the TRADFI market came as reports of a potential de-escalation of tariff tensions between the US and China lifted investors’ sentiment.

Miners and tariff risks

Mining inventory bounces are hampered by compression margins, rising hashrate competition and tariff challenges after months of unperformance, all combined with the weakness of the wider market for risky assets. Most, if not all, published miners still trade near months’ lows.

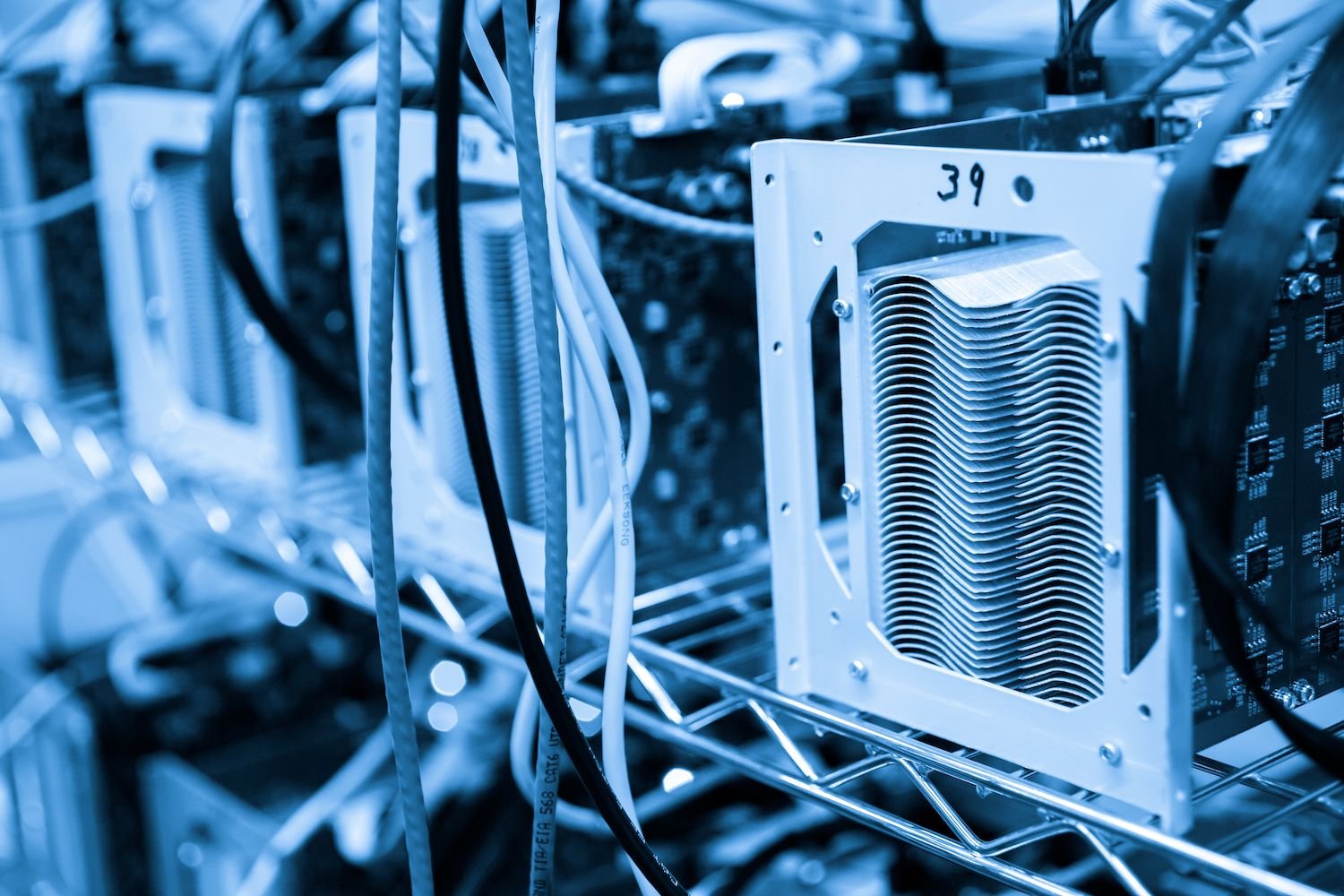

The issue of the US-based mining business is the Trump administration’s tariff policy, threatening to make it much more expensive to import ASICs (the machinery used to mine Bitcoin). In other words, mining operations in the US will likely grow at a much slower rate or even stop growing completely.

Taras Kulyk, co-founder and CEO of mining hardware provider SynteQ Digital, recently told Coindesk that the tariffs “have a significant impact on future spending and US CAPEX.”

“Other jurisdictions that previously required higher costs (will) are being sought after new infrastructure and CAPEX deployment goals. Canada in particular will likely benefit from the implementation of the global tariff system introduced by the White House.”

Relatedly, one of the reasons behind Bitdeer’s outperformance may be that the company has developed its own ASIC manufacturing industry and recently made the decision to build self-recruitment capabilities instead of selling rigs in a slower market. Stablecoin’s giant tethers also purchase BTDR shares. As of last Thursday, the company had invested $32 million in Bitdia.

Still, most miner stocks have been on the downtrend since December, long before the White House announced new customs policies. At present, with BTC above the main technology levels and liquidity flowing into the space, miners are likely catching bids as leveraged proxy for BTC’s profits.

Regardless of today’s outperformance, tariffs, along with other risky assets, continue to play a key role in miners and most crypto stocks. As the revenue season begins soon, all eyes will be comments from the CEO on how the tariff situation will change the outlook for a company. In particular, Elon Musk’s Tesla, who also owns Bitcoin at the Treasury Department, will report on the after-revenue market on Tuesday, providing insight into how traders should price trade war uncertainties.