Bitcoin price weekly outlook

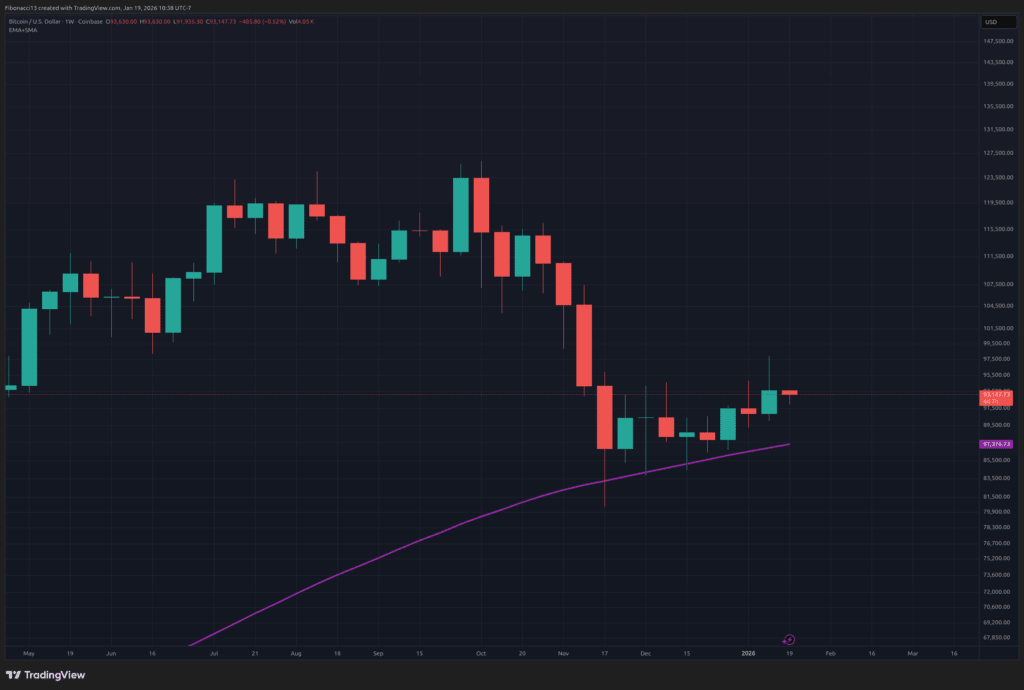

Well, after last week’s close, Bitcoin price action looked very bearish, but the bulls managed to maintain a bullish structure around the $90,000 level and pushed it up to the $98,000 resistance. Prices declined from there, ending the week at $93,638. The bulls are expected to rally above the $98,000 resistance level this week and, if the price sustains above $98,000, aim for the upper end of this resistance zone at $103,500. The $91,400 support could be tested early in the week and will need to hold for the bulls to continue their charge.

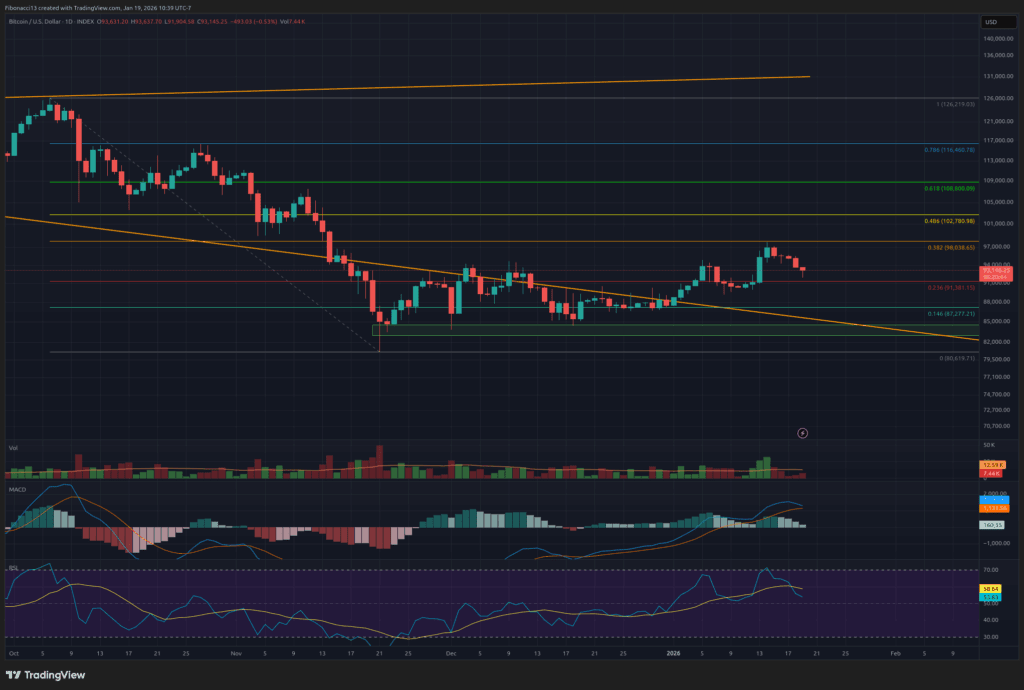

Current major support and resistance levels

The bulls have finally made some progress and chipped away at the overhead resistance. Bulls will aim to recover the $94,000 level this week as short-term support. If this momentum can be maintained, it will once again challenge the resistance at $98,000 and try to push it to the upper end of this zone at $103,500. A close at the upper end of this zone should lead to a rise to the next major resistance zone of $106,000 to $109,000. This area should provide very strong resistance, but if the bulls’ strength can hold, $116,000 is just above this range at the 0.786 Fibonacci retracement.

Note that the bulls authoritatively defend the $91,400 level. Losing this level will give the bears renewed confidence to push prices further down. We believe $87,000 will act as an entry point to the key $84,000 support level, limiting price movements below. A break through the $84,000 support opens up a test area in the low $70,000 area.

This week’s outlook

Bulls should try to capitalize on recent resolve heading into this week. If you can get your $94,000 back earlier this week, expect a further test of $98,000. However, a more bearish test of the support at $91,400 is possible here as well, but as long as the bulls can sustain this level, the bullish bias remains and a re-test of $98,000 is possible. Ending the day above $98,000 should push the price towards $103,500.

Market atmosphere: Moderately Bullish – Last week, the bulls defended the $90,000 area and were finally able to show some resilience here. Heading into this week, price trends tilt in their favor.

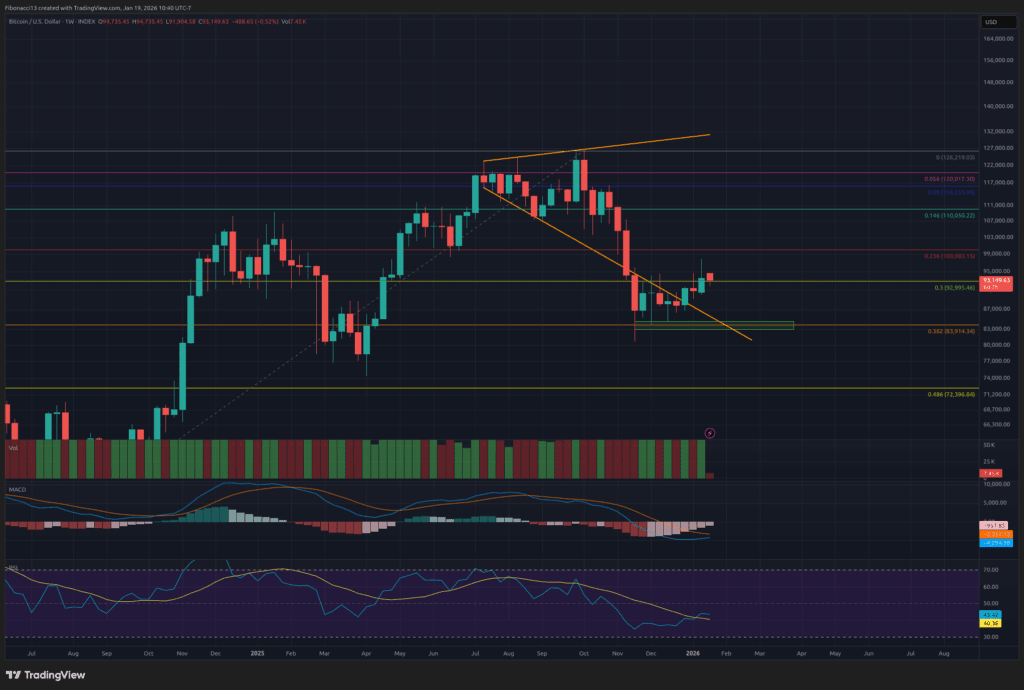

coming weeks

The bulls have maintained some momentum over the past week, but are now entering deeper resistance territory. If the bulls can move higher above $100,000, we will start to see a significant price reversal. $103,500 to $109,000 should be a difficult zone to conquer, and we shouldn’t be surprised if the price is lowered by authorities in this area in the coming weeks. Sustaining support from there will be important in determining whether this rally can continue to make new highs or ultimately give way to new lows below $80,000.

Terminology guide:

Bulls/Bulls: Buyers and investors who expect prices to rise.

Bearish/bearish: Sellers and investors who expect prices to fall.

Support or support level: The level at which the price of an asset should be maintained, at least initially. The more you touch the support, the more likely it will weaken and the price will not be able to sustain itself.

Resistance or resistance level: Opposite of support. A level where the price is likely to be rejected, at least initially. The more times you touch the resistor, the weaker it becomes and the more likely it is that you won’t be able to keep the price down.

Fibonacci retracements and extensions: The ratio is based on what is known as the golden mean, a universal ratio that relates to cycles of growth and decline in nature. The golden ratio is based on the constants Phi (1.618) and Phi (0.618).