April 14, 2025 – Crypto Market Update

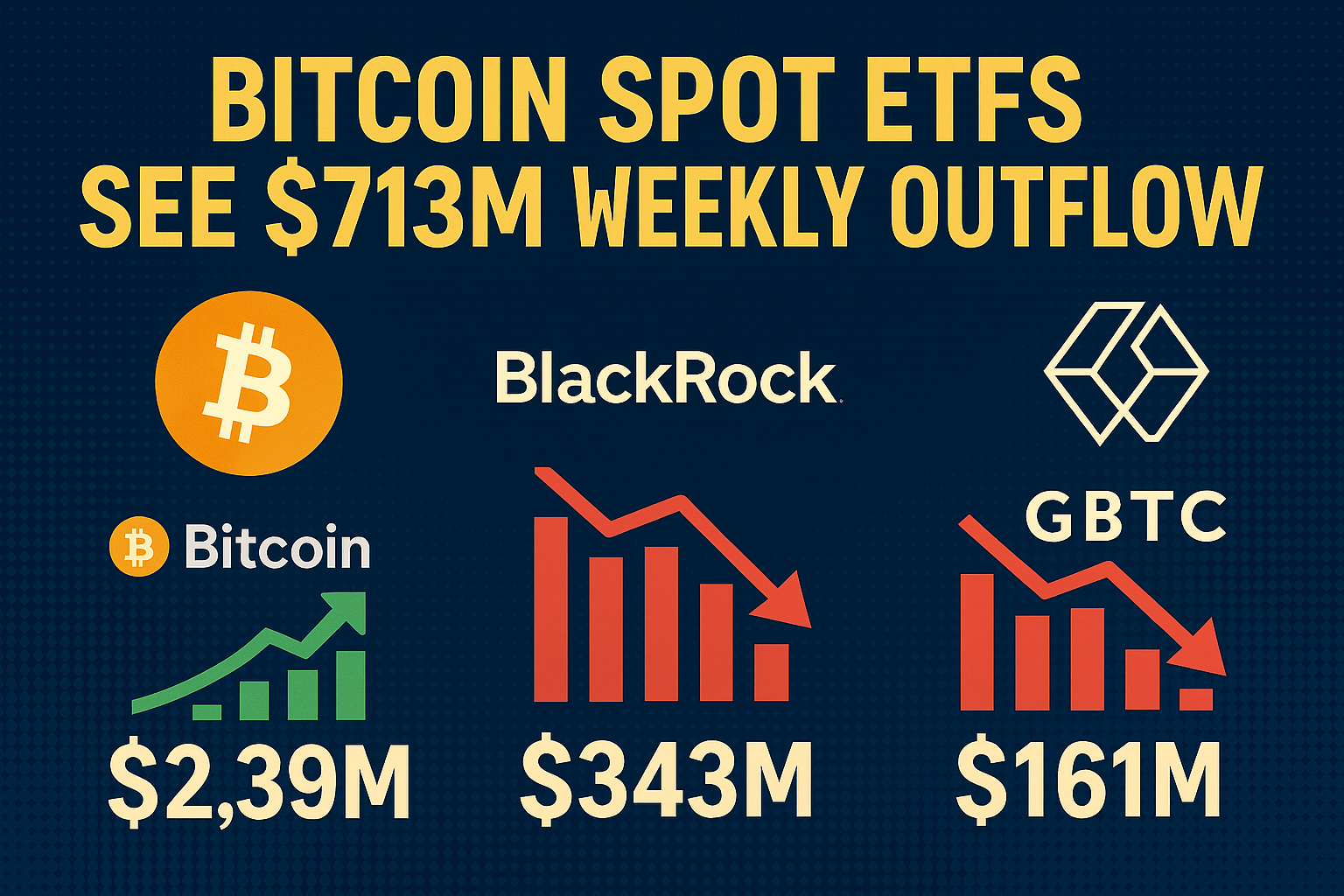

Bitcoin spot exchange-traded funds (ETFs) faced significant turbulence this past week, recording a net outflow of $713 million between April 7 and April 11, 2025 (ET), according to data published by SoSoValue and reported by Foresight News.

This notable withdrawal trend reflects investor caution as the broader crypto market weathers uncertainty. Despite strong historical inflows, key ETFs like BlackRock’s IBIT and Grayscale’s GBTC led the week’s losses, contributing heavily to the overall outflow.

BlackRock and Grayscale Drive Largest Weekly Outflows

The BlackRock Bitcoin ETF (IBIT) posted the largest net outflow for the week at $343 million, though it still maintains a robust historical net inflow of $39.57 billion.

Meanwhile, the Grayscale Bitcoin ETF (GBTC) followed closely with a $161 million outflow. GBTC has now accumulated a total net outflow of $22.78 billion since launch, reinforcing the persistent investor migration away from Grayscale’s higher-fee structure.

Grayscale Bitcoin Mini Trust Shows Modest Growth

Contrary to the outflow trend, the Grayscale Bitcoin Mini Trust ETF (BTC) recorded the highest net inflow among spot ETFs last week, attracting $2.39 million. The product has now reached a total net inflow of $1.15 billion, signaling investor interest in lower-fee alternatives within the Grayscale ecosystem.

Bitcoin Spot ETF Market Overview

As of the latest data:

- Total Net Asset Value (NAV) of all Bitcoin spot ETFs: $93.36 billion

- ETF Net Asset Ratio vs Bitcoin Market Cap: 5.61%

- Total Historical Net Inflow Across All Bitcoin Spot ETFs: $35.36 billion

This data underscores the growing influence of Bitcoin ETFs as institutional-grade vehicles for crypto exposure—despite short-term redemptions and macro market uncertainty.

Investor Caution Rises Amid Regulatory and Economic Pressures

The recent outflows may reflect profit-taking, fear over U.S. macro policy, or temporary risk-off sentiment across digital assets. Analysts continue to monitor whether this trend signals a broader shift or a short-term pullback as Bitcoin hovers around key technical levels.

Disclaimer: Includes third-party opinions. No financial advice.