Bitcoin started 2026 with renewed strength, rising about 8% since the beginning of the year as institutional inflows, derivative positioning, and geopolitical developments conspired to lift overall crypto market sentiment.

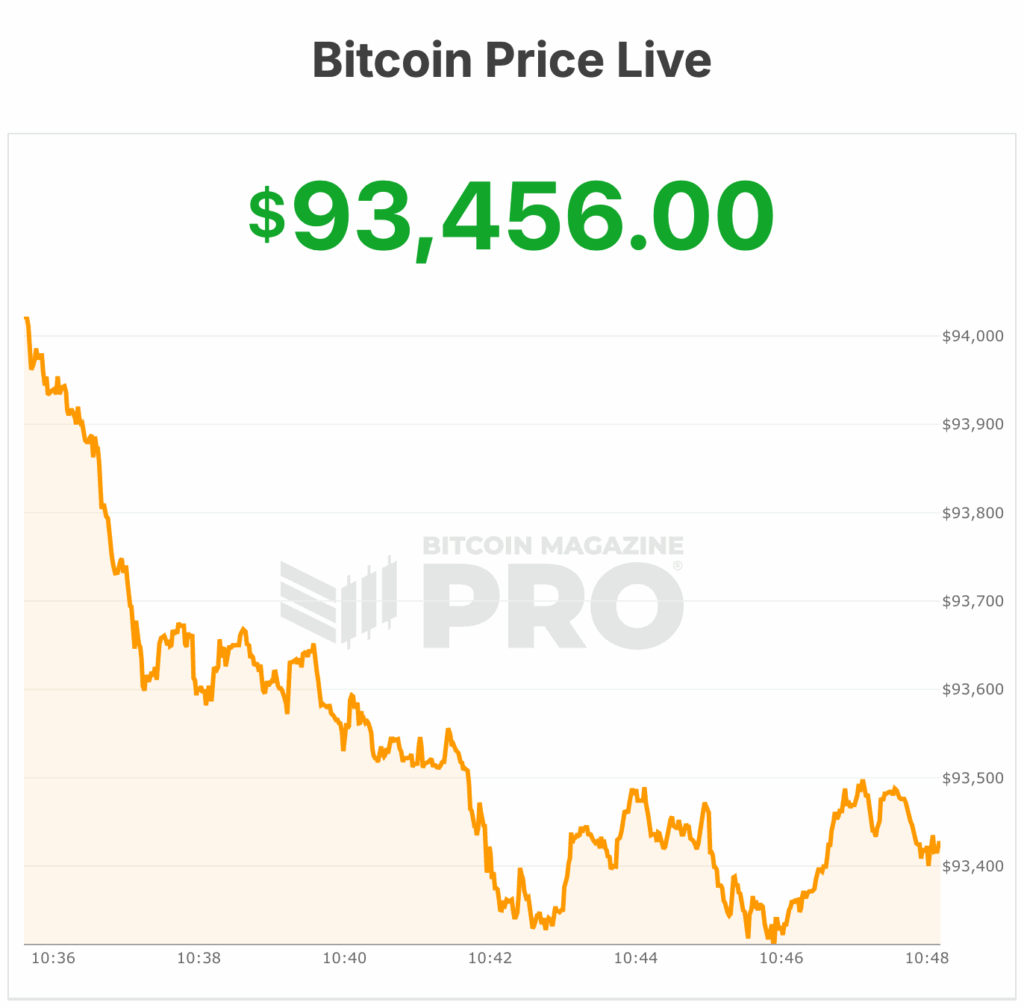

Bitcoin price is currently trading around $94,100, reaching levels last seen in early December. After starting the year near $87,400 on January 1, the price briefly touched an intraday high of $94,352, according to data from Bitcoin Magazine Pro.

As of this morning, Bitcoin was hovering around $94,000, within 1% of its recent seven-day high, according to market data.

This increase has brought Bitcoin’s market capitalization to around $1.87 trillion, with daily trading volume hovering around $51 billion. The circulating supply of Bitcoin is just under 20 million of the fixed upper limit of 21 million.

This rally followed a period of sideways trading until late December, when Bitcoin price struggled to break through resistance near $91,000. This level then became short-term support, opening the door to retest the $94,000-$98,000 range that had been the upper bound for the price for most of the past two months.

A story of geopolitics and hedging

Bitcoin’s rally coincided with reports over the weekend that the United States had captured Venezuelan President Nicolas Maduro, a development that rippled through commodity and crypto markets.

Oil stocks soared on hopes that Venezuela’s energy sector could restart under new leadership, while crypto-related stocks such as Coinbase and Strategies each rose more than 4%.

Analysts cautioned that the event itself was not a direct catalyst for Bitcoin. Rather, Bitcoin’s role as a hedge against geopolitical pressures and sanctions risks has been strengthened.

“Increasing pressure without direct military conflict is supporting Bitcoin,” said Dean Chen, an analyst at crypto derivatives exchange Bitunics. He pointed to a historical pattern in which increased sanctions, capital controls, and restrictions on the global banking system coincide with increases in real-world Bitcoin usage.

Bitcoin price options market aims for six-digit target and returns on ETF inflows

Derivatives markets suggest traders are eyeing further gains. Deribit, the world’s largest crypto options exchange, saw a surge in open interest for January call options with a strike price of $100,000.

January’s $100,000 call became the most popular contract on the platform, with total nominal open interest of approximately $1.45 billion.

Spot Bitcoin exchange-traded funds are also re-emerging as a major driver. U.S.-listed Bitcoin ETFs recorded nearly $700 million in net inflows on Monday, the largest single-day total net inflows since October, according to industry data.

This demand equates to over 7,000 BTC, which far exceeds the daily new issuance by miners. Continued purchases of ETFs, especially when combined with declining balances on exchanges, can tighten available supply and support rising prices.

According to on-chain data, about $1.2 billion worth of Bitcoin has been withdrawn from exchanges in the past 24 hours, a sign that investors are moving their coins into private vaults rather than preparing to sell them.

Bitcoin price technical level

From a technical perspective, Bitcoin price has broken out of a multi-week selloff and attention has shifted to the resistance level near $98,000. Above that level, Bitcoin could return to the $100,000 level, a psychological level that it failed to hold during the bull market in late 2025.

Bitcoin price support is currently near $91,400, with stronger support near $87,000 if the price pulls back. While a break below $84,000 would weaken the short-term structure of Bitcoin price, long-term bulls argue that rising yearly lows continue to define Bitcoin’s broader uptrend.

For now, traders are heading into the new year with momentum on their side. Whether Bitcoin prices can turn an early January surge into a sustained breakout will depend on continued ETF demand, options market dynamics, and how global macro risks develop in the coming weeks.