According to data referenced by the Wall Street Journal, almost half of this capital ($43 billion) was mobilized in June alone, and institutional investors poured around $86 billion into cryptocurrency acquisitions, Bitcoin prices appear to be ready for another surge to a fresh, top-high.

The institution’s claims are led by Strategy (formerly MicroStrategy Inc.), the company that launched the company’s Bitcoin accumulation campaign in 2020.

Throughout this year, the company has secured more than $10 billion in funding, particularly to expand its Bitcoin Treasury.

With Bitcoin currently trading at $119,046 and its daily volume exceeding $60 billion, market observers expect the institution’s capital inflow to catalyze the “institutional supercycle.”

Bitcoin prices benefiting from facility supercycle FOMO effects

The wave of institutional adoption in Bitcoin shows no signs of slowing down.

Earlier on July 28, Japan’s Metaplanet expanded its Bitcoin position by acquiring an additional 780 BTC for around $92.5 million, valued its total holding at around $1.73 billion.

A study compiled by HODL15CAPITAL shows that over 35 additional companies are actively preparing to raise billions of dollars to implement their Bitcoin accumulation strategies.

In line with previous Cryptonews predictions, there is growing optimism within the cryptocurrency community where Bitcoin could potentially provide a 100% return that could effectively double the current price level before this supercycle ends.

Bitcoin Price Prediction: $124,000 Goals Emerge from Chart

From a technical standpoint, the BTC/USDT Daily Chart shows a clear pattern of sustained bullish momentum.

Following a decisive breakout on the upward channel, Bitcoin has entered the trading range of around $116,000-123,000.

This price action created a rectangular integrated pattern just below the current all-time high of $123,218.

Currently, the relative strength index (RSI) is about 61.63, and the moving average of RSI is 64.65. This suggests that bullish momentum exists, but it is not overly expanded.

Given the structure, Bitcoin appears to form a bullish continuation pattern.

If the $116,000 support continues to be retained and breaks past the $119,000 resistance zone, it could potentially push to a forecast target of $124,005 or more.

However, if you can’t keep the support zone, the ascending trend line could be retested, going up the $110,000 level.

Bitcoin Hyper raises $5.5 million to make Bitcoin faster, cheaper and smarter

As Bitcoin prices are getting stronger, many are looking for new crypto projects that can potentially make more money while still maintaining Bitcoin.

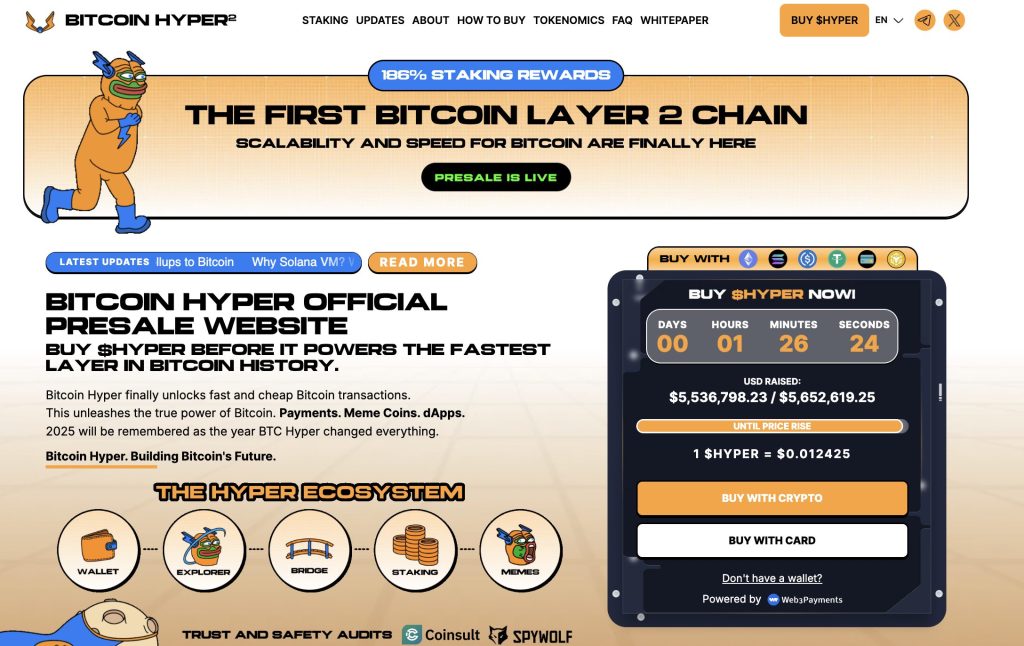

One of the projects that has attracted a lot of attention is Bitcoin Hyper (Hyper).

Bitcoin Hyper Takes Bitcoin’s power and upgrades for the modern world of crypto.

Bitcoin is still the safest blockchain, but it is slow, expensive and limited in what you can do.

Bitcoin Hyper Fix it by moving Bitcoin to a much faster Layer 2 network.

Transactions are almost instantaneous, fees drop dramatically, and smart contracts also support them. This is something that can’t be done with regular Bitcoin.

It works when used Solana’s High Speed Technology (SVM) And a secure bridge to connect to the Bitcoin base layer.

Early access is currently open Hyper Token pre-sale, price 0.012425 dollars Over $5.5 million has been raised so far for a limited time.

Can be purchased directly from staff Bitcoin Hyper Websites using crypto or credit cards, or through The best wallet – A secure app for storing and managing digital assets.

Post-Bitcoin Price Prediction: Global Companies Pour $86 billion into BTC – Could this lead to a new “institutional supercycle”? It first appeared on Cryptonews.