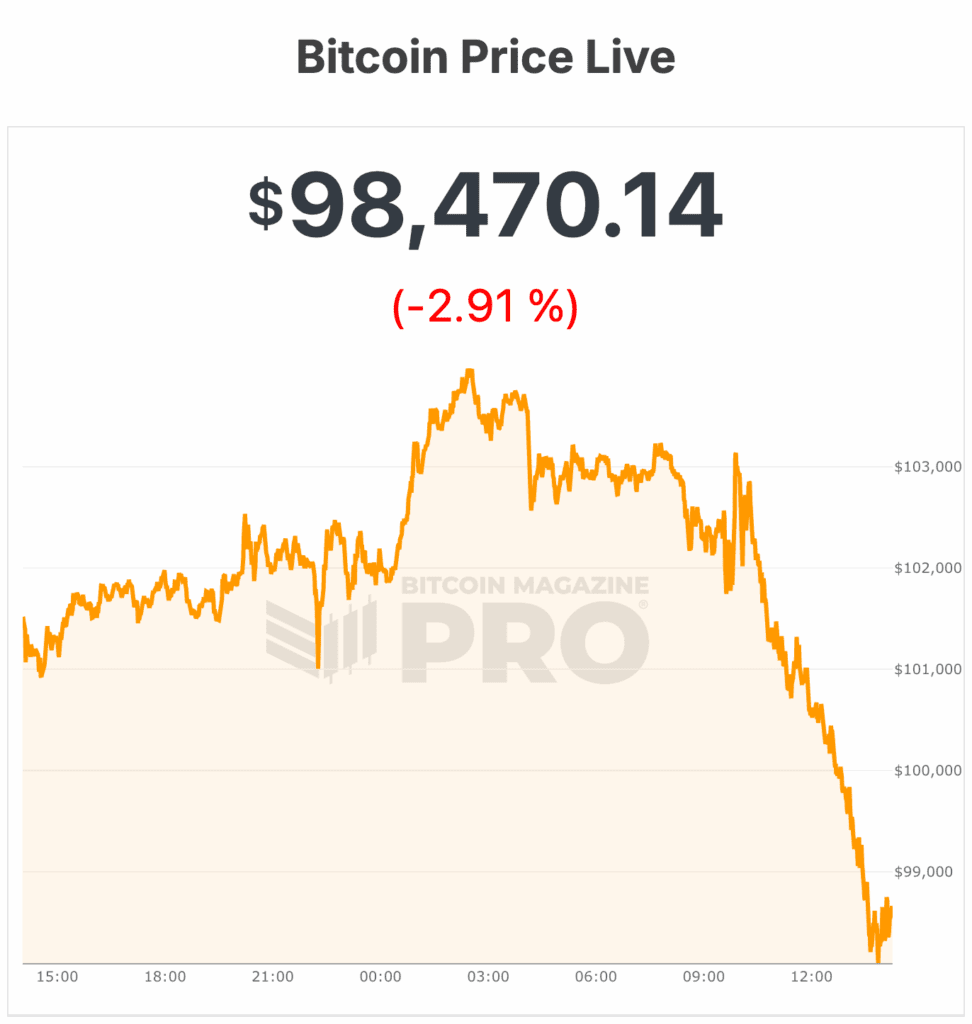

Bitcoin prices plummeted today, dropping from an intraday high of $104,000 to $98,113, erasing previous gains and marking a definitive break in price trend.

Beginning with morning trading, Bitcoin prices fell consistently from the low $102,000s to a low of $97,870.

According to data from Bitcoin Magazine Pro, the last time Bitcoin prices reached around these levels (below $98,000) was in early May, around May 8, depending on your time zone. The price of Bitcoin remained above $100,000 for more than 40 days, but fell to $98,000 in late June.

One possible reason for the soaring price of Bitcoin is that long-term holders are selling their assets at record levels. According to CryptoQuant data, the company sold around 815,000 BTC in 30 days, the highest amount since early 2024, amid weak spot and ETF demand. Profit-taking was dominant, with $3 billion in realized profits on November 7 alone.

Buying by institutional investors is also below the daily supply of mines, increasing selling pressure. The price is hovering around the important 365-day moving average of $102,000, and failure to maintain it could trigger even larger losses, according to the report. Bitcoin Magazine Pro analysis.

Analysts at Bitfinex say Bitcoin’s current decline reflects a mid-cycle retracement, with the decline from October’s highs consistent with the typical 22% drawdown seen throughout the 2023-2025 bull market.

“It is also important to note that even at the $100,000 level, around 72 percent of the total Bitcoin supply is still profitable,” Bitfinex analysts wrote. Bitcoin Magazine. They believe a short-term recovery is likely, but a sustained recovery will require new demand.

According to The Block, JPMorgan analysts say Bitcoin’s current estimated production cost of $94,000 serves as a historical price floor, suggesting limited downside.

Analysts believe that increasing network difficulty is driving up production costs, keeping Bitcoin’s price-to-cost ratio near historic lows. Analysts maintain their bold forecast for a six- to 12-month increase of about $170,000.

All of this comes after President Trump signed a funding bill late Wednesday, reopening the U.S. government after a 43-day shutdown, the longest in history.

Federal government operations are restarting, but the recovery will be slow. Federal workers are still waiting on back pay and air travel delays are likely to continue.

Timoth Lamarre, director of market research at Unchained, explained Bitcoin this way: bitcoin magazine as a “canary in the coal mine as market liquidity dries up”. He noted that the recent government shutdown has swollen the Treasury’s general account, absorbing liquidity, adding that the reopening of the government “increases liquidity being injected into the system, which will benefit Bitcoin’s dollar price in the short term.”

Agencies like the IRS face large backlogs, and national parks struggle to recoup lost revenue. Short-term funding measures have only been extended until January 30, and there remains the risk of another shutdown.

A return to normalcy will take time as the effects of the prolonged shutdown continue to ripple through the economy and public services.

Bitcoin prices skyrocketed in October as the government shutdown began, hitting a new all-time high of over $126,000. However, the excitement quickly gave way to confusion, and Bitcoin’s price fluctuated wildly throughout the remainder of October and into November.

At the time of this writing, the price of Bitcoin is $98,470.

Despite the overall bullish mood in the market, Bitcoin prices continued to fall further this month.

Bitcoin price-Nasdaq correlation can only hurt: Wintermute

According to a recent report from Wintermute, Bitcoin remains closely tied to the Nasdaq, but is exhibiting an unusual pattern: it is reacting more strongly to falling stock prices than rising prices.

This “negative skewness” (stock prices fall more on bad days than it rises on good days) is typically seen in bear markets, not when BTC is near all-time highs. This suggests investors are a little tired rather than euphoric.

There are two main factors driving this. First, in 2025, attention and capital will shift to equities. Big tech stocks and Nasdaq growth stocks are absorbing much of the risk appetite that may have flowed into cryptocurrencies. Bitcoin moves with the market when things go wrong, but it doesn’t get the same upside when optimism returns, acting more like a high beta tail of macro risk.

Second, the liquidity of cryptocurrencies is thinner than before. Stablecoin issuance has stagnated, ETF inflows have slowed, and exchange depth has not fully recovered. This makes the downside movement more pronounced and widens the performance gap.

That said, BTC is holding up extremely well, according to Wintermute. Despite this persistent downward bias, it remains less than 20% below its all-time high. This pattern is unusual near the top and typically seen near the bottom, but it also reflects Bitcoin’s growing maturity as a macro asset.