Bitcoin’s transaction count reached 540,000, marking its highest level in 2025.

Analysts say that increasing network activity is a sign of growing demand and can support the next bullish phase in cryptocurrency.

Rising on-chain transactions indicates an increase in demand

The latest report from Qryptoquant shows a significant increase in activity on the Bitcoin network. Analysts believe the flagship cryptocurrency price trajectory could be affected by a recent spike in network activity.

The CryptoonChain study examined transaction counts for Bitcoin. This indicates the number of confirmed transfers on the network at a given time. In 2025, the 14-day average of these transactions reached 540,000, the highest level ever this year. Analysts said the jump points to stronger demand and more use of the network, with protocols like the Bitcoin Ordinance and Runes likely to be added to the activity.

The report also pointed out a “ullish convergence” between the number of Bitcoin transactions and prices since July. This pattern suggests that current uptrends are not based solely on speculation. Unlike previous periods when prices and activities moved in different directions, current gatherings are supported by stronger practical use on the network. However, maintaining this level of activity is important for Bitcoin to maintain its momentum.

Market outlook

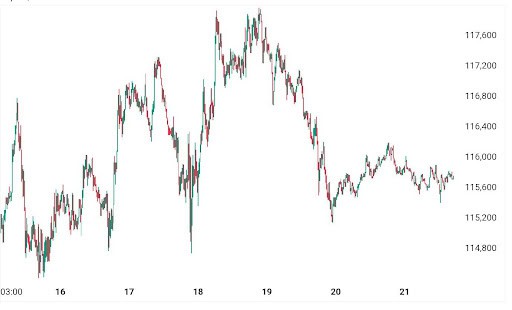

Bitcoin is currently trading at around $112,500, down about 4% that day, and appears to be breaking from the combined range amid mild bear pressure. The prices of major cryptocurrencies have shook sharply over the past week, falling below $113,000 before briefly gathering at $117,800. This was only after the Federal Reserve cut interest rates at 25 bps, and it was to settle at its previous level before today’s decline.

Since September 9th, US spot Bitcoin ETFs have garnered more than $2.8 billion in net inflows, pushing activity into positive territory. Institutional demand remains a stabilizing factor, with ETF allocation and exchange withdrawals reinforce long-term convictions.

While technical indicators suggest potential breakout integrity, network activity does not correspond to price momentum and miners’ incentives are under scrutiny. On the other hand, sentiment indicators that include a mixture of neutral fear and greed indexes and MACD signals will bring attention. Investors need to monitor macroeconomic changes, and ETFs will flow in close proximity to navigate the next stage of Bitcoin’s trajectory.

Post-Bitcoin networks attack record activity high. What does BTC mean? It first appeared in Cryptopotato.