With current bearish sentiment and macroeconomic uncertainty swirling in both Bitcoin and the wider global economy, it may be surprising to see miners as bullish as ever. In this article, we will unfold data that suggests that Bitcoin Miners are not only maintaining their course, but also doubles when many are being pulled back. What do they know exactly that a broader market may be missing?

To find out more about this topic, check out our recent YouTube videos here.

Why Bitcoin Miners are Doubling Now

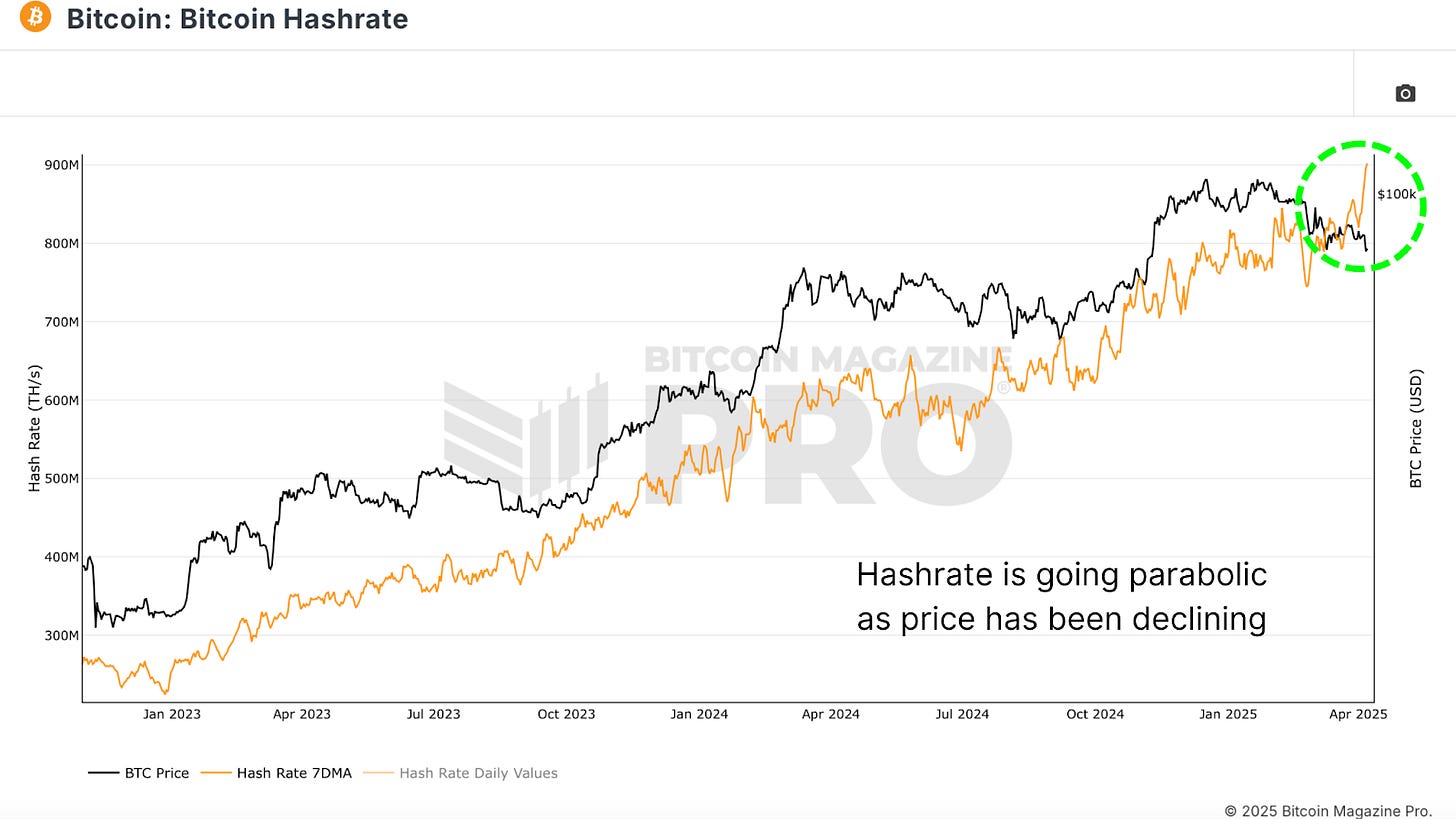

Bitcoin hashrate is parabolic

Despite Bitcoin’s recent price drop, Bitcoin Hashrate is absolutely vertical, breaking the seemingly record high, taking into account macro headwinds and sluggish price behaviour. Hash rates are usually closely correlated with BTC prices. If prices drop sharply or remain stagnant, hashrates tend to plateau or fall due to economic pressure on miners.

But now the hash rates are accelerating in the face of rising global tariffs, slower economics and consolidation of BTC prices. Historically, this level of divergence between hashrate and price has been rare and often significant.

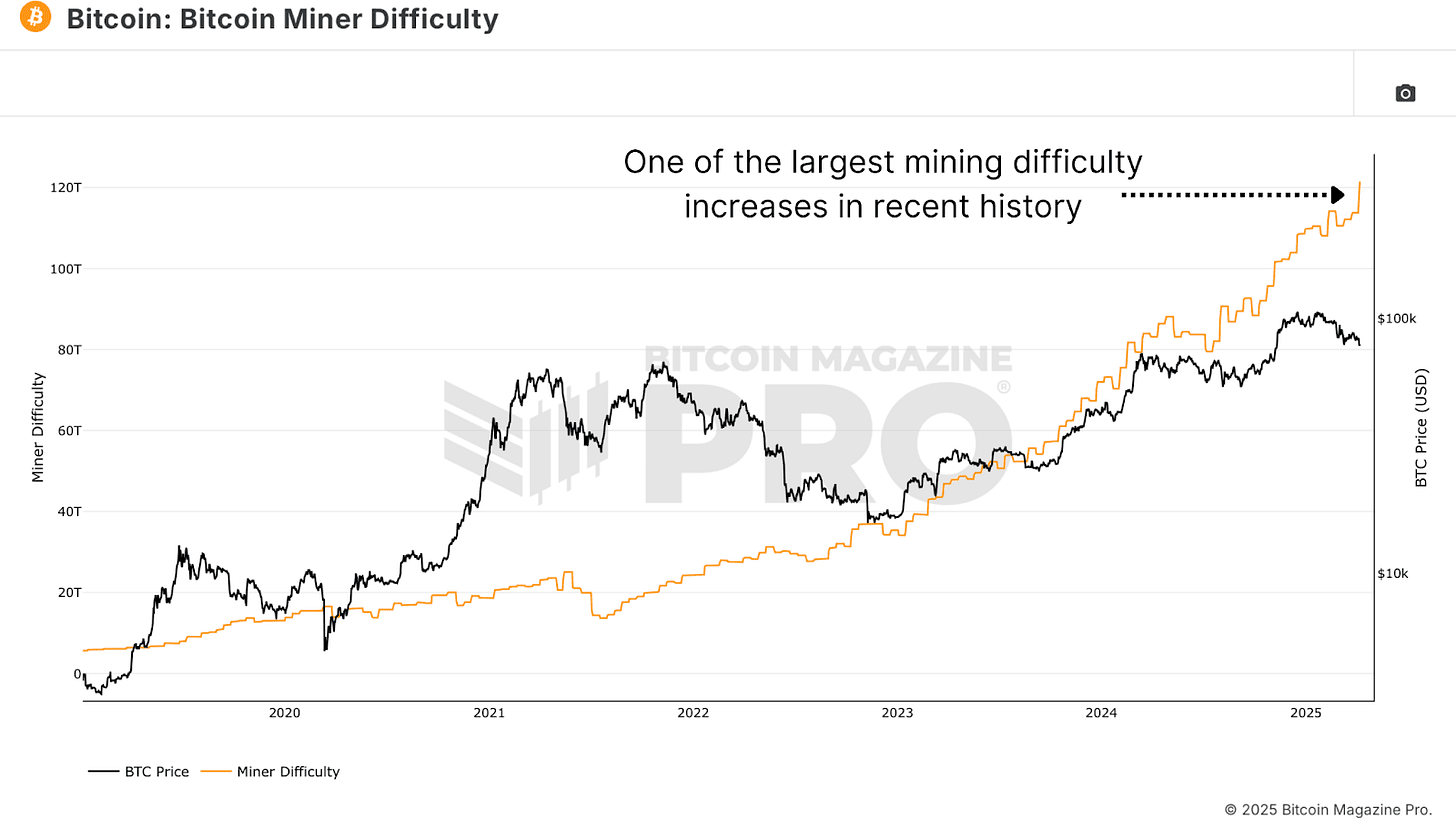

The difficulty of Bitcoin Miner, a cousin close to the hashrate, saw one of the biggest single adjustments in history. This metric will only increase if more computational power is flooded with the network, as it automatically adjusts the timing of Bitcoin blocks. This surge in difficulties of magnitude is almost unprecedented, especially when price performance is low.

Again, this suggests that miners are investing heavily in infrastructure and resources, even when BTC prices appear to not support decisions in the short term.

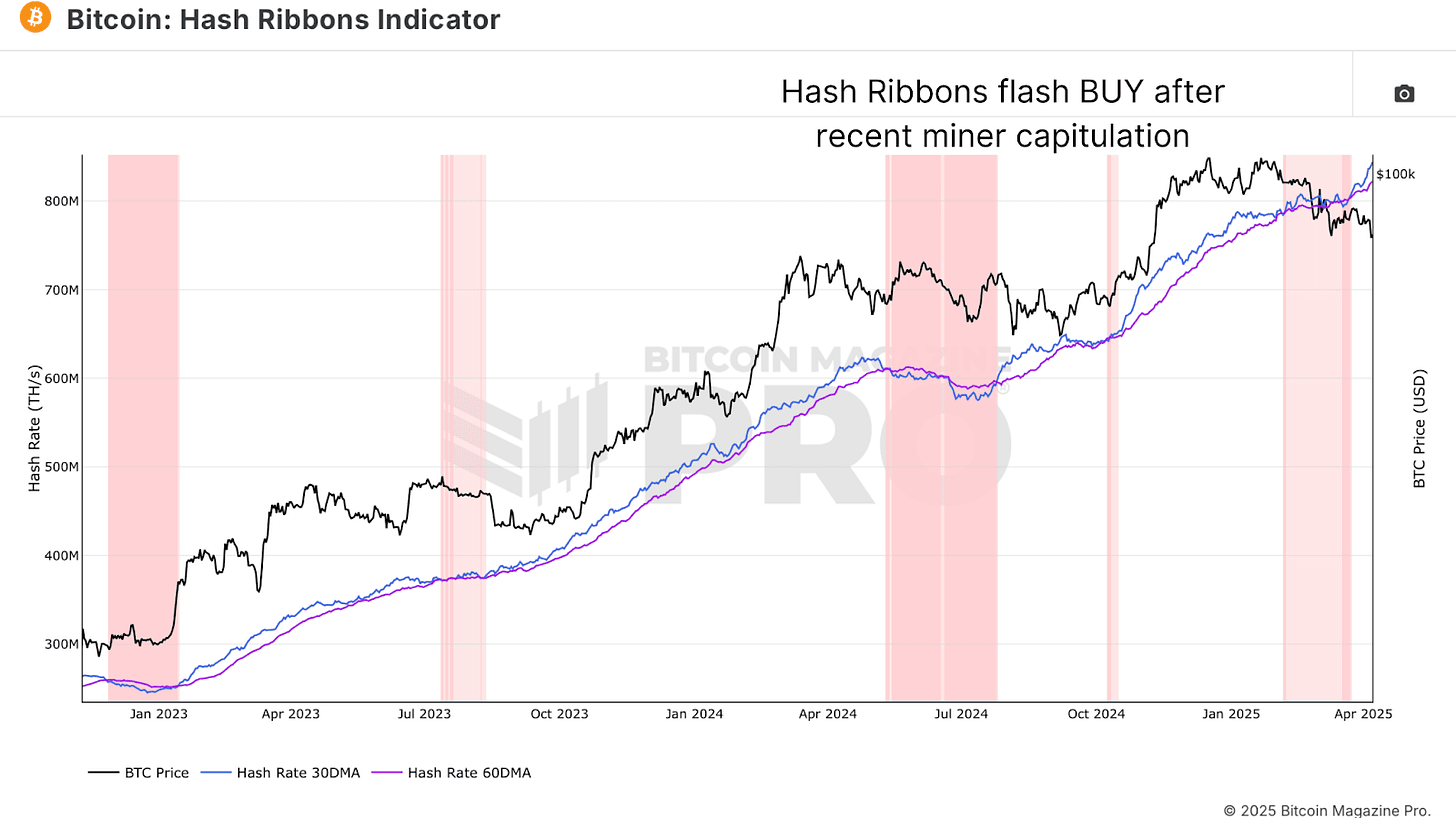

Adding further plot, a blend of hash ribbon indicators, short- and long-term hashrate moving averages recently flashed the classic Bitcoin purchase signal.

When the 30-day moving average (blue line) returns above the 60 days (purple line), it marks the end of the miner’s yield and the beginning of the updated miner strength. Visually, this crossover will shift the background of the chart from red to white. This often marked a strong inflection point for BTC prices.

What’s impressive this time is how aggressively the 30-day moving average has skyrocketed from the 60 days. This is not just a modest recovery, but a statement from miners, and that they are betting a lot on the future.

Tax factors

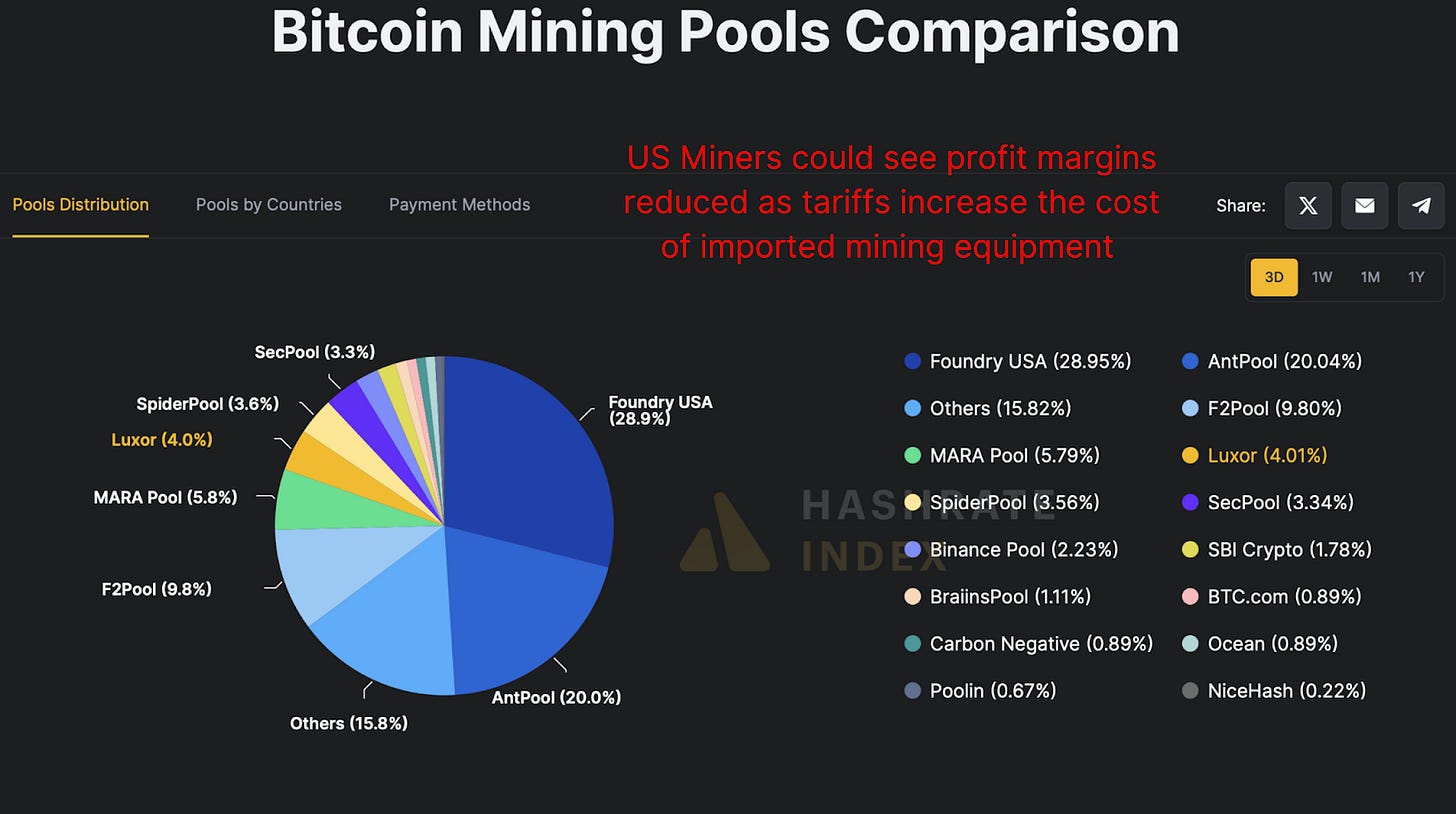

So what is igniting this miner frenzy? The plausible explanation is that miners, particularly US-based miners, are trying to frontrun the impact of the looming tariffs. Bitmain, the dominant producer of mining equipment, is currently in the crosshairs of trade policies where the price of equipment could rise by 30-50%, potentially over 100%.

Given that over 40% of Bitcoin’s hashrate is controlled by US-based pools such as Foundry USA, Mara Pool and Luxor, an increase in costs would significantly reduce profit margins. Miners may now be actively scaled while hardware is (relatively) inexpensive and available.

Bitcoin miners continue mining

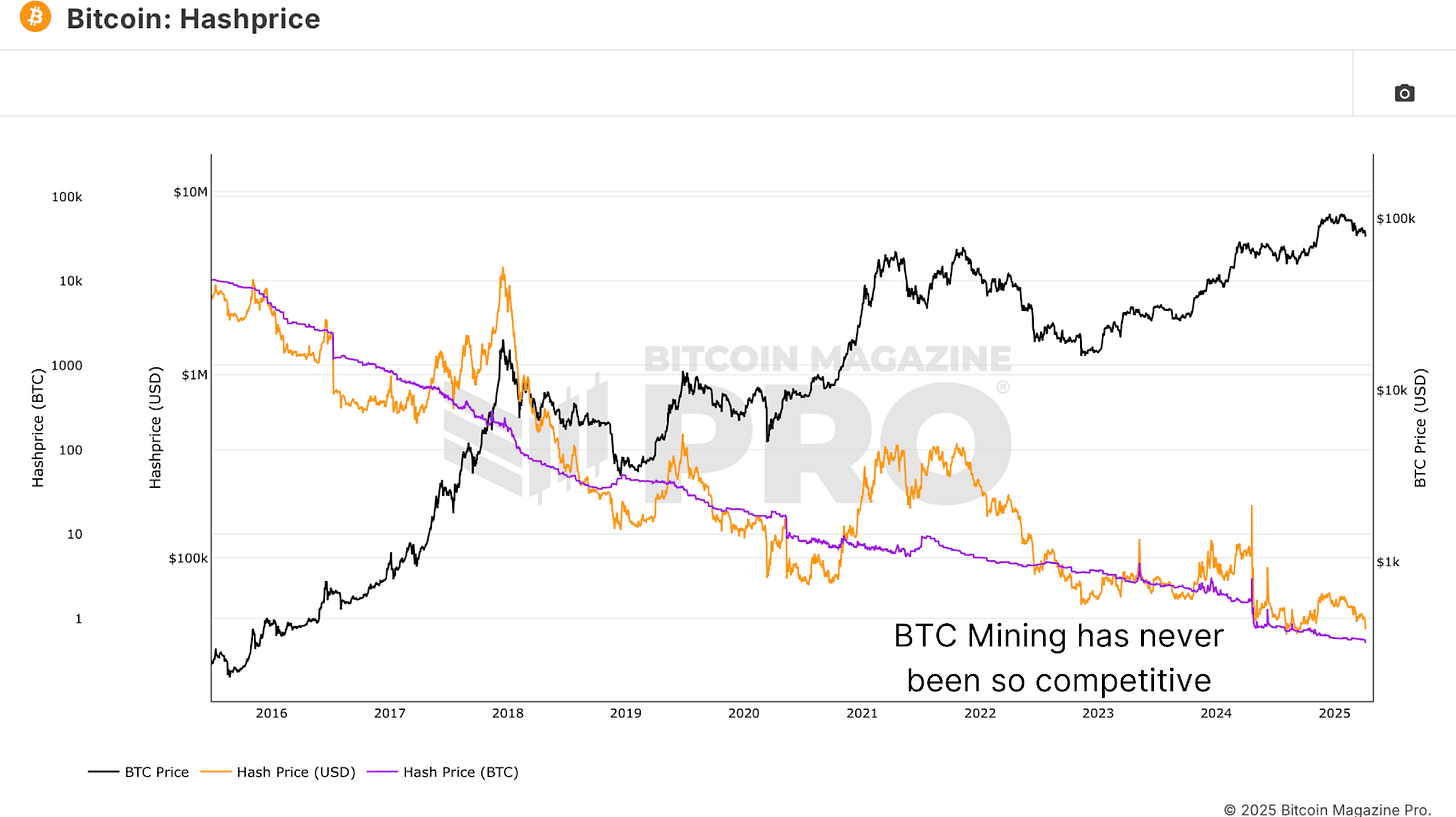

Hashprice is the revenue generated by BTC per terrahash of computing power, and is a historic low. In other words, operating Bitcoin miners on a per-terrahash basis is never less profitable in BTC terms. Typically, hash prices rise towards the tail end of the bear market as competition fades and weaker players leave the space.

But that’s not happening here. Despite its terrible profitability, miners are not only staying online, but also deploying more hash power. This could mean one of two things. Both miners are competing for worsening margins in BTC’s front-load BTC accumulation, or more optimistic, with strong confidence in Bitcoin’s future profitability, and are actively purchasing DIP.

Bitcoin Miner’s conclusion

So, what’s really going on? Both miners either desperately at front-running hardware costs, or one of the most powerful collective votes for the future of Bitcoin, seen in recent memory. We will continue to track these metrics in future updates to see if this minor’s beliefs are proven correct.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making an investment decision.