Key takeout

- Bitcoin shows a stronger correlation with tech stocks rather than gold.

- The correlation between Bitcoin and the Nasdaq has reached 0.7 over the past three years.

Please share this article

According to a new report by Franklin Templeton Digital Assets, “Gold Zigged, Bitcoin Moonwalked,” Bitcoin shows a stronger correlation with tech stocks than gold.

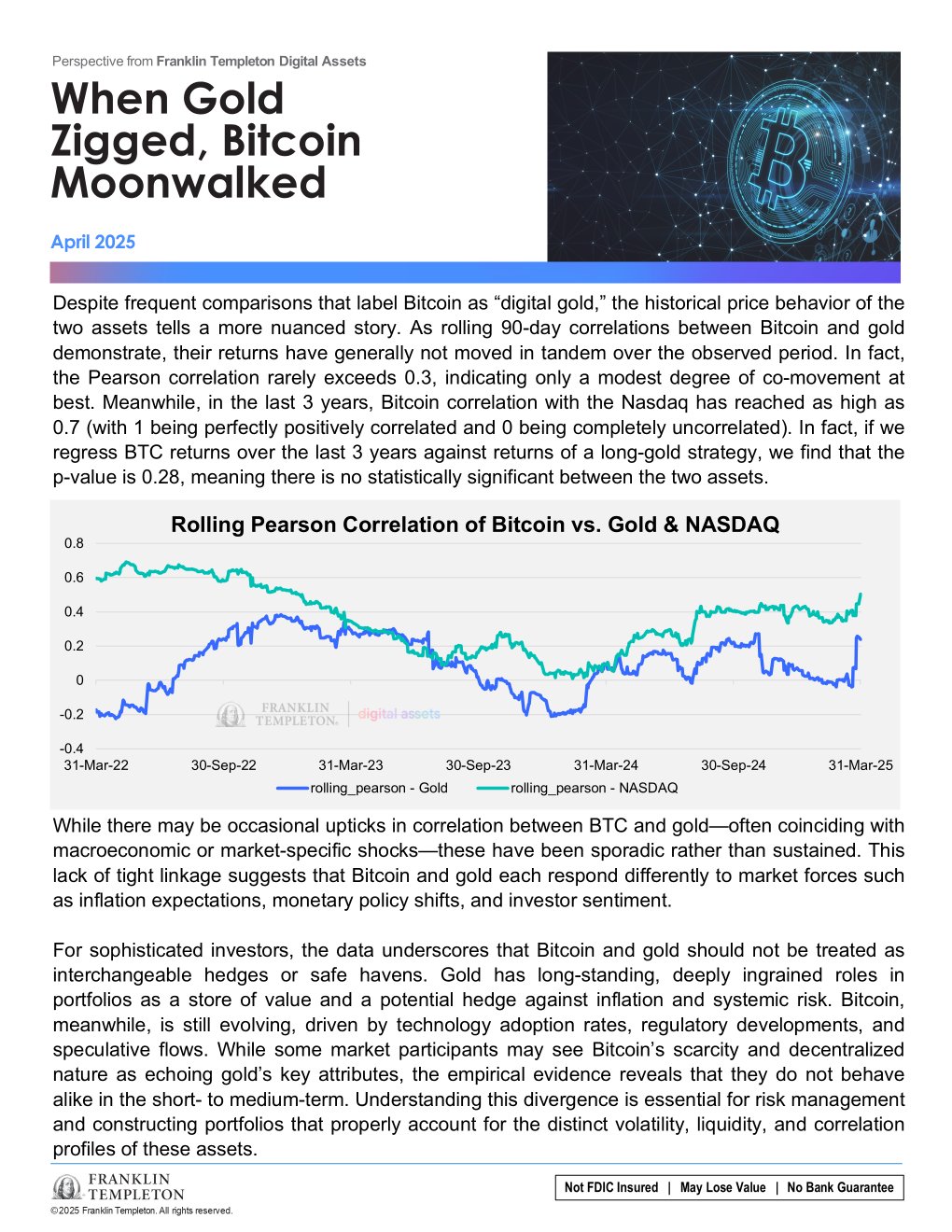

Franklin’s digital assets team analyzed data over three years and found a weak price correlation between Bitcoin and gold. Research shows that the correlation between Bitcoin and gold rarely exceeds 0.3 over a 90-day rolling period. In other words, two assets generally move independently.

They may occasionally exhibit some comovement, but they do not operate consistently in tandem.

Instead, Bitcoin has a much stronger and growing correlation with the NASDAQ stock index, reaching 0.7 over the past three years. This suggests that Bitcoin’s actions track tech stocks more closely than traditional safe havens.

“In fact, when BTC returns against long-term strategy returns over the past three years, we see that the P value is 0.28. That is, there is no statistically significant between the two assets,” the report states.

According to Franklin Templeton Digital Assets, several key factors lie behind the divergence. Gold has years of institutional adoption, deep liquidity, and a robust market structure developed over the centuries.

Meanwhile, Bitcoin has recently just entered its institutional portfolio and is affected by new dynamics such as regulatory changes, technological innovations and speculative trends.

Usually there was a short period of time when Bitcoin and Gold moved in tandem during the macroeconomic shock, but these episodes were more exceptions than the rules.

The report argues that the inherently unstable and technology-driven nature of Bitcoin limits its usefulness as a gold substitute for a diverse portfolio.

“Coupled with the inherently unstable and tech-driven nature of Bitcoin, the maturation gap continues to limit its correlation with gold, and it argues that the ‘digital gold’ moniker may be more ambitious than reflecting actual market behavior, at least for now,” the report states.

Gold prices rise to fresh highs as US-China trade tensions escalate

Bitcoin surged over $83,000 early on Friday as US producer price index (PPI) data reported lower than 2.7% against a 3.3% forecast.

The decline in PPI, along with a decline in the US dollar index below the key 100 level, has also fueled optimism among crypto traders about the potential bullish market situation for Bitcoin.

However, despite these ostensibly positive inflation numbers, major US stock indices such as the S&P 500 and NASDAQ showed minimal changes, reflecting ongoing concerns about the US trade war.

Bitcoin has experienced increased volatility, primarily in response to President Trump’s sweeping tariff announcements, rattling the global stock market.

Despite early signs of decoupling, Bitcoin continues trading alongside high-tech stocks. Crypto Asset went above $83,000 today in PPI data after a brief fall below $80,000 on Thursday as the US-China trade dispute intensified.

At the time of publication, Bitcoin changed hands at around $82,600, up about 4% over the past 24 hours.

On Friday, Friday surged to a new record high as investors gathered on safe haven assets amid growing trade tensions between the US and China. Spot Gold climbed over 1% per ounce to $3,207, with futures reaching $3,236.

Precious metals are currently rising about 20% per year, superior to most major asset classes.

Please share this article