Bitcoin (BTC) today fell to $114,386, causing a liquidation of around $300 million over the past 24 hours as investors’ trust in their assets remained unstable. Still, rising spot trading volumes offer a faint hope of hope that BTC could now enter the accumulation phase.

Is Bitcoin in the accumulation stage?

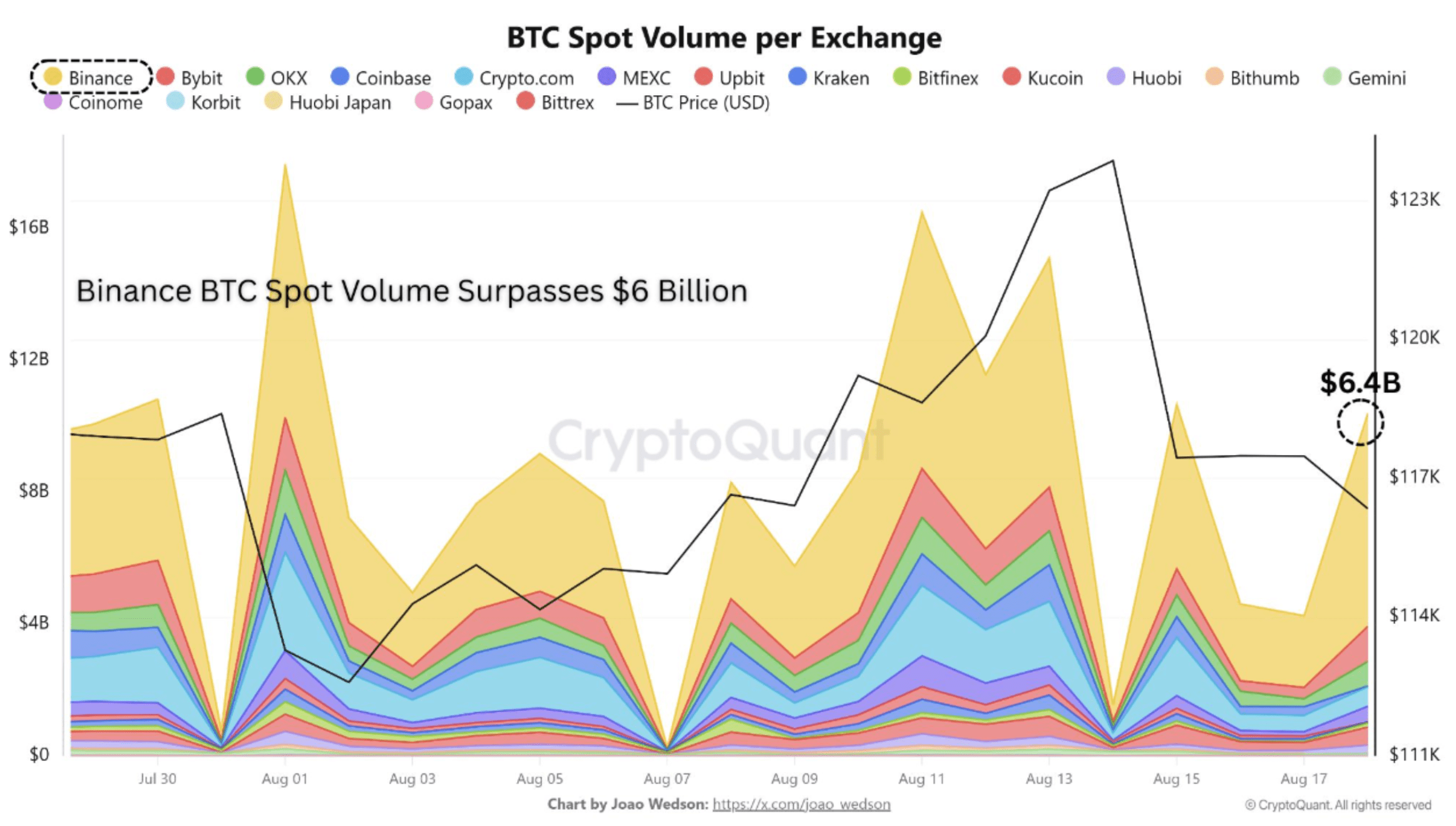

Binance’s BTC spot trading volume exceeded $6 billion on August 18th, according to a encrypted quick take post by contributor Amr Taha. This is one of the most important spikes of the month.

Taha said such sudden spikes usually indicate an increase in participation from institutional investors and large traders, as well as an increase in retail activities seeking to capitalize on high volatility.

It is noteworthy that the surge in Binance spot volume coincided with a fall below $115,000 in BTC.

Historical data suggest that strong spot buying during price declines reflects traders intervening to accumulate BTC at discounted prices. This dynamic can ease sales pressure and lay the foundation for rebound if demand continues.

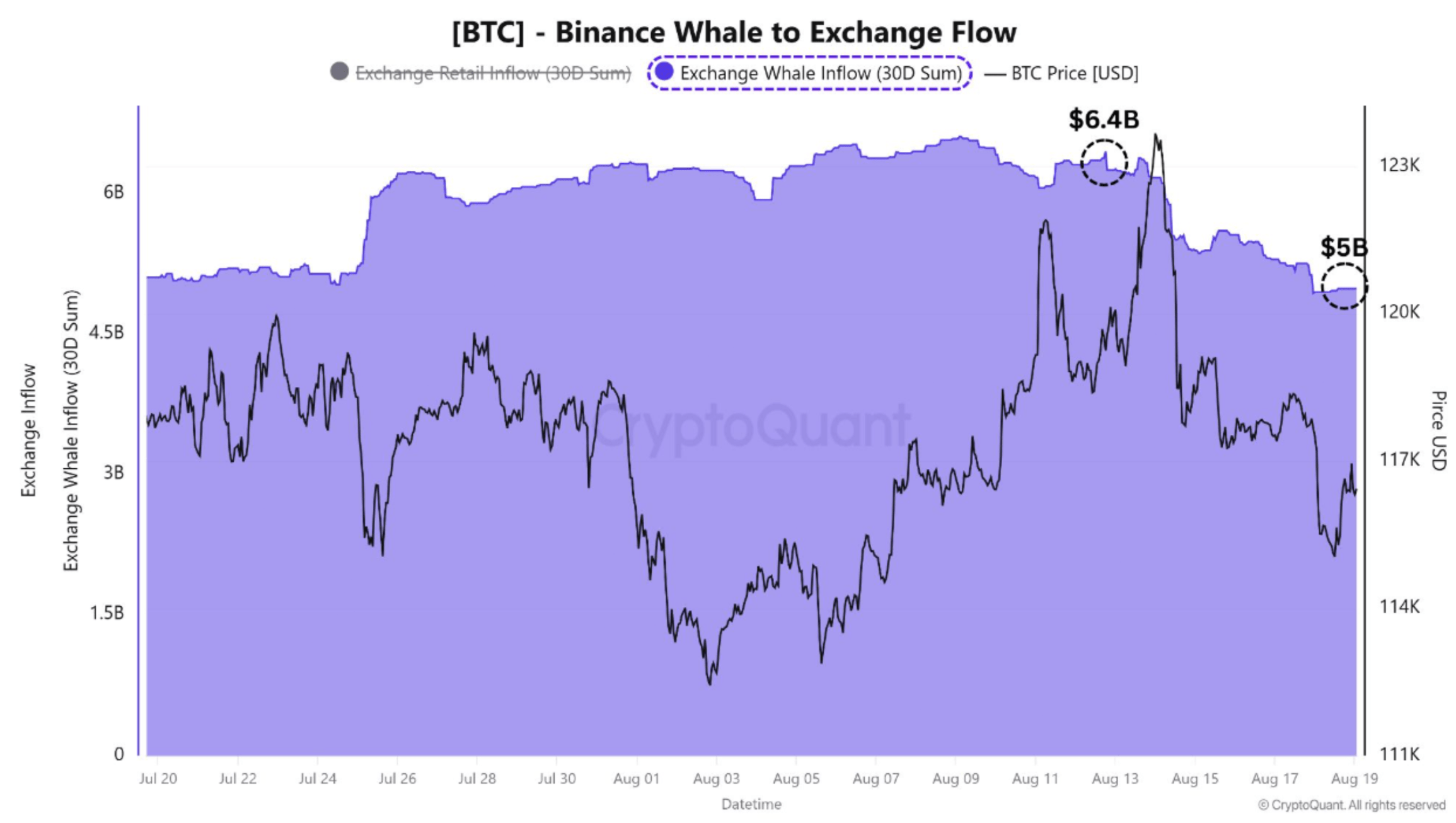

Taha also highlighted that an increase in Binance Spot Volume occurred with a decrease in exchange flow from Binance Scudella, which had dropped from $6.4 billion to $5 billion.

This reduction in whale deposits suggests that fewer large holders send BTC to exchanges for potential sales, a trend that is generally considered bullish. Taha concluded:

To summarise these factors, the market shows early signs of stabilization – the spike in binance spot volume, increased demand when prices fall, and the decline in whale sediment. If accumulation continues at current levels, Bitcoin has a solid opportunity to recover and retest high levels of resistance in the short term.

From a technical standpoint, Crypto analyst Titan of Crypto pointed out that BTC is still following the weekly trendline. If the trend passes, BTC could target $130,000 in the coming weeks.

September warning sign

Taha suggests that BTC may be in the accumulation stage now, but there is a possibility of a trend reversal in the coming months, but other analysts remain cautious. Crypto analyst Josh Olszewics warned that BTC must survive a “brutal September” before any meaningful rebounds occur in the fourth quarter of 2025.

Similarly, Cryptoquant contributor Borisvest warned that the next week or two could lead to increased sales pressure on top cryptocurrencies due to market capitalization. At press time, BTC will trade at $115,489, a 0.1% decrease over the past 24 hours.