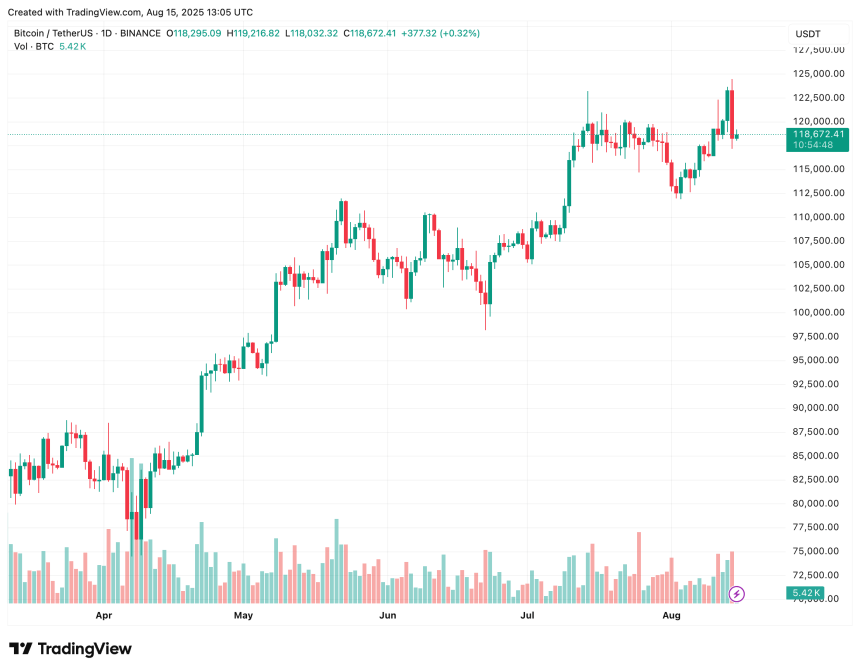

Bitcoin (BTC) has increased its mild rebound to $117,180 from yesterday’s inflation-driven decline, returning to $119,000 at the time of writing. The decline in leverage ratio suggests that the bullish momentum of top cryptocurrencies could last, and it continues to run for the new all-time high (ATH) in the short term.

Bitcoin leverage ratio drops, and the Bulls are pleased

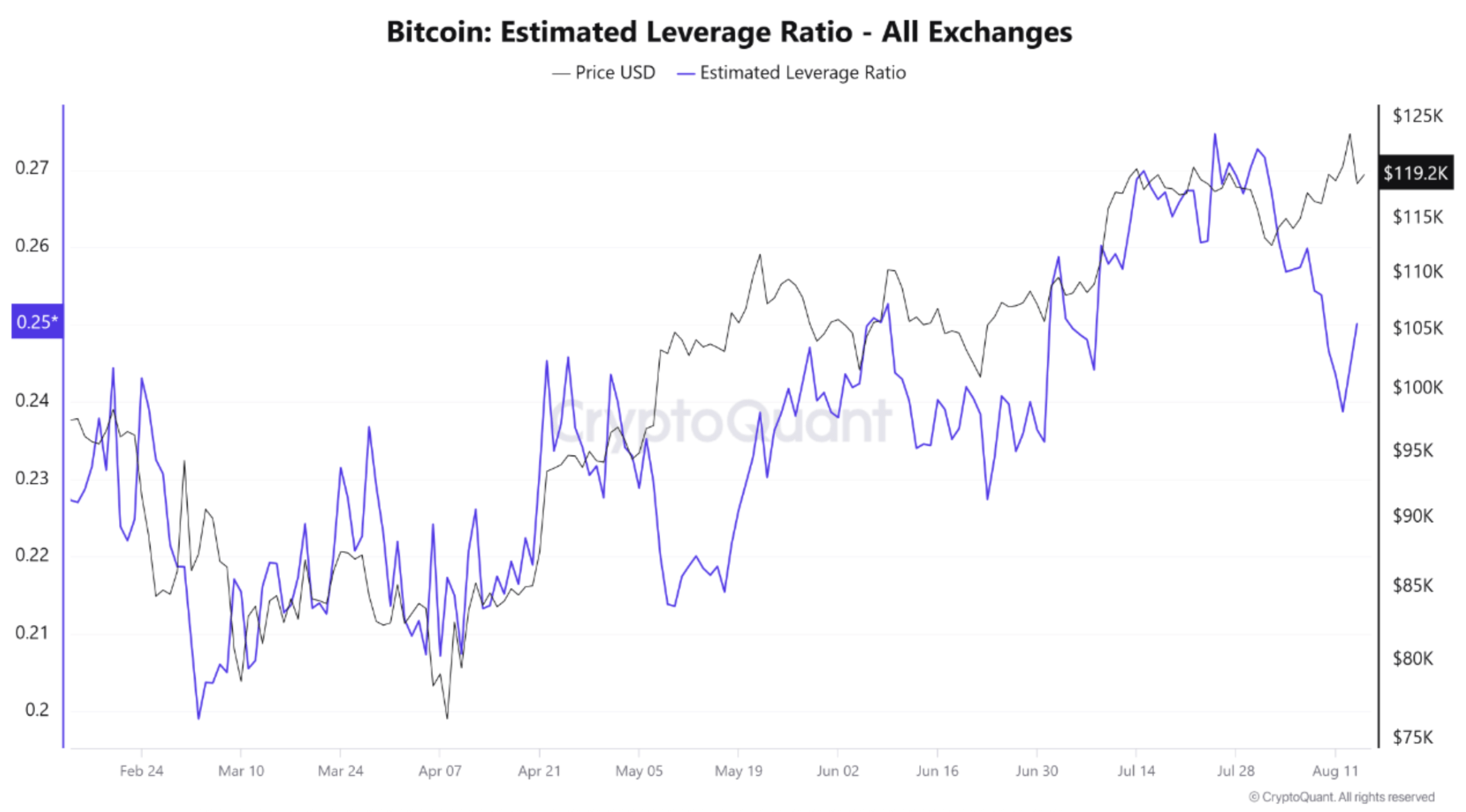

Bitcoin leverage ratio across all cryptocurrency exchanges has dropped sharply from its peak of 0.27 from late July to early August, according to a cryptographic quick take post by the Arab chain.

Related readings

In particular, the ratio fell to 0.25 in early August, with a moderate decline in rebound. In contrast, during the period from May to late July, the price-to-leverage ratios rise in tandem, indicating that trader inflows open up larger positions.

In contrast, leverage this time fell without a comparable drop in prices. This is a sign that risk has been mitigated since the recent uptrend. Arab chains point out that this could be the result of high-risk positions being settled or traders withdrawing from the market amid volatility.

With BTC holding around $119,000, the low leverage ratio is a sign of bullishness, suggesting that the latest price rise is driven by authentic liquidity rather than speculative excess.

Continuous reductions in leverage can further reduce the likelihood of sudden corrections. Conversely, rushing for sudden leverage along with price rally will increase the risk of pullbacks. Analysts added:

If leverage remains medium or low levels while prices are stable, this could provide a stable base for new uptrends. The estimated leverage ratio (ELR) between 0.24 and 0.25 with a gradual price break above 120K indicates a possible expansion to spot-supported upside and July highs, with moderate funding and slow, open interest.

However, quick jumps with leverage ratios above 0.27 before or during testing between $120,000 and $124,000 can indicate high liquidation risk and the possibility of abrupt downward “shakeout.”

On-chain data refers to potential sales pressure

Bitcoin bulls, on-chain data, especially the rising exchange reserves and Whale Movement – Indicates pressure that could be sold first.

Related readings

For example, Binance’s BTC reserve is recent It has risen sharply Up to 579,000 raised concerns about profitability after Bitcoin’s recent fresh Ass rally. Similarly, more BTC miners are Move Their holdings are potentially prepared for sale.

In addition to note, some analysts caveat It could potentially pull back to $110,000 to fill the outstanding fair value gap. At the time of pressing, BTC will trade at $118,672, a 0.1% decrease over the past 24 hours.

Featured images from Unsplash, Cryptoquant and TradingView.com charts