Long-term Bitcoin holders have recently been spending accelerated, with the biggest spikes being held every day on Friday.

Bitcoin investors ages 1-2 make up for the biggest part of the spike

In a new post from X, on-chain analytics firm GlassNode discussed how Bitcoin long-term holders (LTHS) have been viewing the recent activities. LTHS refers to BTC investors who have held coins for more than 155 days.

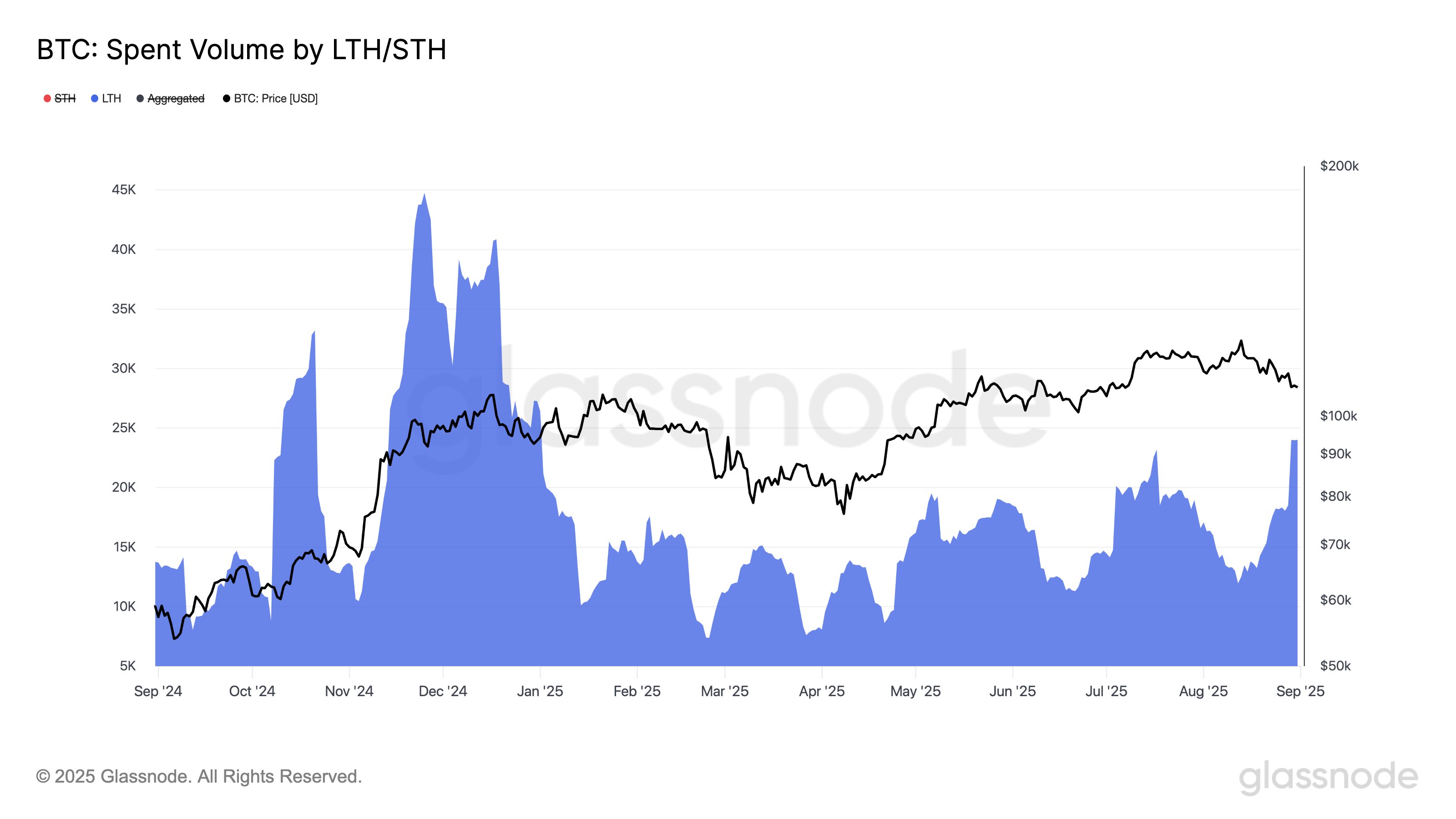

Statistically, the longer an investor holds on a coin, the less likely he is to sell in the future. Therefore, LTH with relatively long holding times is considered a decisive entity. However, despite their beliefs, even members of this cohort may have decided to let go of the coin. Below is a chart shared by GlassNode that shows how spending from this cohort has fluctuated over the past year.

As seen in the graph, the 14-day Simple Moving Average (SMA) of Bitcoin Volume spent by LTHS has been rising recently, indicating that Hoddlers is increasing transaction activity.

The spike in LTH expenditures came after the decline in BTC prices. The timing could be a sign that some of the diamond’s hands are beginning to think that the bull run is shrinking, so they decided to leave on their profits while still possible.

Bitcoin’s LTH transactions are currently being promoted, but are still significantly below the levels observed in the last quarter of 2024. Additionally, smooth data from the 14-day SMA could suggest that development corresponds to increased spending over a period of time, but we can see that this is primarily due to large-scale spikes in the day.

From the charts, it is clear that around 97,000 BTC is involved in the big spike that took place on Friday, and is worth a whopping $10.6 billion. This is the biggest spending date for LTHS so far in 2025.

There is another chart as the 155-day cutoff for the LTH group means that the cohort covers a rather large range.

Bitcoin LTHS, ages 1-2, appears to have provided the largest portion of the expenditure spake of 34,500 BTC. The 6-12 months and 3-5 years segments are other outstanding segments that contribute approximately 16,000 BTC, respectively.

BTC price

Bitcoin slid to $107,000 over the weekend, but it appears the coin has returned on Monday as it trades at around $109,500.