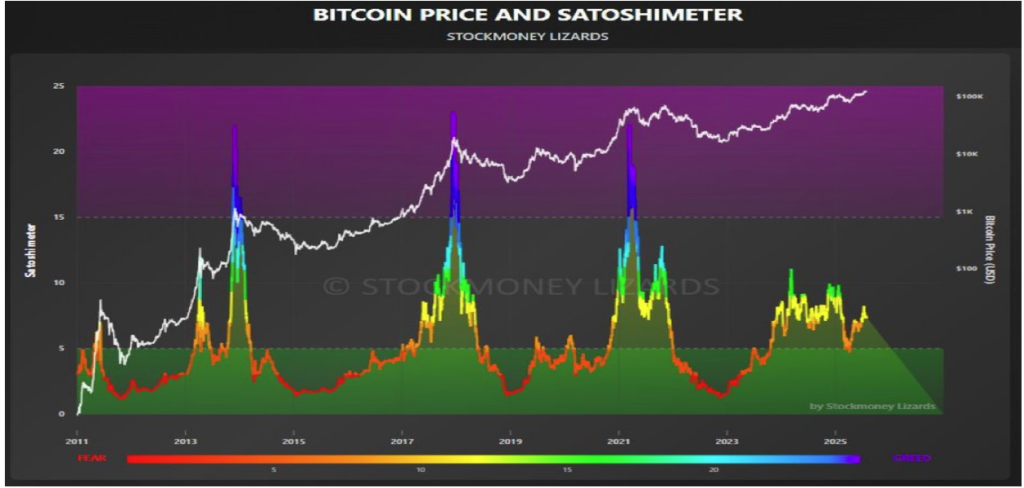

Bitcoin prices are over $120,000 It reignited speculation about where the flagship cryptocurrency of the current cycle is. Although price action alone provides only a portion of the photos, Satoshimeter indicator’s on-chain data suggests that Bitcoin is still in the middle phase of the cycle. Long-term orbit.

Bitcoin prices still in the cycle

Bitcoin climbs from $100,000 to a New ATHs Over $123,000 It has brought new attention to on-chain metrics used to identify current stages of cryptocurrency in the current market cycle. Among them, Satoshimeter, an indicator developed by Crypto analyst Stockmoney Lizard, subtly looks at Bitcoin’s movement and price position.

Related readings

According to expert analysis release X On social media, bitcoin is still in Satachimeter Not far from the euphoric peak zone It was observed in previous bull markets. Stockmoney lizards also have a bitcoin gathering The final leg of the bull cycle.

Supporting this analysis, satachimeter employs and maps metrics on the chain Bitcoin cyclical behavioridentify both the long-term bottom and top. Historically, measurements for this indicator around 1.6 are usually marked as a measure. Bear Market BottomsAs seen in the price lists for 2011, 2015, 2019, and 2022. On the other hand, higher values previously aligned with cycle peaks, often signaling sharp corrections.

As of now, the Satahimeter is still far below the top edge, indicating that Bitcoin’s price is not yet in the overheating zone. Analyst charts clearly show this trend. The market tops of the past have been marked by sudden spikes in indicators. Parabolic price action And extreme emotions.

In contrast, current indicator measurements are rising, but stable, sitting in the midrange, well below the levels seen at the top of the cycle in the past. This suggests that Bitcoin’s broader bullish structure It could be even more reversed on the table and remains intact.

Bitcoin reaches $200,000 in this cycle?

Based on the Stockmoney lizard, the current level of Satoshimeter project Extended run on Bitcoin prices. Recent jumps over $123,000 are reflected The momentum is gaininganalysts anticipate the progress of the stair step towards a potential high of $200,000 before a significant market correction begins.

Related readings

This projection was based not only on measurements from the atshimeter indicator, but also on movement seen in previous cycles, with BTC usually passing through multiple stages of accumulation, breakout, and parabolic growth. At the time of writing, the flagship cryptocurrency traded at $113,759, reflecting an 8.3% decline from an all-time high. and $200,000 set as the next peak targetwhich means more than 75% of potential gatherings in the current cycle.

Unsplash featured images, TradingView charts