Good morning, Asia. This is what makes news in the market:

Welcome to Asian morning briefings, daily summary of top stories throughout the US time, and an overview of market movements and analysis. For a detailed overview of the US market, see Coindesk’s Crypto Daybook Americas.

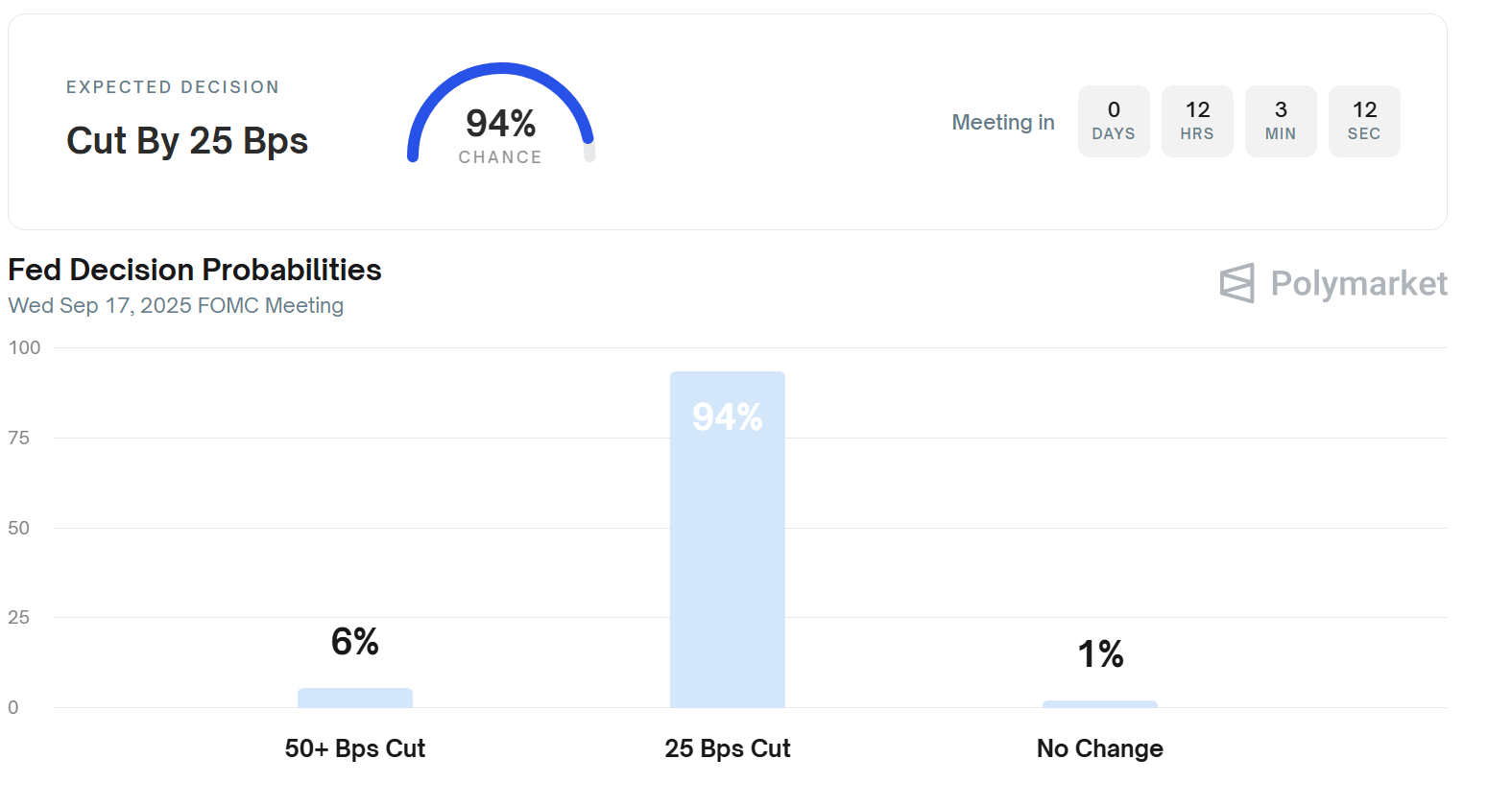

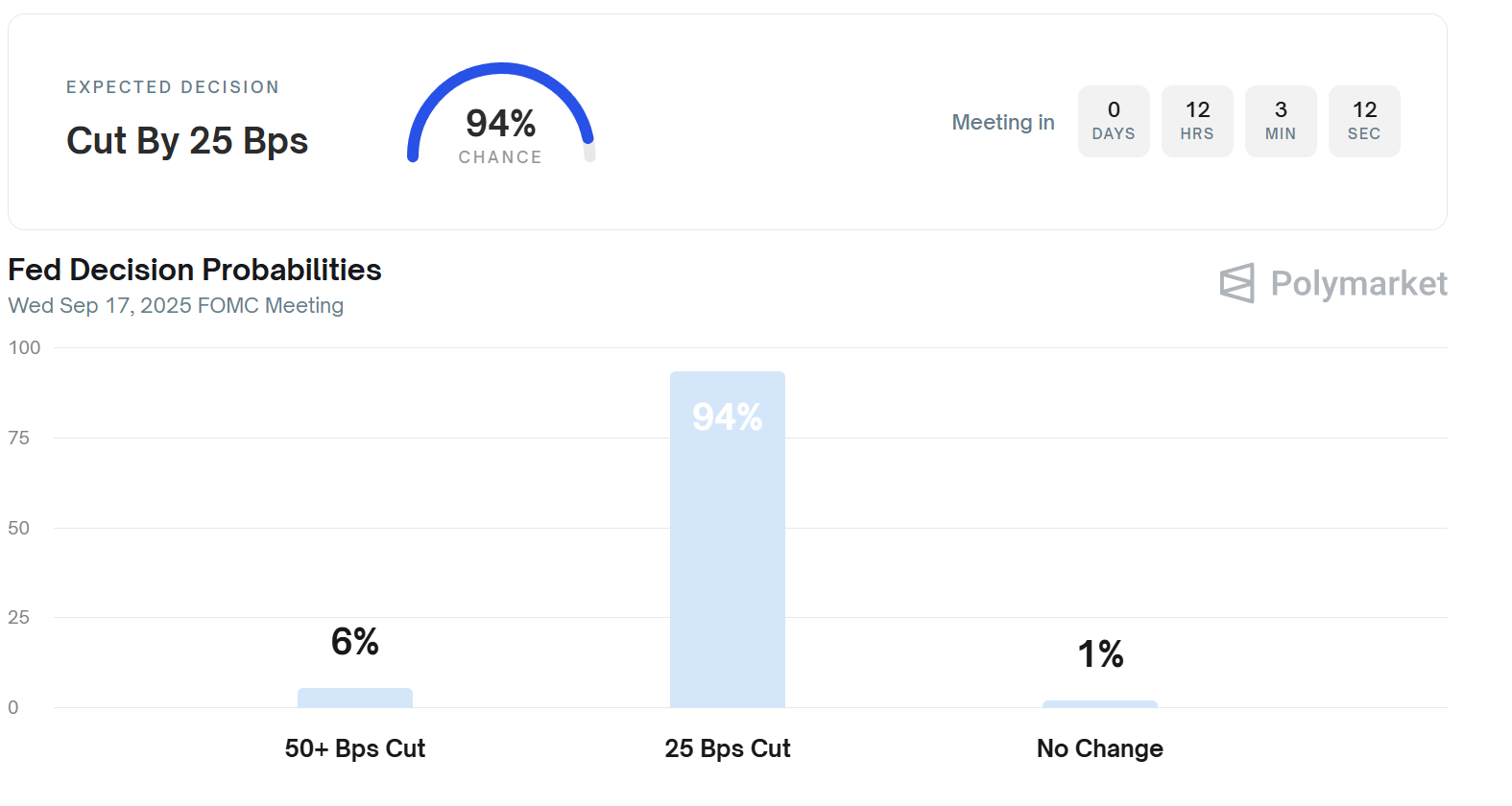

Polymarket and CME FedWatch are all available. The Fed’s mitigation cycle begins tomorrow. Both have a 25 bps cut locked in for the next FOMC meeting, with the odds being built towards three cut passes through the end of the year.

Polymarket traders leave room for aggressive easing, and CME assigns a stable probability of 25 bps steps. In any case, the market is seeing a 75 bps cut as its baseline for 2025.

Market convictions regarding Fed pivots have already appeared on-chain, with BTC trading rising by $116,762, a 1.3% increase per day and 4.7% increase per week, while ETH is $4,502 for the trader price for reductions and 4.3% increase per week.

Now, some traders are sitting on the sidelines to see how the market will react as the Fed announces the cut.

Recent reports show that encrypted data has dropped to a seven-day average of just 25,000 BTC, bringing its lowest in over a year and a half. BTC first exceeded $120,000 in mid-July. The average BTC deposit size has also been halved to 0.57 BTC. This proves that large holders are sitting idle rather than rushing to sell.

ETH looks at the same pattern. Exchange inflows fell sharply from 1.8 million in August to a two-month low of 783,000 ETH. The average ETH deposits decreased from 40-45 ETH to 30 ETH earlier this summer, suggesting a decrease in sales side activity from whales.

If BTC and ETH are stockpiled, the report will contain Stablecoins in encrypted statements. USDT deposits surged to $379 million at the end of August, the highest of this year. The average daily USDT deposit has doubled since July, replacing the “dried powder” needed to support post feed drizzle.

However, the flow is not uniform. Altcoins are seeing a revival of exchange activities, with transaction deposits rising to a seven-day total of 55,000, which rose from the 20,000-30,000 range earlier this year. Even if BTC and ETH supply remains tight, the fork indicates that it will earn possible profits with higher beta names.

“In September, we have a wave of tokens that unlock a total of $4.5 billion, which is a dynamic that could test liquidity and market absorption.”

Lynn argued that true opportunities go beyond short-term volatility.

“Stablecoins are approaching $300 billion in supply, and unlocking tokens has market depth in testing, indicating that Crypto is becoming part of the global financial system rather than outliers, just like a major infrastructure upgrade, as is the transition to tokenized securities,” she writes.

The message is clear: the Fed’s pivot is almost priced. What’s important now is whether Crypto’s liquidity buffer, stubcoins, exchange inflows, and token unlocking can absorb BTC shocks and channel capital into the next leg.

Market movements

BTC: BTC is trading above $116,500 as traders are optimistic about the potential for US interest rate cuts. Technical factors such as closing the futures gap have exerted upward pressure. A certain amount of attention has been paid prior to the Fed meeting.

ETH: ETH is traded at a modest strength supported by the overall crypto market momentum (dominated by BTC), but there is some resistance as investors weigh the macro risk and clarify policies from the Fed.

gold: Gold has reached record highs along with hopes that the US Federal Reserve will cut interest rates, weaken the US dollar, and increase geopolitical or macroeconomic uncertainty. There is strong safe demand from investors.

Nikkei 225: Asia-Pacific shares fell on Wednesday morning, with Japan’s Nikko 225 down 0.3%.

S&P 500: The S&P 500 slipped 6,606.76 to 0.13% on Tuesday.

Other locations in the code

- Eric Trump defends UAE-Vinance deals, saying his father is “the first man who hasn’t made money from the presidency” (Block).

- President Trump alleges that the New York Times harmed memecoin in a $15 billion lawsuit

- The Clarity Act is probably dead. This is what happens next in the successor (Coindesk)