Bitcoin (BTC) was stomping water below $85,000 late Thursday as tensions between US President Donald Trump and Federal Reserve Chairman Jerome Powell added another layer of uncertainty to investors.

After Hawkish’s comments from Powell criticising Trump’s tariff policy, the markets immersed on Wednesday, saying it is likely to lead to a decline in the economy and rising prices. In his remarks, Powell has made it clear that his bigger focus is on prices for now, suggesting stricter Fed policies than otherwise thought.

Trump has appointed a former investment bank and lawyer to chair the Fed in his first term (Powell was given a second term from President Biden) — expressing his dissatisfaction with Powell since he was taken from the White House. However, Powell, who is scheduled to remain on the central bank until May 2026, has repeatedly stated his determination to end his term and suggested that the president does not have a position to fire him.

According to people familiar with the issue, the WSJ reported on Thursday that Trump was personally discussing shooting Powell for several months. The story says former Fed Governor Kevin Wahsh is reportedly waiting on the wing to replace Powell, but Wahsh works to keep the president from opposing the federal chair.

Participating in that warning is Treasury Secretary Scott Bescent, who said the move could already shake the US market as central banks should be independent of political influence.

The odds polymer that Trump eliminated Powell in the blockchain-based forecast market this year rose to 19%.

Trump’s comments cut key interest rates on Thursday as he warned that the European Central Bank (ECB) cuts key interest rates have deteriorated its growth outlook on Thursday.

More pressure has been created on the market from the latest Philadelphia Fed Manufacturing Index issued Thursday morning. Meanwhile, prices have risen to the highest reading since July 2022, increasing concern that the Trump administration’s massive tariff policy has pushed the US economy into a male dog.

The S&P 500 and the high-tech NASDAQ stock index traded almost flat during the day.

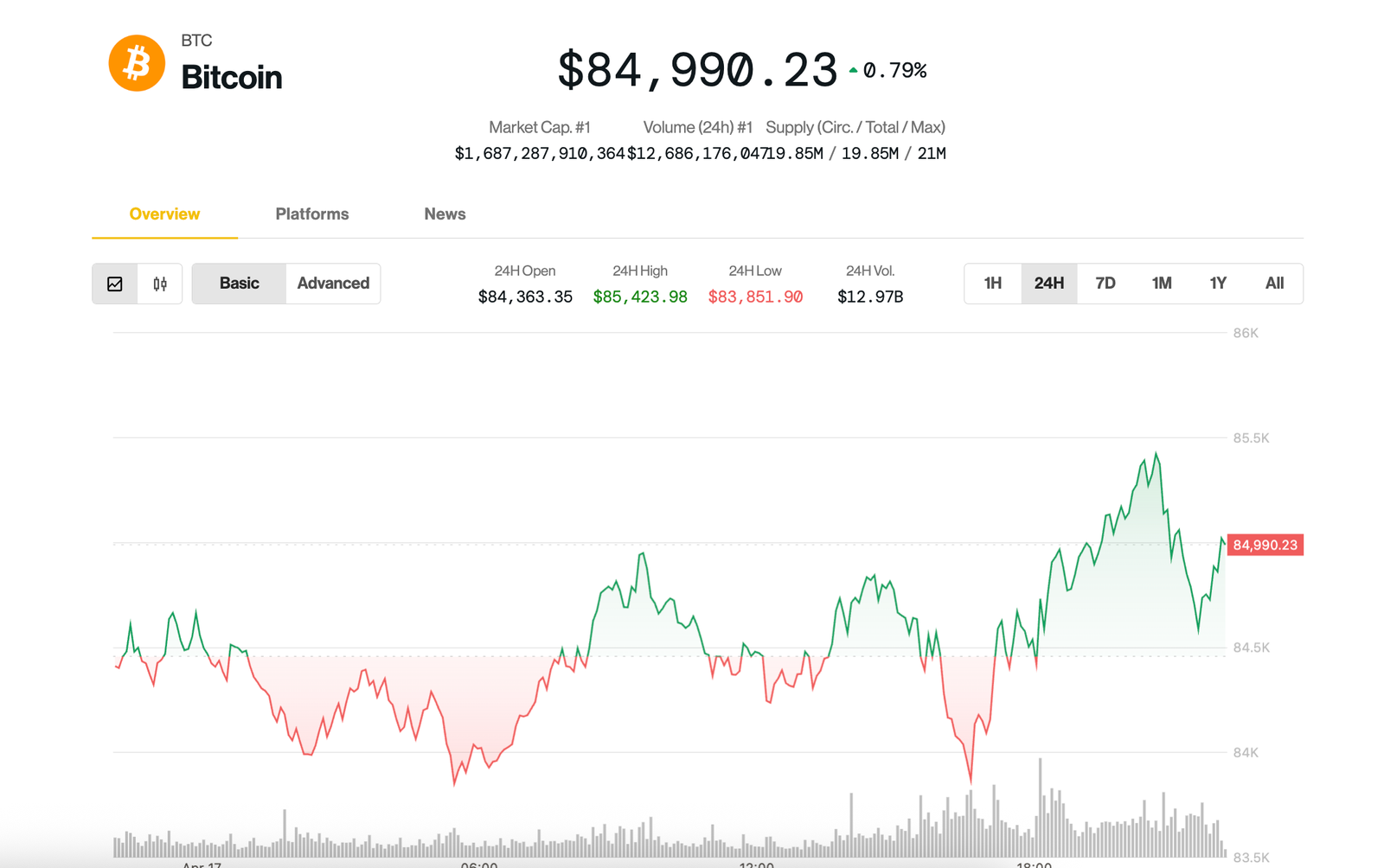

Looking at the Crypto market, BTC and Ethereum ETH have increased by 0.8% over the past 24 hours. Most assets in the Coindesk 20 Index traded higher during the day, with Bitcoin Cash (BCH), near and Aave’s major profits.

How are Bitcoin traders positioned amid increasing fears on Wall Street?

Bitcoin is stable between $83,000 and $86,000, and traders are still chasing bullish bets while they seek negative side protection.

At Delibit, traders are actively calling on strikes of between $100,000 to $90K, which expire in May and June, the exchange said in a market update on Thursday. Call demand shows expectations for a continuous price increase.

Some of these bullish bets are funded by premiums collected by selling put options.

At the same time, there is a renewed interest in purchasing put options, expired at $80,000 this month, representing preparations for a potential price drop. Buying put options is similar to purchasing insurance on price slides.

The diverse two-way flows have emerged with the VIX, a Wall Street fear gauge that measures 30 days of implicit volatility, well above the 50-day average despite pullbacks from recent highs above 50.

VIX warns that the macro situation is still clear rather than resolved, the exchange said in X.