Reasons to trust

Strict editing policy focusing on accuracy, relevance and fairness

Created by industry experts and meticulously reviewed

The highest standard for reporting and publishing

Strict editing policy focusing on accuracy, relevance and fairness

Morbi Pretium leo et nisl aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque Nec, ullamcorper eu odio.

Español.

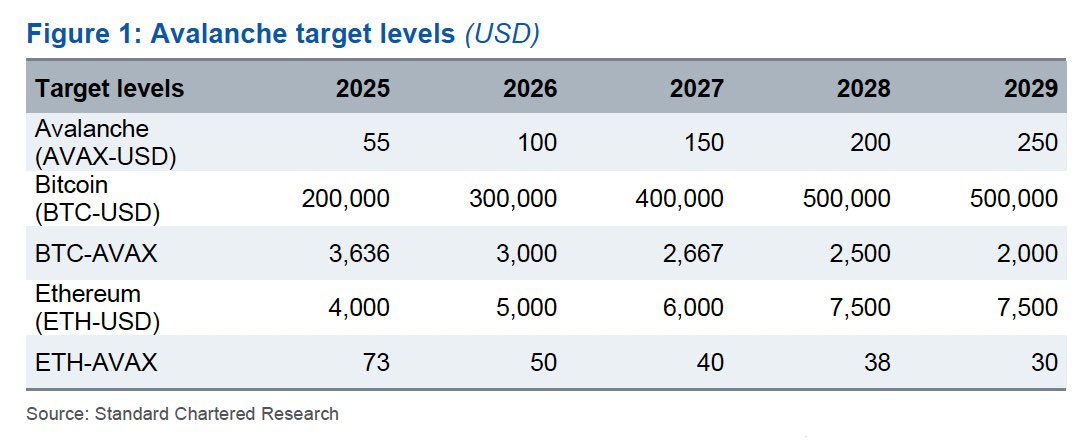

Global Banking Giant Standard Chartered has published new five-year price forecasts for three major cryptocurrencies: Avalanche (Avax), Bitcoin (BTC), and Ethereum (ETH). These forecasts show that the avalanche is poised to gain great evidence in both Bitcoin and Ethereum by 2029.

Ryan Rasmussen, Bitwise’s research director, turned his attention to these ambitious goals through X.

Standard Chartered expects Avalanche (Avax) to reach $55 by the end of 2025, $100 by 2026, $150 by 2027, $200 by 2028 and ultimately $250.

Meanwhile, Bitcoin (BTC) has revised its forecast, assessing $200,000 in 2025 to $300,000 in 2026 to $400,000 in 2027, achieving $500,000 in 2028, and at a level that will remain in place until 2029.

For Ethereum (ETH), standard chartered projects were $4,000 in 2025, $5,000 in 2026, $6,000 in 2027 and $7,500 in 2028, indicating that they are unchanged in 2029.

Related readings

From a comparative assessment perspective, the bank provided ratio metrics showing how Avax works for BTC and ETH. The BTC to Avax ratio, which measures the number of Avax tokens equal to one BTC, is expected to fall from 3,636 in 2025 to 2,000 in 2029.

This trend means that Avax rates faster than Bitcoin over time. Similarly, the ETH to AVAX ratio is projected to drop from 73 to 30 over the same period, pointing to similar outperformance against Ethereum.

Standard Chartered Bullish Case for Avalanches

Standard Chartered has begun reporting on the avalanche, and expects Avax to rise from around $20 to $250 by the end of 2029 from its current price. “And I think Avalanche will be another winner, probably the winner of the EVM (Ethereum Virtual Machine) chain.”

Related readings

Kendrick emphasized that after the Etna upgrade, also known as the Avalanche 9000, Avalanche’s approach to scaling will place the network for long-term success. Activated in December 2024, ETNA upgrade dramatically reduced the cost of launching subnets (now called Layer 1 Blockchain), reducing setup costs from $450,000 to nearly zero.

Kendrick said these changes appear to attract new developer activity. “A quarter of Avalanche’s active subnets are Etna compatible, with developer counts increasing by 40% since the upgrade.”

He also said that some developers are moving from the Ethereum Layer 2 solution to an avalanche due to their compatibility with Ethereum Code and the low overhead for launching new subnets or L1 chains. Avalanche fees could run higher than certain Ethereum L2s like Arbitrum, but Kendrick believes it will attract completely new applications, particularly in areas such as gaming and consumer-focused tools.

“As a result, we see Avacks outperform both Bitcoin and Ethereum in terms of relative price increases over the next few years,” Kendrick said he is focusing on the higher volatility levels in the Avalanche compared to BTC.

At the time of pressing, BTC traded for $83,334.

Featured images created with dall.e, charts on tradingview.com