Key takeout

- The seamless protocol has shifted its lending infrastructure to the MORPHO Defi protocol, enhancing borrowing and lending operations.

- The seamless ecosystem focuses on innovation with $70 million managed on TVL, providing over 200,000 wallets, leveraged tokens and real-world asset integration.

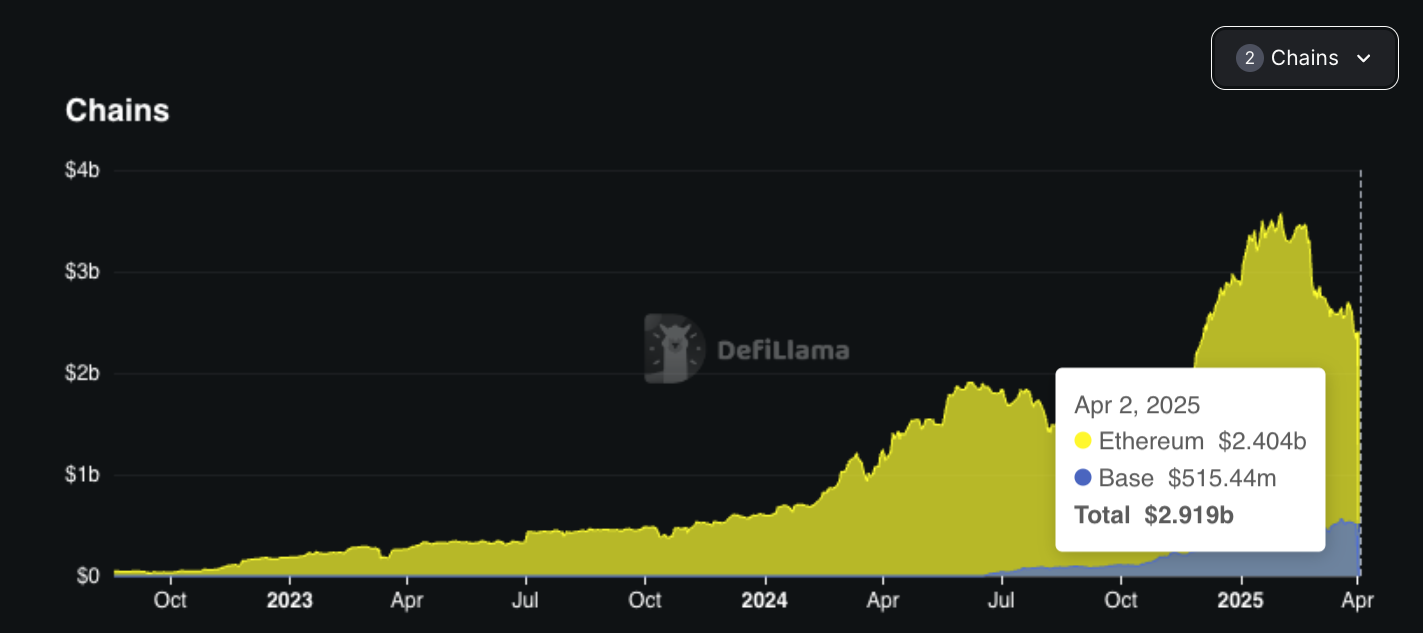

Today, the entire infrastructure announced its migration to Morpho, a seamless Defi Lending Protocol. It is a distributed lending lending protocol with more than $500 million in liquidity and more than $2.4 billion in Coinbase incubated bases.

The transition, approved by the Seamless DAO in early 2025, will seamlessly transform into a “platformless” defi venue built on Morpho’s permitted infrastructure.

“We will use existing liquidity to facilitate future product development, such as leveraged tokens, which leverage basic liquidity sources,” said Wes Frederickson, co-founder and CTO of Seamless. “If you go all the way to the platform first, it proves that less infrastructure means more value for borrowers. This is a seamless 2.0.”

“We’re committed to providing a range of services to our customers,” said Paul Frambot, co-founder and CEO of Morpho Labs.

“Seamless’s vision is supported by Morpho’s unauthorized, unchanging infrastructure. MorphoStack allows seamless teams to focus on product innovation and growth.”

The Seamless Ecosystem currently offers over 200,000 wallets.

The platform’s 2025 product roadmap includes leveraged tokens, expanded borrowed products and real-world asset integration.

In January, Coinbase reintroduced Bitcoin-assisted loans through a partnership with Morpho’s Defi platform, allowing users to borrow up to $100,000 from USDC.