If there was ever any doubt that a bear market was coming, the recent drop in the price of Bitcoin to around $81,000 has given some credence to its possibility. A variety of factors are believed to be responsible for the decline, including geopolitical tensions, Microsoft’s revenue failures, and a chain of liquidations, but the premier cryptocurrency appears to be struggling to catch a break at the moment.

Interestingly, the recent decline not only shattered the remnants of Bitcoin price’s bullish structure, but also tilted the on-chain framework towards an even more bearish outlook. It appears that the bears are winning the battle for control of the BTC market, with both technical and on-chain data looking less optimistic.

This indicator changes first, BTC price reacts later: Crypto Founder

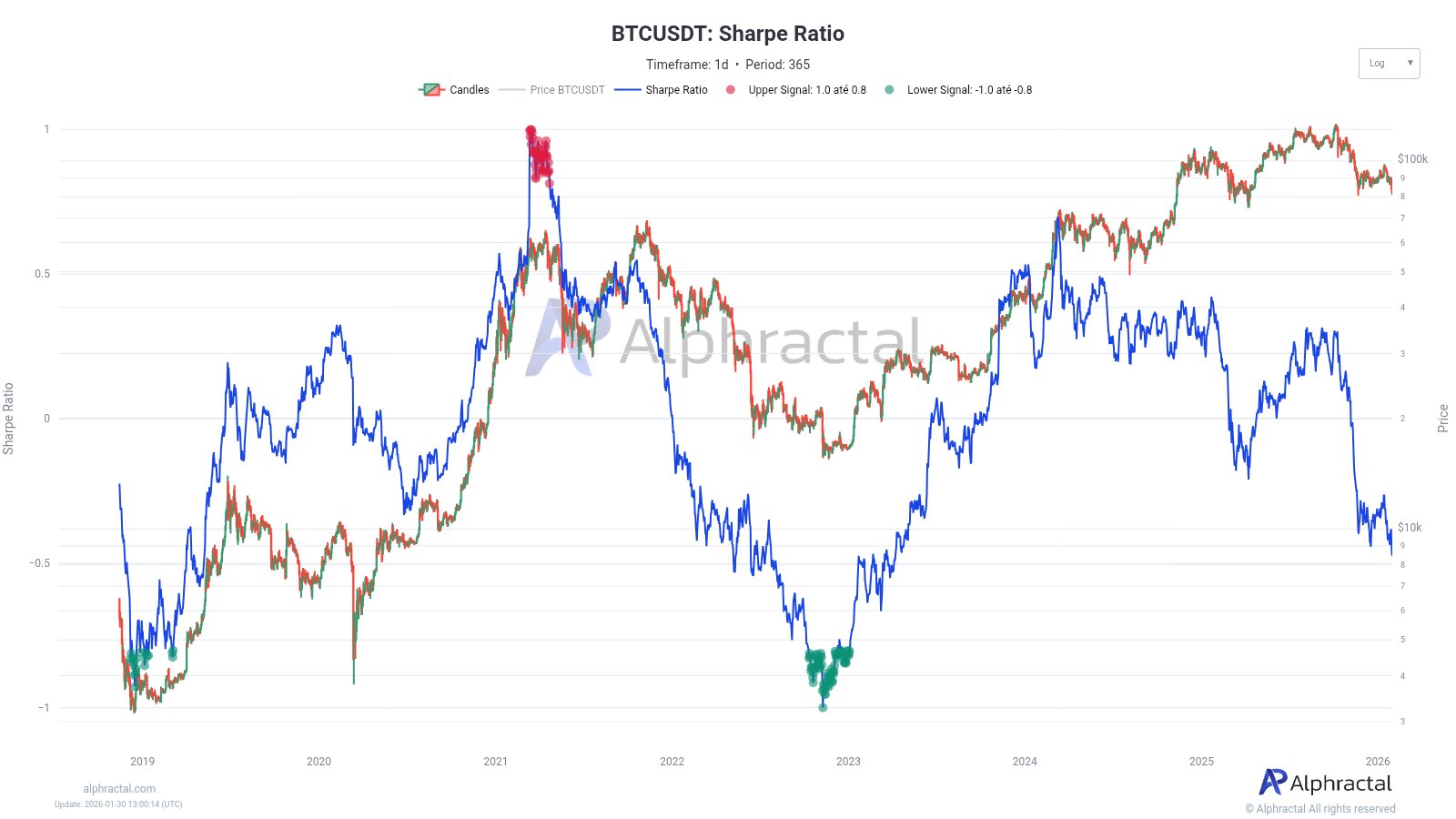

Joan Wesson, founder and CEO of Alpharactal, revealed in a January 30 post on the X Platform that the Bitcoin Sharpe Ratio is falling faster than the BTC price. The relevant metric here is the Sharpe ratio, which evaluates the risk-adjusted return of a particular cryptocurrency, in this case Bitcoin.

This on-chain metric essentially tracks the amount of return an investment delivers per unit of risk (considering that risk is measured by volatility), with higher values indicating better risk-adjusted performance. On the other hand, a negative Sharpe ratio indicates that the returns realized on the investment are not commensurate with the risks assumed.

In a post about X, Wesson wrote:

Simply put, the market is taking on more risk for less return.

Source: @joao_wedson on X

In fact, Bitcoin Sharpe Ratio fell into negative territory within the first few days of the new year. However, even after this change, the price trend of BTC is still incredibly strong, rising as high as $97,000, making on-chain observations less important.

What’s even more interesting is that the Sharpe ratio is declining and weakening faster than the Bitcoin price. Historically, this rate of decline has often coincided with a long period of loss of momentum or sideways movement in prices. In fact, Wesson concluded that risk-adjusted metrics need to change before prices react positively.

If this happens, Bitcoin price could fall to $65,500

Wesson predicted a target for BTC price if major cryptocurrencies continue their downward spiral. In an old post on X, the Alpharactal founder revealed that the Bitcoin price cannot fall below the $81,000 level under any circumstances.

On-chain experts said that if the market leader falls below the $81,000 level, a capitulation phase similar to the one seen in 2022 could unfold. Based on Fibonacci-adjusted market average prices, Wesson identified $65,500 as the next major support level.

$81,000 came into focus as Bitcoin price approached this level during the decline on Thursday, January 29th. However, as of this writing, BTC has recovered above the $83,000 mark, with the price still down nearly 8% on the week.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

editing process for bitcoinist is focused on providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards, and each page is carefully reviewed by our team of top technology experts and experienced editors. This process ensures the integrity, relevance, and value of your content to your readers.