The launch of spot XRP ETF (exchange traded fund) in the US was one of the rare success stories of the final quarter of 2025. Cryptocurrency-linked products have helped ensure large inflows into altcoins in recent months.

The XRP ETF recorded its first negative outflow day in the past week, while the exchange-traded fund also set a new record for total trading volume in a week. This milestone reflects the growing maturity of the XRP ETF market in the United States.

XRP Fund records $219 million in trading volume over the past week

According to the latest market data, the Spot XRP ETF posted its highest weekly trading volume since its debut at $219 million. This number is almost double the amount traded in the XRP ETF market the previous week ($117.4 million).

Meanwhile, this new record only surpasses the previous record of $213.9 million, set in the third week of December 2025. This feat shows that investor demand for XRP exchange-traded funds is increasing even as interest in the broader crypto ETF market has waned.

As previously mentioned, the US-based XRP ETF recorded net outflows of $40.8 million on Wednesday, January 7, marking its first negative performance in the past week. However, this one-day performance did not stop exchange-traded products from ending the week in the black.

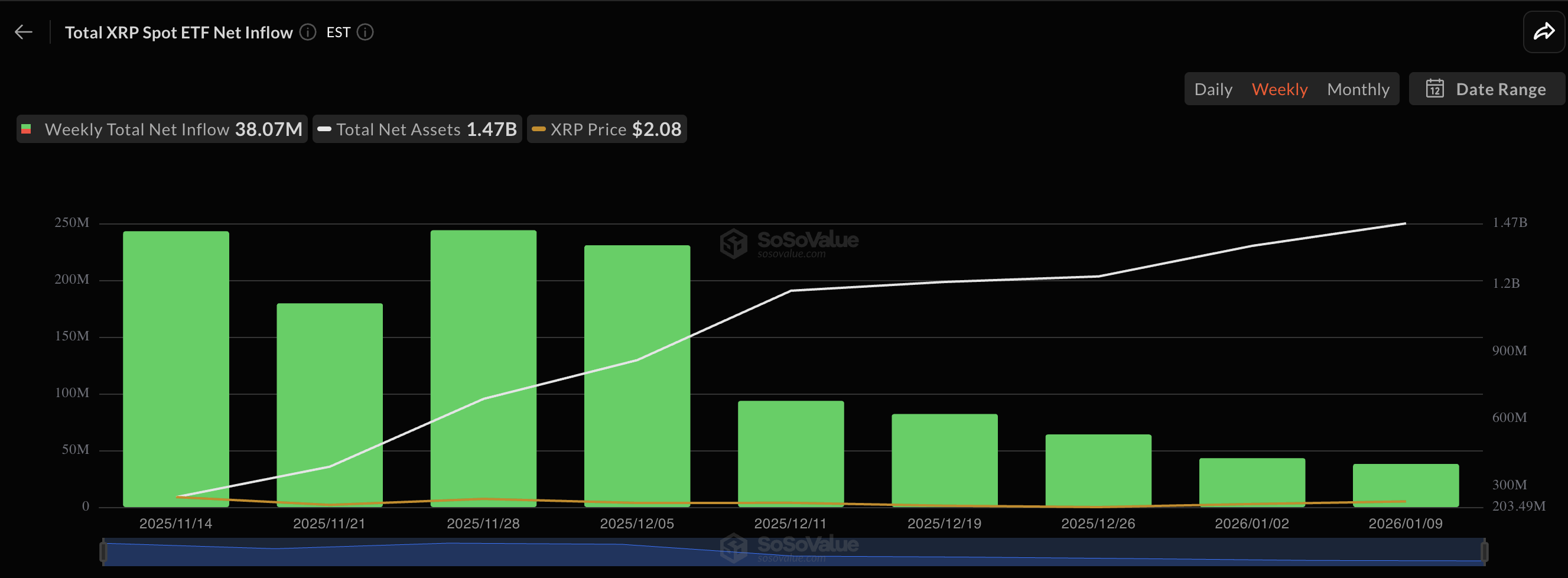

Data from SoSoValue reveals that the XRP ETF market added an additional $38.07 million in value during the week ending January 9th. However, looking at the graph, we can see that capital inflows into crypto-related products are steadily decreasing.

As of this writing, the Spot XRP ETF has accumulated $1.47 billion in total net assets since its launch in mid-November 2025. Canary Capital’s XRPC topped the list with $375.1 million in net assets under management (AUM), followed by Bitwise’s XRP fund with $303 million and Franklin Templeton’s XRPZ with $279.6 million.

XRP ETF shines as crypto ETF market slumps

While the XRP ETF appears to have withstood the market rough waters, the more established Bitcoin and Ether ETFs have seen better days. According to recent market data, crypto funds recorded a total of $749.6 million in withdrawals during the first full trading week of this year.

Most notably, the Spot Bitcoin ETF recorded its largest single-day net outflow of $486.1 million on Wednesday, January 7th. BTC exchange-traded funds ended the week with net outflows of over $681 million.

Meanwhile, the Ethereum ETF market started strong with inflows of $168.1 million on January 5th and $114.7 million on January 6th, but ultimately ended the week with net withdrawals of $68.6 million.