Published date: January 9, 2026 14:09

Cardano (ADA) price resumed its bullish rise and broke above the moving averages.

ADA Price Long-Term Forecast: Bullish

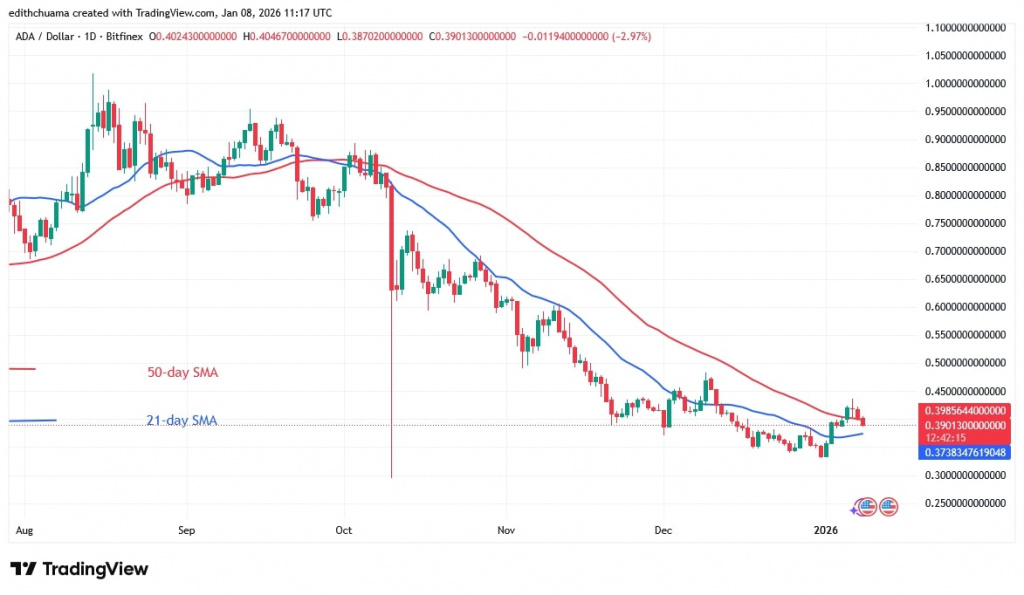

The uptrend peaked at $0.437 and then reversed. Buyers were unable to sustain the positive momentum above the $0.44 high, resulting in a decline. This rejection causes the altcoin to trade within a narrow range above the 50-day SMA support and below the $0.44 barrier.

On the downside, if the bears push the price below the 50-day SMA support, Cardano could fall to levels above the 21-day SMA support, i.e. $0.37. After that, bearish momentum could push the price down to the previous low of $0.329.

However, if the 21-day SMA support holds, ADA will remain trapped between the moving averages. Currently, ADA is $0.388.

technical indicators

-

Major resistance zones: $1.20, $1.30, and $1.40 -

Major support zones: $0.90, $0.80, $0.70

Cardano price index analysis

The price of the cryptocurrency was previously above the descending moving average, but is now falling between the descending moving averages. The decline resumes when the price falls below the moving average. On a 4-hour chart, the price bar is located between the upward-sloping moving averages. ADA establishes a new trend when it breaks either the 21-day moving average or the 50-day moving average.

What’s next for Cardano?

Cardano’s bullish scenario is invalidated as the altcoin faces rejection at high prices of $0.44. On the 4-hour chart, negative momentum pushed the price below the moving average, but it has since stabilized above the 50-day SMA support. If the 50-day SMA support is broken, ADA price will fall to an all-time low of $0.33. Meanwhile, the cryptocurrency’s price remains trapped within its range.

Disclaimer. This analysis and forecast is the author’s personal opinion. The data provided was collected by the creator and is not sponsored by any company or token developer. This is not a recommendation to buy or sell cryptocurrencies and should not be considered an endorsement by Coinidol.com. Readers should do their research before investing in a fund.