Puntos Clave de la Noticia:

- Vanguard bans Solana Lister ETF and prohibits $SOL reversals for $50 million customers.

-

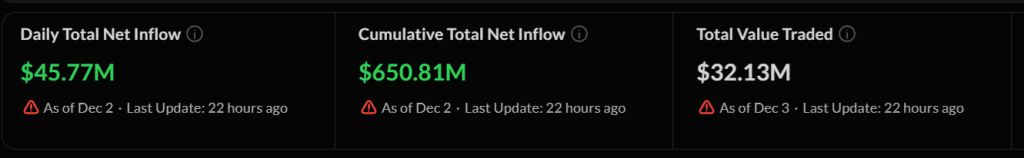

Los ETF de Solana recibieron has $45.7 million in trading diary and $29.4 million in $BSOL condor per bit.

-

ETF recovery matched $400 million with $BTC and $93.000 liquidity.

Vanguard invests in consideration of the importance of Solana ETF registration. We need to continue our activities to gain the big world’s permission for our customers Work with virtual currencies and cryptocurrenciesAbriendo La Puerta a Unos, including $SOL’s Replican El Precio. 50 million de Inversole. The ETFs on the platform contain history over a 22-day period during SOL’s treatment period.

Roth ETF de Solana Registraron $45.7 million Diary, Liderados of Fondo Bitwise $BSOLreceives $29.4 million in AUM $663 million. franklin templeton Prohibitions regarding ETF $SOL en NYSE Arca con una comisión de 0,19%, la más competitiva del mercado. CoinShares accepts claims for Solana ETFthe result is more likely to be bitwise.

CoinShares Retiro su ETF de Solana

Vanguard is taking full advantage of trends in the TradFi sector. SoFi and Bank of America institutions enable activity in Solana Crypto of social action, provides the functions of capital institutions and minority digital ecosystems. Vanguard decision does not allow solo access and all must be resolved Verify ciphertext applying traditional rules and regulations..

En las últimas 48 hours Liquid that requires $400 million in funding.impulsively 12% EN EL PRECIO DE $BTCcheck the Minimo for $82.000 and see the real situation for $93.000. Combination of ETF and counterparty clearing El Optimismo Vuelve de Manera Gradualprioritizes final response to federal product regulations.

ETF recovery Solana Enjoy a view that integrates traditional platformer activities Impact of liquid and impact of demand. Benefits include regulation of Solana and ETF competitors, investment explanations for ETF competition, and capitalization of investments.