Well, the hopes and dreams of the bulls were dashed this week as Bitcoin ended the week at $94.290, below the key weekly support level of $96,000. More bearish price action should be expected in the coming weeks as key support levels have been lost. While a rebound is possible, it is unlikely to result in a meaningful recovery in price levels.

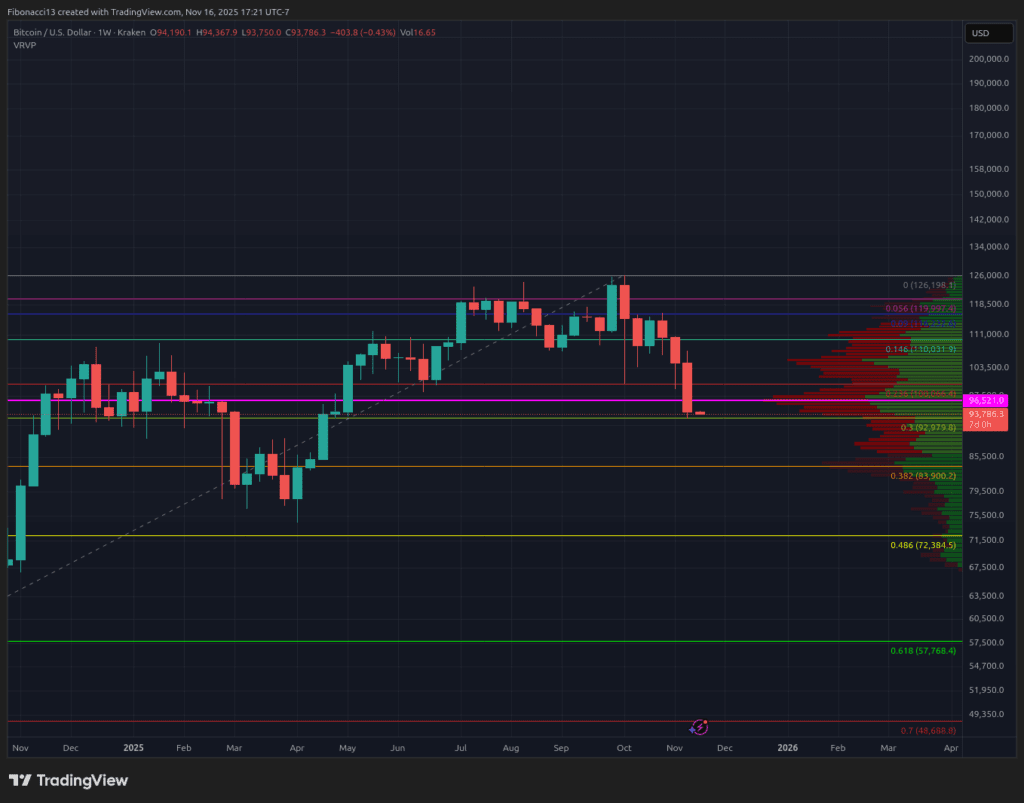

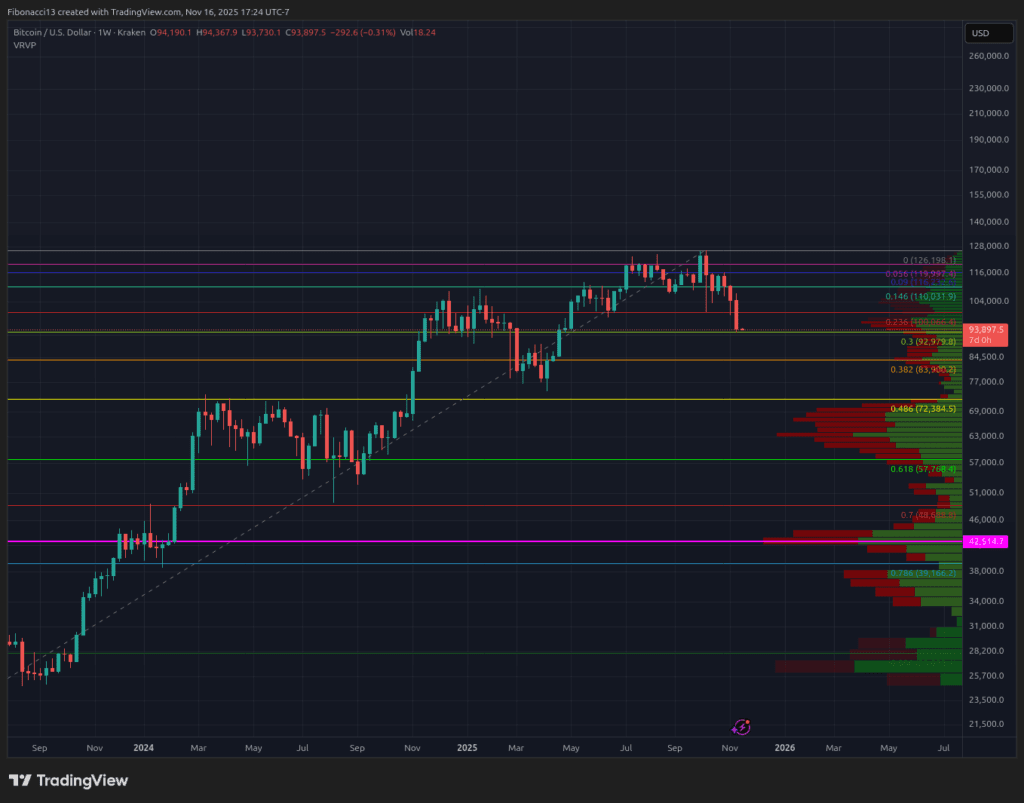

Current major support and resistance levels

Bitcoin price has ended below the $96,000 support level identified in this article over the past few weeks. If we close near the lows below this level, there is little chance, if any, of the price recovering quickly and resuming the bull market. Looking further down, the next major support level lies below the 0.382 Fibonacci retracement from the 2022 bottom to the October 2025 high, with another high volume node in the $83,000-$84,000 area. Below, we focus on the 2024 consolidation zone high between $69,000 and $72,000.

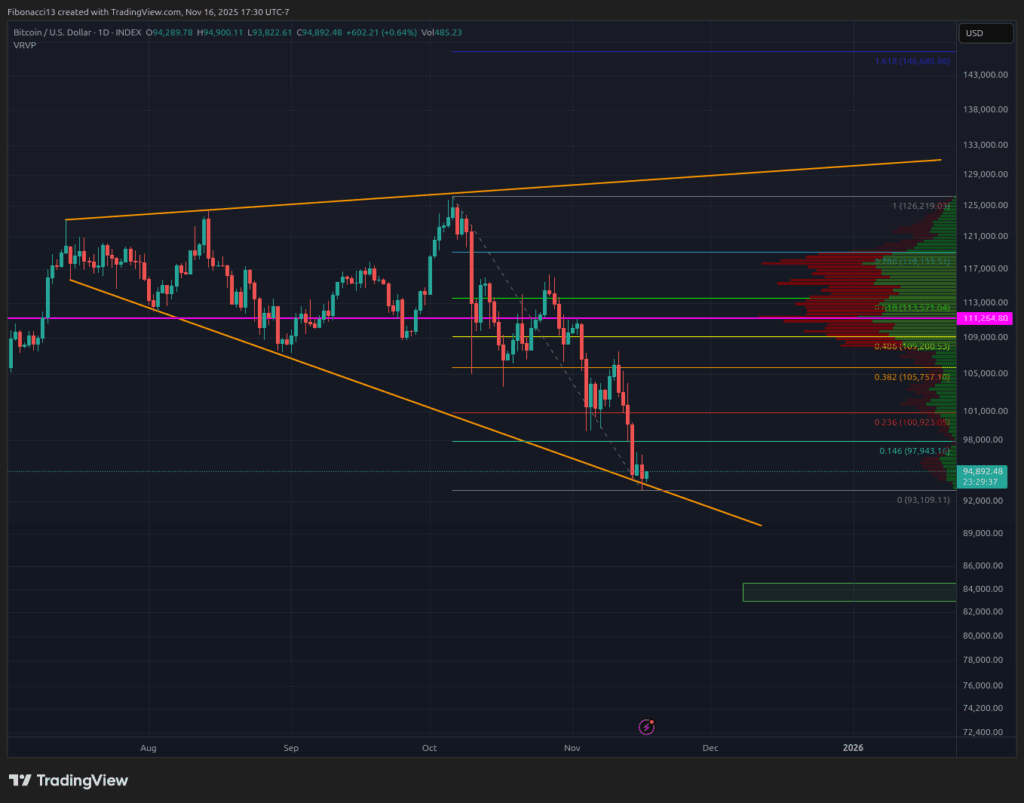

There is currently thick resistance above $94,000. Given the very low closing price, we don’t expect much, if any, rebound at this level. If the price sees any kind of rebound this week, we will look to hold the $98,000 level as resistance. A short squeeze could push the price beyond this point to $101,000. Above this level is the equivalent of a brick wall in the $106,000 to $109,000 zone. Beyond the wall lies $114,000 for serious resistance and $116,000 for final reinforcements to the Bear factions. If the price closes above $116,000, we will need to reconsider the market structure as there is a potential for a bullish reversal that far if the bulls can push it that far.

This week’s outlook

do you believe in miracles? We need to know if Bitcoin prices can expect any meaningful gains this week. There is a bit of hopium for the bulls in that the widening wedge pattern has not conclusively broken out of the bears. If we extend it as low as possible (adjusting from the previous week), the price will be barely bottom-supported at the current low. However, it is a difficult challenge for bulls to take meaningful profits at all the resistance levels outlined above. The most bulls should expect is a rebound to $106,000, with the price likely to turn to new lows anywhere south of there. Rather, the widening wedge is likely to break to the downside at some point this week as the bears are clearly in full control.

Market atmosphere: Very Bearish – Bulls are underperforming. Bitcoin hovered around $94,000, down more than 25% from its October high. After losing a key support level, there is little hope left for meaningful upside or new highs.

coming weeks

Examining Bitcoin’s four-year cycle theory from every angle, the high is most likely already here. That timing was expected to occur between September and December 2025, but with prices so low and resistance so high, it is highly unlikely that any rally would remain strong enough to take prices to new highs before the end of this year. Is the 4 year cycle over? Well, that doesn’t seem to be the case, as prices hit a high in early October and have basically gone straight down from there. Will we see four-year highs in Q1 2026? Yes, it’s possible, but it’s still very unlikely given Bitcoin’s lack of strength in recent weeks while the stock market has remained strong. Traditional stock markets appear to have a bearish outlook for the foreseeable future, making it unlikely that Bitcoin will see meaningful gains during this period.

Terminology guide:

Bulls/Bulls: Buyers and investors who expect prices to rise.

Bearish/bearish: Sellers and investors who expect prices to fall.

Support or support level: The level at which the price of an asset should be maintained, at least initially. The more you touch the support, the more likely it will weaken and the price will not be able to sustain itself.

Resistance or resistance level: Opposite of support. A level where the price is likely to be rejected, at least initially. The more times you touch the resistor, the weaker it becomes and the more likely it is that you won’t be able to keep the price down.

Fibonacci retracements and extensions: The ratio is based on what is known as the golden mean, a universal ratio that relates to cycles of growth and decline in nature. The golden ratio is based on the constants Phi (1.618) and Phi (0.618).

Volume profile: An indicator that displays the total amount of buys and sells at a particular price level. The Point of Control (POC) is the horizontal line on this indicator that indicates the price level at which the most volume of trades occurred.

Widening wedge: A chart pattern consisting of an upper trendline that acts as resistance and a lower trendline that acts as support. These trend lines must move away from each other to validate the pattern. This pattern is the result of widening price fluctuations, typically with higher highs and lower lows.