Kind MD (NAKA) has notified the SEC that the submission of its quarterly financial report will be delayed as it proceeds with detailed accounting procedures related to its merger with Nakamoto Holdings in August.

The 19th-ranked Bitcoin treasury firm said it will miss the filing deadline for its Form 10-Q, which ends Sept. 30, but plans to file its report within the five-day extension allowed by SEC rules.

Kindly MD was originally an integrated healthcare services provider and merged with David Bailey’s. Bitcoin Focus on Nakamoto Holdings To create a publicly traded Bitcoin financial instrument. Currently owns 5,765 BTC.

“Due to the complexity of the accounting procedures associated with the merger, including the application of relevant accounting standards under U.S. GAAP and review procedures consistent with PCAOB requirements, additional time was required to ensure the accuracy and completeness of the information provided on Form 10Q,” Kindly MD said in the filing.

Preliminary figures indicate significant post-merger losses, including approximately $1.41 million in realized losses on digital assets, approximately $22.07 million in unrealized losses, $14.45 million in extinguished debt losses, and $59.75 million in losses on the Nakamoto acquisition, partially offset by a positive change in the fair value of contingent liabilities of $21.85 million, the filing shows.

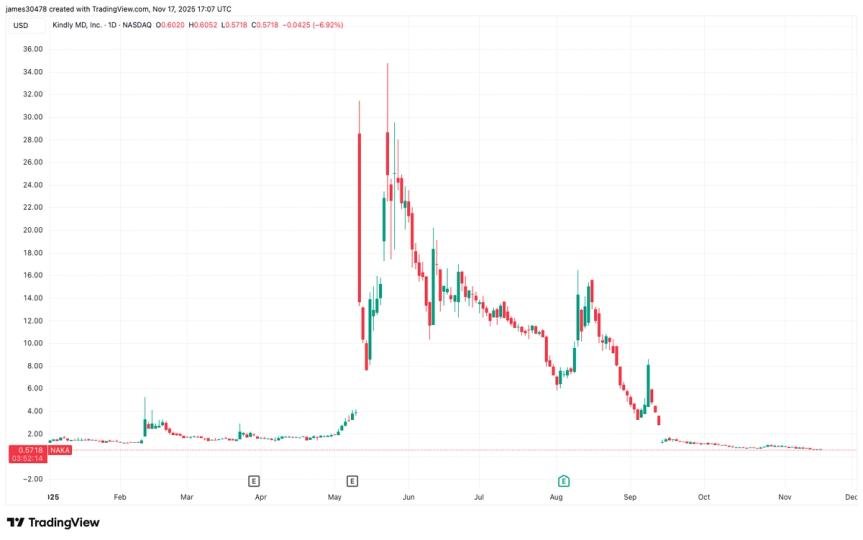

NAKA is trading 7% lower on the day at $0.57.