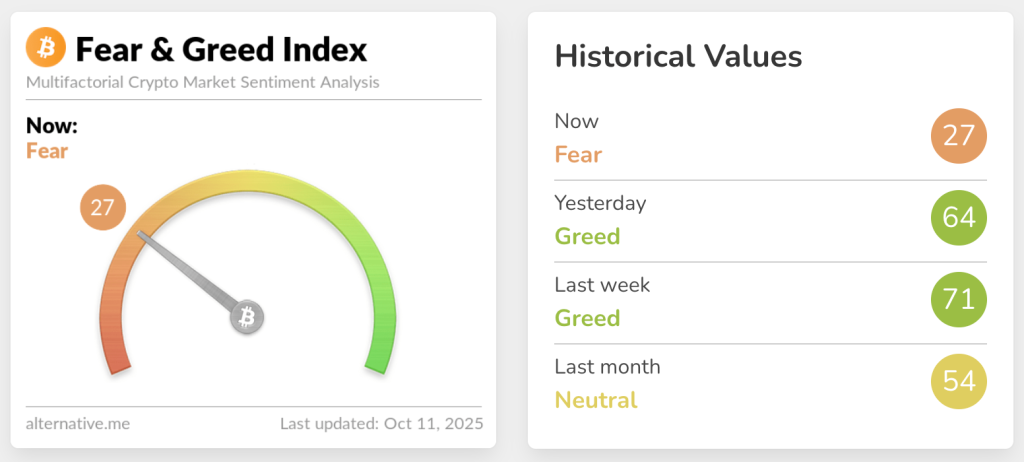

After President Donald Trump announced 100% tariffs on imports from China, the crypto fear and greed index plummeted from 64 (greed) to 27 (fear) in less than 24 hours, with CoinglassThe largest liquidation event in virtual currency history.”

More than 1.66 million traders were liquidated, with total losses exceeding $19.33 billion, but since Binance only reports one liquidation order every second, some estimates suggest the actual figure could be more than $30 billion.

Tariff shock wipes out $1 trillion in 3-hour chain

Bitcoin Ethereum crashed above $122,000 and briefly below $102,000, erasing all gains since August, while Ethereum fell from $4,783 to $3,400 before recovering.

The global cryptocurrency market capitalization fell more than 9% in 24 hours to $3.8 trillion, erasing about $1 trillion in just three hours.

On Friday alone, more than $7 billion in positions were liquidated in less than an hour of trading.

Most of the damage was absorbed by long positions, with total losses of $16.83 billion, compared to $2.49 billion for short positions.

Bitcoin led the way in liquidations with $5.38 billion, followed by Ethereum with $4.43 billion, Solana with $2.01 billion, and XRP with $708 million.

On HyperLiquid, the largest single liquidation ETH-USDT position was worth $203.36 million.

The exchange processed $10.3 billion, or about 53% of all liquidations, followed by Bybit with $4.65 billion, Binance with $2.39 billion, and OKX with $1.21 billion.

The collapse dwarfed previous record-setting events, such as the coronavirus crash in March 2020, which resulted in $1.2 billion in liquidations, and the FTX collapse in November 2022, which resulted in $1.6 billion in liquidations.

Friday’s event was about 20 times larger than the coronavirus crash, and Multicoin Capital’s Brian Strugatz noted that the focus has now shifted to “.Counterparty exposure and whether this will cause broader market contagion”

October’s historic strength faces unprecedented test

Yesterday, economist Timothy Peterson noted that falls of more than 5% in October are “extremely rare” and have only happened four times in the past decade, in 2017, 2018, 2019 and 2021.

After previous declines, Bitcoin recovered 16% in 2017, 4% in 2018, 21% in 2019, and only dropped another 3% in 2021.

According to data from CoinGlass, October ranks as Bitcoin’s second-best performing month on average since 2013, with an average return of 20.10%, behind November’s average return of 46.02%.

If history repeats itself and Bitcoin mirrors October’s strongest rebound of 21% from 2019, a similar move from Friday’s low of $102,000 would take Bitcoin to around $124,000 within a week.

However, President Trump’s tariff announcements scheduled for November 1 in response to the Chinese government’s export restrictions on rare earth elements continue to create policy uncertainty.

The president then signaled that while liquidation losses remain fixed, the tariffs could be lifted if China changes course before the deadline, which could trigger a short-term market recovery.

According to Bloomberg, Orbit Markets co-founder Caroline Moron identified $100,000 as Bitcoin’s next major support level, below which “It would mark the end of the bullish cycle of the past three years.”

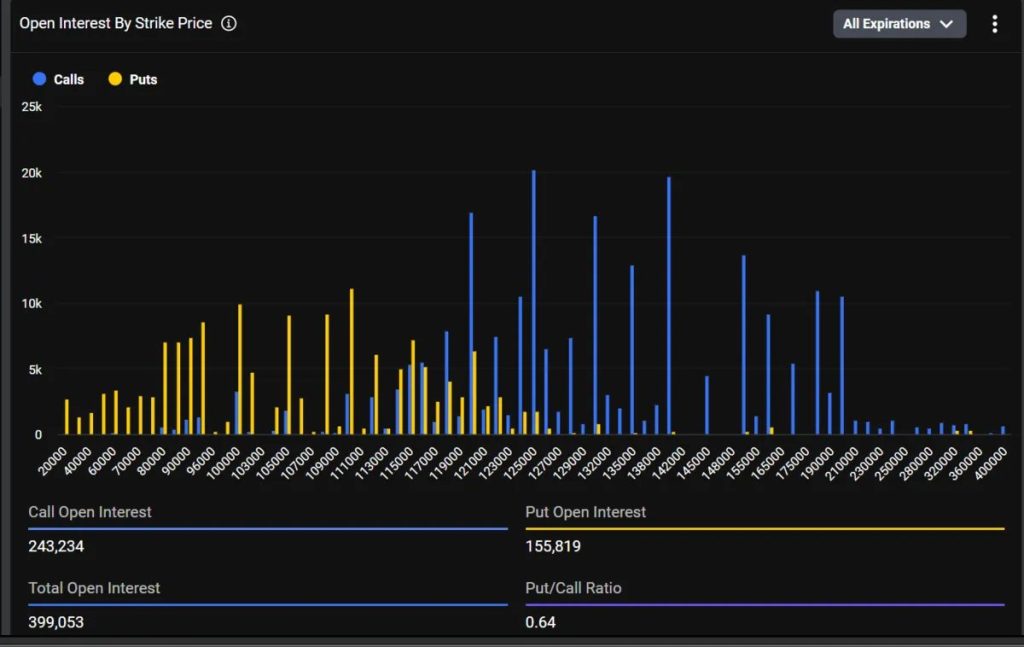

The Bitcoin options market reflects this view, with the highest number of put strikes at $110,000 and the second-highest number at $100,000, according to Deribit data.

Analysts are divided on whether liquidations have bottomed out or whether more pain lies ahead.

Jan3 founder Samson Mow maintained his bullish sentiment, saying:There are still 21 days left in Uptober.”

Michael Van de Poppe, founder of MN Trading Capital, called the event “the bottom of the current cycle,” and compared it to the COVID-19 crash that hit the previous cycle low.

Bitcoin Libertarians take a long-term view and suggest:Within a few years, Bitcoin will plummet from $1 million to $0.8 million in a matter of hours.”

David Jeong, CEO of Tread.fi, said in a Bloomberg report that the market:black swan event”, noting that many institutions probably did not anticipate this level of volatility.

Similarly, Vincent Liu, chief investment officer of Cronos Research, said that the reason for the loss was “Driven by US-China tariff concerns but facilitated by institutional overleverage”, he added, adding that the macro-linkage of cryptocurrencies is now clear.

The Fear and Greed Index measured 27, 64 yesterday, 71 last week, and 54 last month, marking one of the fastest sentiment reversals in crypto history, with Bitcoin also hitting a six-month low within hours.

Technical Analysis: Critical Support Test for BTC and ETH

BTC It has rebounded from the lows of $102,000 and is currently trading around $111,522.

The immediate amount of support is between $110,000 and $113,000, with the $113,500 level being considered important to trigger a relief rally.

Resistance zones above the current price are $117,933, $124,475, and recent highs near $126,000.

The $20 billion liquidation could remove extreme leverage and remove selling pressure, but the sustainability of the rebound depends on fundamental improvements.

Volume characteristics do not show overwhelming confidence in either direction.

Ethereum After testing $3,400, it is trading at $3,833, with immediate resistance at $4,000, the psychological level needed for upward momentum.

The support zone is around $3,600 to $3,800, and failure to recover $4,000 could trigger a retest of these levels.

Higher resistance levels are $4,080, $4,265, and $4,783. Although the RSI indicator has reached an oversold level historically associated with a reversal, it could still remain depressed in a full-blown bear market.

Both assets face real uncertainty following a liquidation event.

Bitcoin To test the recovery scenario from $117,000 to $120,000, we would need to collect and hold $113,500, but failure could mean retesting $102,000, or potentially $95,000 to $100,000.

Ethereum Sustained trading above $4,000 is needed to extract momentum towards $4,200-4,500, and a breakdown risks heading towards $3,600-3,800.

While the unwinding of leveraged positions removes the immediate selling pressure, outstanding tariffs and the potential for further volatility suggest that consolidation between current levels and recent lows remains the most likely short-term outcome until direction is clearer.

The post Cryptocurrency market turns from “greed” to “fear” in 24 hours – Will another crash come? The post appeared first on Crypto News.