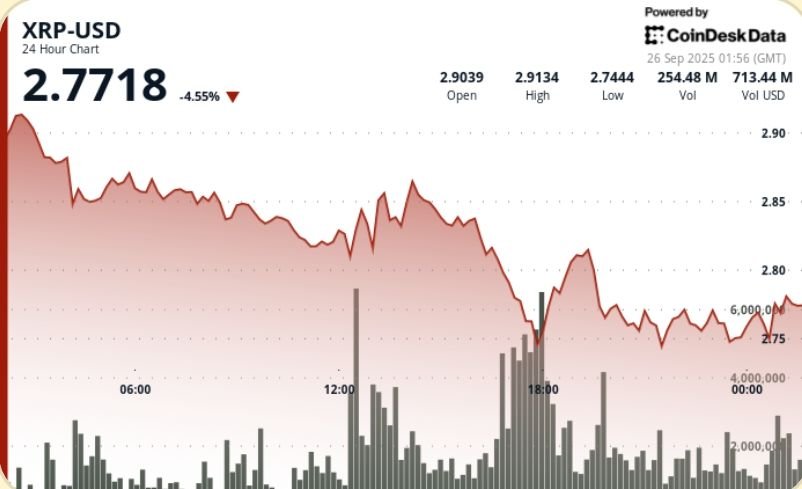

The XRP push collapsed under a massive sale on September 25th, exceeding $2.90. The $277 million spike hammer ring price has returned to $2.75.

The move erased more than $18 billion in market value over the past week, confirming fresh resistance at $2.80, and traders helped test support at $2.70.

News background

•XRP slid 5.83% in the September 25-26 session, dropping from $2.92 to $2.75 for heavy engine sales.

• A sudden refusal at $2.80 over the 17:00 hour triggered a 276.77 million volume spike. This averages over 2.5 times the average 24-hour period.

• Despite the SEC approval of the first US XRP ETF, optimism was offset by Powell’s warning about valuation and Treasury yields.

•Last week, XRP’s market value fell by $18.94 billion, down 10.22%, below the $3.00 psychological threshold.

Price Action Overview

XRP traded between $2.92 and $2.74 (range 6.3%), closing nearly $2.75.

• Sellers dominated after a $2.80 refusal on extreme volumes, and created an upside-down capped distribution zone.

• Subsequent recovery attempts stalled around $2.81-2.82, confirming fresh resistance clusters.

• At the final time, a short 1.09% bounce was seen, ranging from $2.75 to $2.78, driven by a concentrated flow of 00:50–00:57 at volumes above 3 million per candle.

• Short-term support is currently seen at $2.75-$2.77, with risks downward towards $2.70 if a breach occurs.

Technical Analysis

• Range: $0.18 (6.3%) high, $2.92 to $2.74 low.

•Resistance: Initial refusal of $2.80. Clusters ranging from $2.81 to $2.82 were formed in failed retests.

•Support: A $2.75 zone was defended in the late session. The next psychological level watch of $2.70.

•Volume: 276.77m vs. average daily 108.42m at 17:00.

•Pattern: A large amount of rejection signal distribution. The near $2.77 short-term integration suggests indecisiveness before the next move.

What traders see

•Whether $2.75 will be held throughout the Asian session or reach $2.70.

• ETF optimism and real money leaks – Sales news patterns exist.

•Whales flow after $800 million transfers over the past week. Positioning risk when selling resumes.

• Macro Overhang: Powell’s Hawkish Tone, Treasury will win climbs and reduce rejected expectations.