Solana trades at $238.45, with a market capitalization of $1295.1 billion and a 24-hour trading volume of $35.5 billion. The tokens have been consolidated in recent sessions, but analysts say technical breakouts can define the next major move.

CME expands to Solana and XRP options

The Chicago Mercantile Exchange (CME), the world’s largest derivative exchange, will introduce options for Solana (SOL) and XRP futures starting October 13th.

Since debuting earlier this year, Solana and XRP futures have found significant momentum. More than 540,000 Sol Futures contracts, a significant equivalent of $22.3 billion, have been traded since March, with 9,000 contracts recorded in August.

XRP futures also collect interest, with public interest in August alone of $16.2 billion and $942 million. Giovanni Vicioso, global cryptographic product head at CME, said the move reflects “severe growth and liquidity” in these markets.

ETF Leads Improve Investor Trust

Solana will be able to qualify for Spot ETF under the SEC’s new listing framework. The rules state that Altcoin, which has established futures markets on regulated exchanges for at least six months, is applicable. With Solana Futures already trading with Coinbase on CME, Sol is sitting in position for potential ETF approvals.

Analysts argue that Spot ETF access can unlock fresh institutional demand, reflecting the impact seen when Bitcoin ETF pulled out an influx of billions earlier this year.

Additionally, the launch of Coindesk Crypto 5 ETF Grayscale at NYSE Arca has led to an increase in institutional exposure. The fund includes Bitcoin, Ethereum, XRP, Solana and Cardano, providing investors with a diverse basket of key digital assets.

The debut highlights the growing appetite for regulated multi-asset crypto products, which could deepen Solana’s liquidity over the upcoming quarter.

Solana (SOL/USD) Price Forecast – Technical Outlook

Technically, Solana’s price forecast remains neutral as Sol is integrated within the rising channel, with prices being compressed between a 50-hour EMA for $239 and a 200-hour EMA for $230. Buyers continue to maintain high prices, while sellers continue to operate near the $248-$253 resistance zone.

The relative strength index is at 45, signaling neutral momentum, but leaning towards oversold territory. The candlestick formation shows demand of around $236.

A breakout over $244 could pave the way to $248, $253, with a further extension to the channel top coming close to $259.

If momentum arises, analysts can potentially see $310 if SOL tests are $300 in the medium term and ETF approvals accelerate the inflow.

On the downside, a break below $231 exposes $226 and potentially $220, but a wider institutional trend suggests that DIP may be short-lived.

For investors, the consolidation could be the foundation for Solana’s next major gathering heading into 2026.

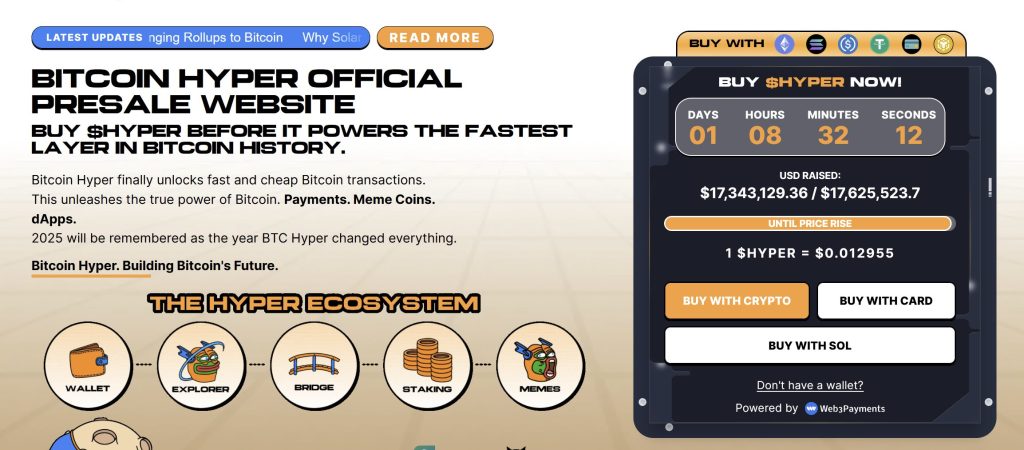

Presale Bitcoin Hyper ($Hyper) Combines BTC security with Solana Speed

Bitcoin Hyper ($Hyper) is positioned as the first Bitcoin Native Layer 2 with Solana Virtual Machine (SVM). The goal is to expand the BTC ecosystem by enabling the creation of Lightning-Fast, low-cost smart contracts, decentralized apps, and even Meme Coin.

Combining BTC’s unparalleled security with Solana’s high-performance framework, the project opens the door to all-new use cases, including seamless BTC bridging and scalable DAPP development.

The team has a strong focus on trust and scalability, and the project has been audited by consulting to show investors are confident in the foundation.

Momentum is quickly building. Prescile is already over $17.3 million, with only a limited allocation still available. At today’s stage, the price of Hypertokun is only $0.012955, but that number increases as it progresses.

You can purchase Hyper Token on the official Bitcoin Hyper website using your Crypto or a bank card.

Click here to join the pre-sale

Post Solana Price Prediction: Analysts first appeared on Cryptonews with a technical breakout that could push Sol to $310.

Breaking: The SEC has approved the general listing standard for Spot Crypto ETFs under the ’33 Act.

Breaking: The SEC has approved the general listing standard for Spot Crypto ETFs under the ’33 Act.