Key takeout

- Gold hit a record $3,508, while Bitcoin went above $110,000 as central banks expect interest rates to be cut in September.

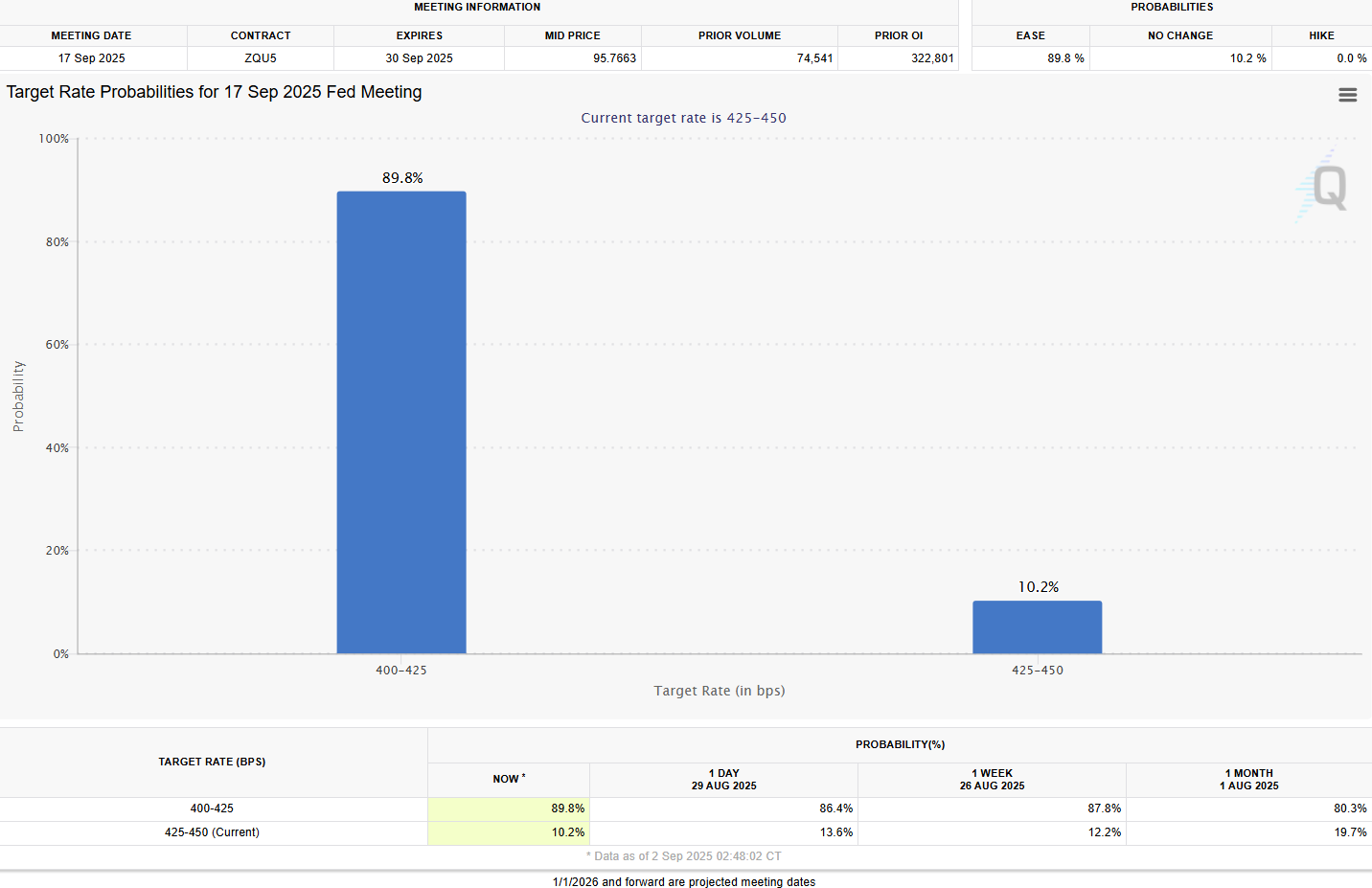

- The crypto and gold markets have skyrocketed, with around 90% of probability traders allocated for the imminent Fed rate cuts.

Please share this article

Gold won a fresh high of $3,508 in Asian trading on Tuesday, but Bitcoin went above $110,000 amid growing bets to cut interest rates at its September 17 meeting.

According to the FedWatch tool, the odds of a quarterly cut were up nearly 90% from 86% yesterday and 84% last week. The odds at this level on August 22 were the last after Fed Chairman Jerome Powell signaled that the cut could be on the table.

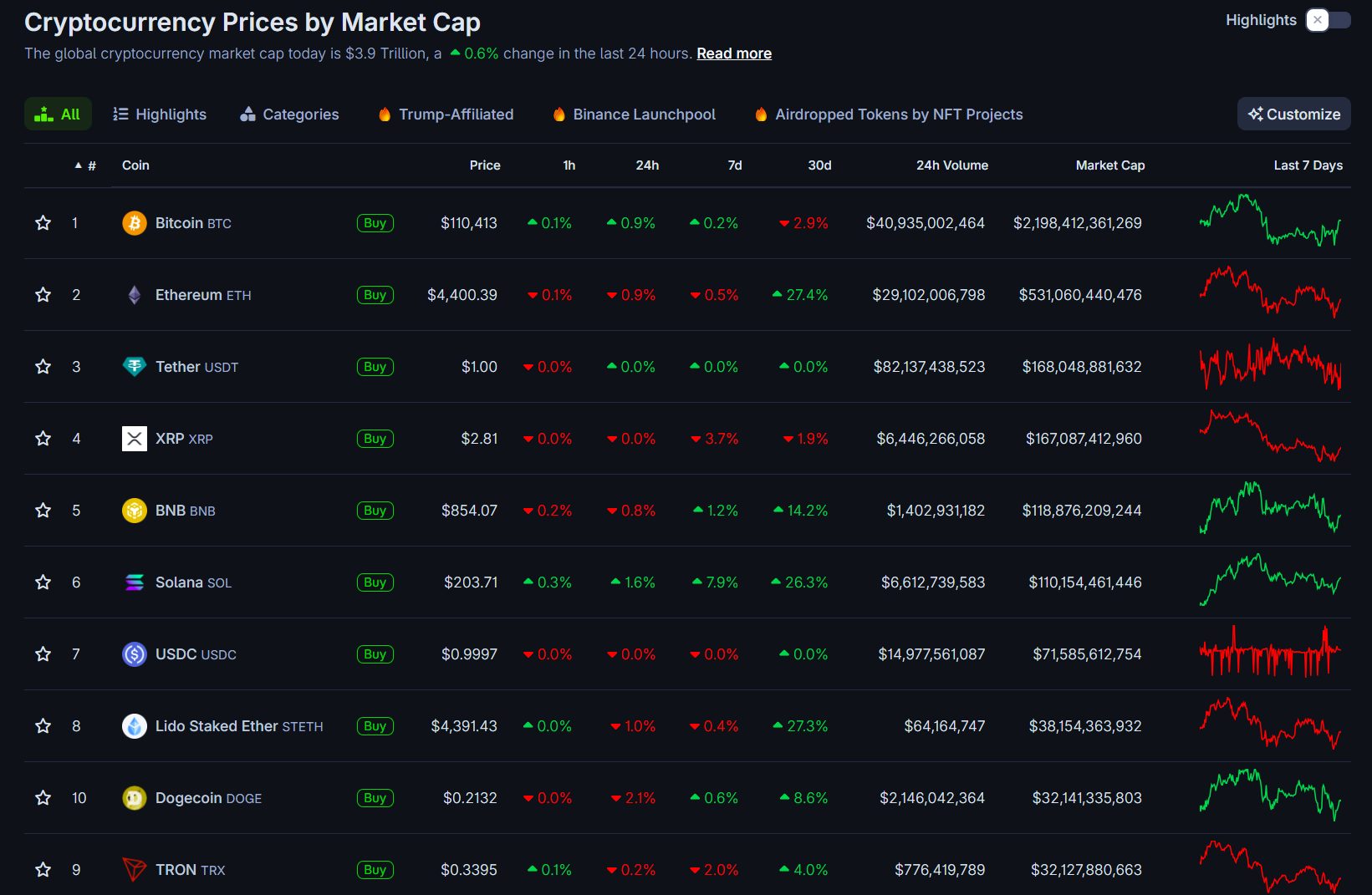

Bitcoin climbed from $107,500 to $110,500, lifting other crypto assets. Ethereum has regained $4,400, Solana has traded over $200, and other major tokens have also become sophisticated.

Crypto’s total market capitalization has skyrocketed to $3.9 trillion, a slight rise in the last 24 hours.

Analyst Macroscope sees gold breakouts as Bitcoin’s bullish macro signal. When gold spiked in April, Bitcoin branched out from other risky assets and temporarily pulled back from $109,000 to $75,000 before rising to hit highs in order to hit highs.

Analysts are seeing signs of a recurring pattern, and Bitcoin could immerse in the short term before staging another strong rally.

“We are screaming that once this BTC retracement is complete, gold will be a long BTC,” Macroscope said in a statement. “This last happened in April was in April. Gold had just made a big move into the 3400-3500 area. At the same time, BTC was pulled back from 109K to 75K.”

“The inflection point was a positive divergence from BTC from risk assets. BTC has run to a new high. The current timing is unknown.

Investors are waiting for a series of US economic releases that can hone their Fed policy expectations. This week’s focus was on the August employment report, with the first full reading on working conditions since the July revision revealing weaker employment growth than initially reported.

The August inflation print, scheduled for September 11th, will give you further clarification of whether rate reductions are imminent.

Beyond the numbers, investors are also turning to ongoing legal and political developments at the Fed, including a hearing of the Fed Bank’s Banking Committee, Trump’s candidate for the Fed Committee, and an unsolved case of Federal Reserve Gov. Lisa Cook.

Please share this article