On September 1, 2025, Metaplanet hosted EGM in the heart of Tokyo.

At the event, Metaplanet president Simon Gerovich laid out the company’s plans to acquire 210,000 Bitcoins (1% of total supply) by 2027.

This vision includes the issuance of two versions of new financial instruments, with persistent preferred stock products similar to the type that the strategy unfolded in March 2025.

Metaplanet Milestone

Jerovic launched the meeting by explaining how he manipulated Bitcoin Treasury from his struggles as a hotel company in early 2024.

Since then, Metaplanet has acquired around 0.1% of its total supply of Bitcoin, far surpassing its initial goal of getting 10,000 Bitcoin.

During the event, Gerovich also announced that Metaplanet had increased its holdings to 20,000 Bitcoin, providing the world’s sixth largest Bitcoin balance sheet.

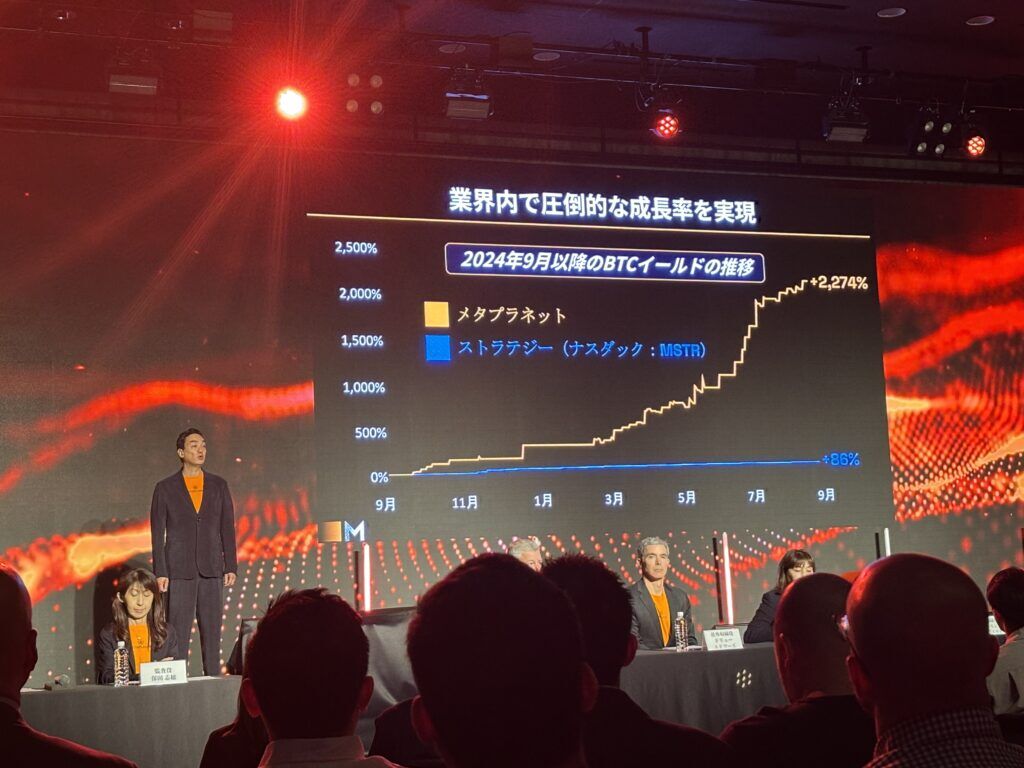

He added that his goal is for Metaplanet to have the second largest Bitcoin balance, second only to strategy. He then compared Metaplanet’s Bitcoin per share over the past year to the Strategy percentage, noting that percentage has increased to 2,274% compared to 86% of Strategy.

Gerovich also pointed out that Metaplanet’s stocks are traded over 100 hours a week through exchanges and brokerages around the world, helping to make Metaplanet’s success a global story as well as a Japanese story.

“Where you are in the world, Metaplanet is within reach,” Jerovic told more than 3,000 attendees at the event.

Metaplanet Prefes

“Traditionally, priority equity has been in the quiet corner of finance, but what’s backed up by Bitcoin is completely new,” Gerovich said.

He explained how the preferred stock metaplanet offering will become the main funding mechanism for winning more Bitcoin, just as it has for strategy, but also establish a yield curve for Bitcoin support.

Furthermore, Jerovic highlighted the fact that Metaplanet is in a unique situation for creating such a product in that it can be borrowed at very low interest rates.

“The low prices in Japan are our hidden superpower,” he said.

He also shared that traditional bond markets have been “tensty” and investors are “searching for alternatives.”

This is the opportunity, according to Gerovich, to become the biggest issuer of Bitcoin-backed bonds in Asia. He believes the type of preferred equity metaplanet offering serves as an attractive alternative to traditional bond products.

Metaplanet will provide two classes of priority fairness.

Class A is designed to be a “safeterial and stable” financial product that provides yields, just like traditional bond products. The product produces 5%. Class B is risky, but comes with an option to convert it to Metaplanet common stock.

These new financial products offer four distinct advantages for Metaplanet, says Jerovic.

Four Benefits of Metaplanet’s Persistent Equity Products

- Diversification of fundraising: So far, Metaplanet’s sole fundraising mechanism is issuing shares in common stock. Prefs offers a new way to raise money for your company.

- Permanent: By issuing a permanent debt certificate with a promise of a 5% return fee, Metaplanet can obtain funding without the constant burden of refinance risk.

- Low-cost funding: As mentioned above, Japan’s interest rates are the lowest of all G7 countries, and Metaplanet can raise funds at lower interest rates than most of the peers of the Bitcoin Treasury company.

- Ability to suppress preferred stock issuance:Metaplanet will reduce preferred share issuance at 25% of Bitcoin Nav. Doing this will allow you to float Metaplanet if Bitcoin’s price drops 75%.

After discussing these four benefits, Gerovich summarized his presentation in Metaplanet’s revised mission statement. A pioneer of Japan’s new theory of credit. (Problem) Equipment built on over-secured, absolutely rare digital capital.

Overwhelming approval

After laying out the Metaplanet Plays plan, Gerovich asked participants if they would approve the recruitment of a company that would attempt to revise the incorporation article.

He met an overwhelming applause.

And the audience members were not the only ones excited by Jerovich’s vision and his proven ability to carry it out.

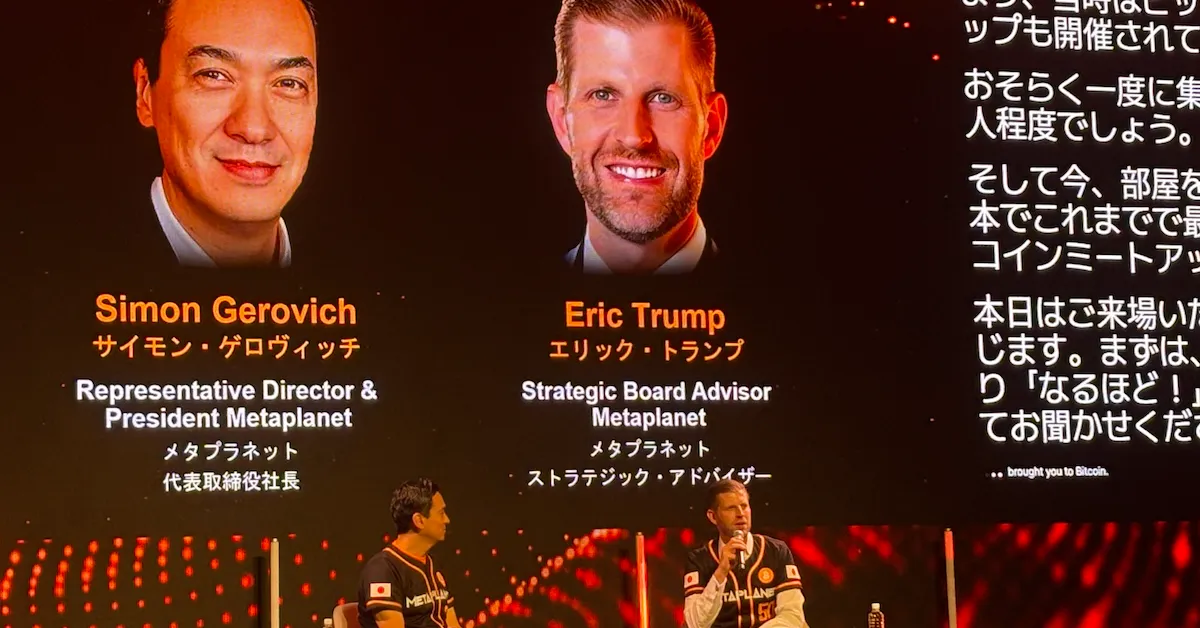

Eric Trump, who served as Metaplanet’s Strategic Board Advisor and attended a fireplace chat with Gerovich during the afternoon programming, praised Gerovich.

“Simon is one of the most honest people I’ve ever met in my life,” Trump said. “You have a great leader in Simon and a great product in Bitcoin. I think it’s a winning combination.

Nakamoto CEO David Bailey invested in Metaplanet shortly after implementing his Bitcoin financial strategy, praised Jerovic and the Metaplanet team, noting that Japanese investors are being forced to pay attention to the company.

“The Metaplanet has grown so big that it cannot be ignored,” Bailey said.

Bailey went on to say that he looks forward to the day when Jerovic is invited to meet the Japanese Prime Minister and the country’s emperor, thanks to the work that Jerovic has done to make Metaplanet a “systematic institution of Japan.”