Bitcoin has been trading at a critical level after successfully exceeding $110,000 in support, but market sentiment is still present. The recent defense in this zone has given the Bulls a temporary cushion, but sales pressures increase as volatility continues to drive uncertainty. Some analysts warn that if buyers can’t regain momentum, they could drop even further, putting Bitcoin’s resilience in tests.

Related readings

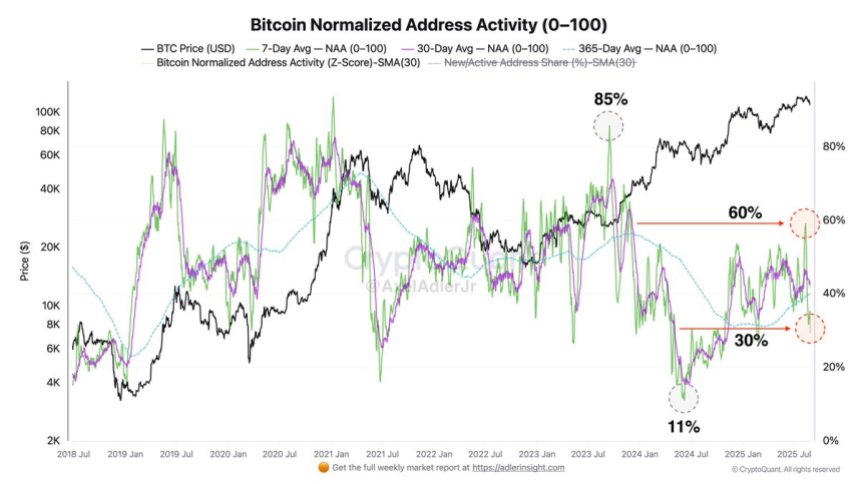

Top analyst Axel Adler highlights the key on-chain signals that shed light on the current market structure. According to Adler, Bitcoin’s Normalized Address Activity (NAA) fell sharply from 60% (a level where an all-time high of $124,000 was formed). This reduction reflects a clear cooling of transaction strength, with fewer coins moving in the chain. This indicates that short-term supply has weakened and immediate sales pressures have eased, but also raises doubts about whether there is sufficient demand to promote another gathering.

The balance between cooling activity and sustainable support is critical. If Bitcoin holds $110,000 and demand reappears, the market could stabilize. However, if volatility continues to put pressure on buyers, the risk of deeper corrections remains firmly on the table.

Bitcoin’s long-term seller base expands

Adler said Bitcoin’s short-term supply activity is chilled, but the long-term dynamics reveal a different story. Annual Normalized Address Activity (NAA) has now risen from 30% recorded when Bitcoin was trading nearly $80,000 to 40% now. This steady increase indicates that more holders want to realize profits at a higher level and gradually expand their seller base.

Due to context, the peak sales activity in this cycle occurred in September 2023. This reached 85% of the yearly NAA with around $37,000 in Bitcoin. It showed periods of heavy distribution at low ratings. In contrast, the current phase reflects a more balanced environment, with sales pressure rising compared to the beginning of the year, but still far below the peak cycle. Adler suggests that this positioning suggests that Bitcoin has entered the “mid-term” stage of distribution.

Nevertheless, price action emphasizes hesitancy. Bitcoin holds critical support at $110,000, but so far has failed to regain a higher supply zone that confirms bullish continuity. The market is currently located at an intersection, with speculation rising about the next major move. Whether buyers can overcome the growing long-term sales pressure could determine whether Bitcoin will stabilize for another rally or face a deeper correctional wave.

Related readings

Bulls push to test key level

Bitcoin has traded nearly $112,900 after pushing a string of volatile swings that exceeded $123,000 from its recent high. The chart highlights how BTC struggled to regain lost ground, and the resistance level still keeps the momentum in the short term. After defending the $110,000 zone, buyers are trying to recover, but the structure suggests that a more critical move is needed to change emotions.

Currently, BTC is below its 50-100-day moving averages and is hovering between $113,000 and $115,000. These levels form an immediate barrier for bulls and breaking over them is important for changing momentum in favor of upward pushes. A successful retest and retention of $115,000 could indicate an onset of updated strength, setting the stage for another attempt in the $120,000-$123,000 resistance zone.

Related readings

On the downside, if a higher intrusion fails, BTC becomes vulnerable. A refusal near current levels could open the door to another retest of $110,000 support, with a deeper risk of $108,000. Market sentiment is cautious, and the next few sessions could determine whether Bitcoin will regain bullish momentum or remain under pressure. For now, $115,000 stands as a key line of sand.

Dall-E special images, TradingView chart