Key takeout

- Bitcoin and altcoin fell into a broad crypto market decline ahead of the Jackson Hole speech of the Fed Chair.

- Market volatility increased as investors anticipated changes in the federal reservoir rate potential and responded to ongoing inflation concerns.

Please share this article

Bitcoin slipped under $113,000 on Tuesday, causing an overall market slump that sent Ethereum, XRP and Solana Lower. The total crypto sector fell to $3.8 trillion, down 3.5% that day.

Bitcoin prices fell nearly 3% on the last day, indicating a return to levels not seen since the beginning of the month, according to Coingecko data.

Ether has fallen more than 4% to $4,100 after flirting with record highs over the past few days. Losses spread across major altcoins, with XRP dropping by nearly 6%, Dogecoin and ChainLink taking over 5%, SEI and Cardano taking 8%.

The pullback will be in front of the Fed’s Jackson Hole symposium on Friday. There, Chairman Jerome Powell will be giving a keynote speech. The market is supporting whether it shows interest rate cuts in September or doubles inflation concerns, particularly after US inflation data provided with mixed signals in July.

Headline CPI slowed to 2.7%, but core inflation rose up to 3.1% and PPI increased by 3.3%. The combination of weakening employment growth and sustained price pressure can cause stag fear and complicate Fed decisions.

“The more than expected PPI numbers (producer prices rose 0.9% a month against 0.2% forecasts) complicate the Fed’s policy framework, so the market is looking for tips on Fed thinking before the policy meeting in September,” QCP Capital Analyst said in a statement. “Last year, Powell telegraphed the mitigation bias using Jackson Hole. This year, Trump’s tariffs and political pressures created a much more controversial background.”

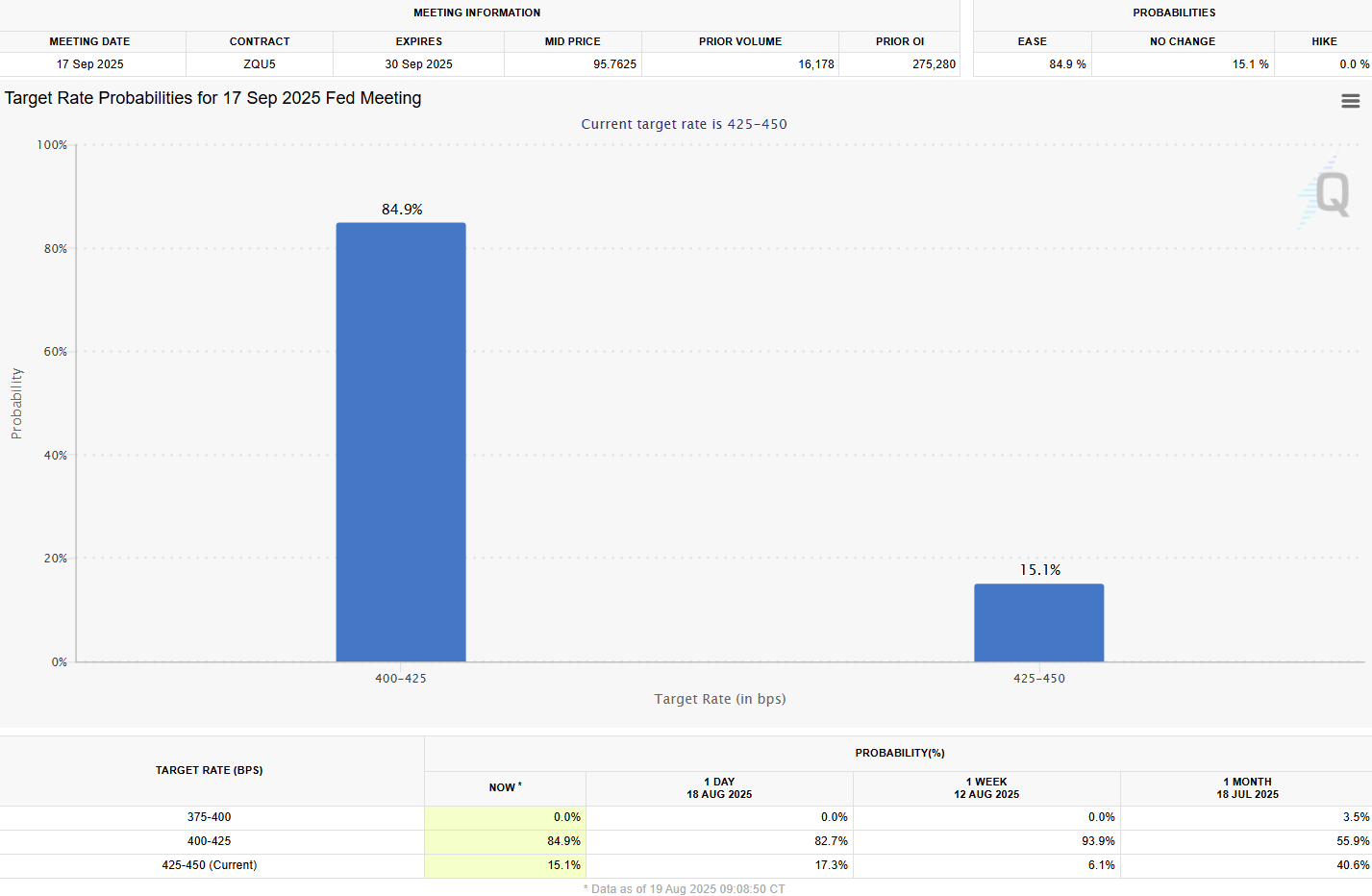

Traders are still priced at the FOMC meeting on September 17 with a 25 vegis point cut, but the odds have been eased after a hotter than expected inflation measurement.

Analysts predict that Powell will be cautious during his final Jackson Hole speech. The Fed’s chairman may acknowledge that employment and risks to inflation are balanced. It suggests that a cut may be appropriate if the trend continues, but it is unlikely to commit to certain policy measures.

The hint that actions could be delayed can feel like a tightening of investor policy, as expectations for a September cut have already been priced.

However, a signal that quantitative tightening could end or regulatory changes could be coming could boost liquidity and rekindle Bitcoin’s year-end rallies, analysts suggest.

Elsewhere, US stocks also reflect uncertainty with the market closure on Tuesday.

The S&P 500 fell nearly 0.6%, the NASDAQ composite fell by about 1.5%, and the Dow Jones industrial average was postponed.

Tech and Chipmakers led the losses, with Nvidia down 3.5%, AMD down 5.4% and Broadcom down 3.6%. Palantir sunks 9%, the worst S&P 500 performer, but Tesla, Meta and Netflix also skate.

Please share this article