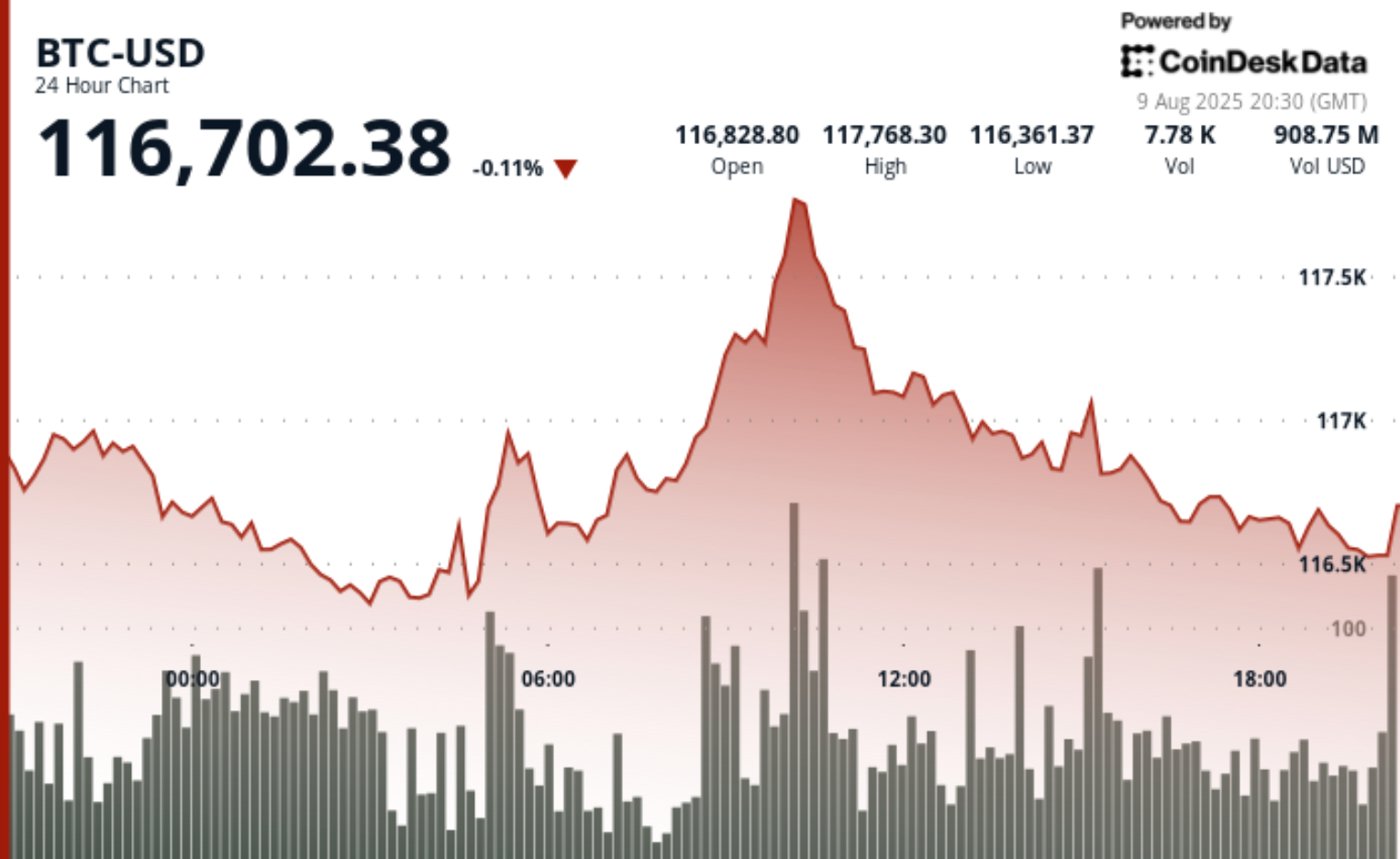

Bitcoin has reduced its 0.11% to $116,702 over the last 24 hours, up 25% per year, according to Coindesk data. From this year (YTD) Performance is second only to Gold’s 29% increase in the major asset classes, according to data shared by financial strategist Charlie Billelo at X.

Previous performances in 2025

As of August 8, Bitcoin’s 25% return from the start of the year ranked only in Gold’s 29.3% advance. Other major asset classes recorded more modest earnings with new market shares (VWO) 15.6% increase, Nasdaq 100 (QQQ) Large US caps increased by 12.7% (spy) A rise of 9.4%. Meanwhile, the US midcap (MDY) And a small cap (IWM) 0.2% only increased by 0.8% each. This is the first time Gold and Bitcoin have taken the top two positions in Billello’s annual asset class rankings since the start of records.

2011-2025 Cumulative Returns

In the long term, Bitcoin has provided an extraordinary 38,897,420% gross revenue since 2011. This is the number that warps all other asset classes in the dataset. A cumulative return of 126% of gold over the same period places it in the middle of the pack and follows an equity benchmark like the Nasdaq 100 (1101%) And our big cap (559%)as well as the mid cap (316%)small cap (244%) and emerging market stocks (57%). Based on Billello’s figures, Bitcoin’s total revenue has surpassed gold’s total revenue by more than 308,000 times over the past 14 years.

2011-2025 Annual Returns

Measured on an annual basis, the advantage of Bitcoin is equally clear. The flagship cryptocurrency has brought an average annual increase of 141.7% since 2011, but from 5.7% in gold, 18.6% in the NASDAQ 100, 13.8% in the US large cap and 4.4% to 16.4% in other major stock and real estate indexes. Gold’s long-term stability has become a valuable hedge in certain market cycles, but its viewing pace has been much slower than Bitcoin’s exponential climb.

According to Peter Brandt, Gold vs Bitcoin

Famous trader Peter Brandt showed weight on August 8, contrasting the merits of gold with the merits of value as a store with the potential for bitcoin beyond all Fiat alternatives. “Some people think gold is a great store worth it, but that’s true. But it proves that the ultimate storage of value is Bitcoin,” he said in X, sharing a long-term chart of the US dollar’s purchasing power. His comments recurs the growth of the narrative that bitcoin’s rarity and decentralization have led to its own position over time as it is superior to traditional hedges.

Looking ahead

Bitcoin’s ability to hold more than six figures in 2025 while maintaining top two performance among key assets highlights its resilience in the background of volatile macros. Traders are looking at whether they can retest the annual peak nearly $123,000, but long-term holders point to their outperformance as evidence of their long-established retention since 2011. Market participants say future macro data and risk appetite for stocks and products can set the tone for the next leg.