Michael Saylor’s controversial Bitcoin financial strategy is no longer bound. It is imitated in America. According to a recent Wall Street Journal report, the company raised more than $85 billion in 2025 to purchase the company’s Treasury Department cryptocurrency.

Unlike in 2020, when MicroStrategy’s Saylor stood alone in selling stocks to buy Bitcoin, a new wave of companies, from toy makers to semiconductor companies, is implementing similar strategies to supporting institutions. Capital Group, Galaxy Digital, and D1 Capital are among the companies that pour cash into companies that raise funds to accumulate digital assets directly. Surges are extended beyond Bitcoin and contain lesser known tokens, often with a higher reward profile for risk.

One of the most notable examples is Hyperliquid Strategies Inc. (HSI), a public cryptocurrency company founded to hold large reserves of hype, a native token of high lipid blockchains.

How to Create an HSI: Atlas and Sonnet Join Forces

The HSI initiative was first disclosed on July 14th, when Sonnet Biotherapeutics (Sonn) announced a reverse merger with Rorschach I LLC, a newly formed vehicle backed by Atlas Merchant Capital, Paradigm and other well-known crypto investors. The agreement will transform Sonnet into a platform for implementing corporate cryptocurrency strategies that focus on hype, which is a native token of high lipid blockchains, rather than bitcoin or ether.

Upon closing, the composite entity will be renamed Hyperliquid Strategies Inc. (HSI) and will continue trading on the NASDAQ Capital Market. HSI initially holds 12.6 million hype tokens worth $583 million at the time of signing, and will roll out at least $355 million to acquire additional hype in the open market. If fully executed, this creates one of the largest institutional reserves of a single Altcoin ever disclosed.

According to Atlas CEO Bob Diamond, the new company chairman, Bob Diamond, the opportunity is not just financial, but strategic. In his words, “I think the hype is pretty special.” Diamond believes that high lipids provide differentiated products in the digital asset space, and that HSI is uniquely positioned to capitalize on its use because it combines encryption with traditional financial leadership.

Paradigm co-founder Matt Fan said institutional demand for high lipids is on the rise, but noted that direct access to hype tokens is still limited in the US.

Sonnet will become a wholly owned subsidiary of HSI and will continue to manage its biotech program, but the company plans to sell its non-core assets. Existing investors will receive conditional value rights (CVRs) associated with Sonnet’s treatment portfolio.

The HSI board includes former Boston Federal Reserve Presidents Bob Diamond and Eric Rosengren, along with the following financial leadership: The deal is supported by Galaxy Digital, Pantera Capital, D1 Capital, Republic Digital and 683 Capital and is expected to close in the second half of 2025.

What are high lipids and how do hype tokens work?

High lipids are the name of distributed exchange (DEX) and are high performance layer-1 blockchains released in 2023. It is designed to provide transparency and unauthorized access to centralized exchange speed and trading experience with transparency and decentralized finance (DEFI).

Its infrastructure includes two core layers.

- Hypercore trades fast spots and permanent futures with on-chain orders.

- HypereVM, a generic smart contract layer compatible with Ethereum, allows developers to build Defi applications that can interact with Hypercore’s liquidity.

Hype is a native token of high lipid ecosystems. It is used as a core asset for staking, governance, trading incentives, and value capture across the network. At the time of writing, the hype was the 15th largest cryptocurrency by market capitalization, with high lipids dealing with cumulative trading volumes of over $1 trillion.

Analyst Comments: Strong Basics, Branch View

The surge in institutional attention has not resolved the debate on the declaration of hype despite strong rallies from the $37.41 minimum to nearly $50 from the strong rallies earlier this quarter (which reached July 14th).

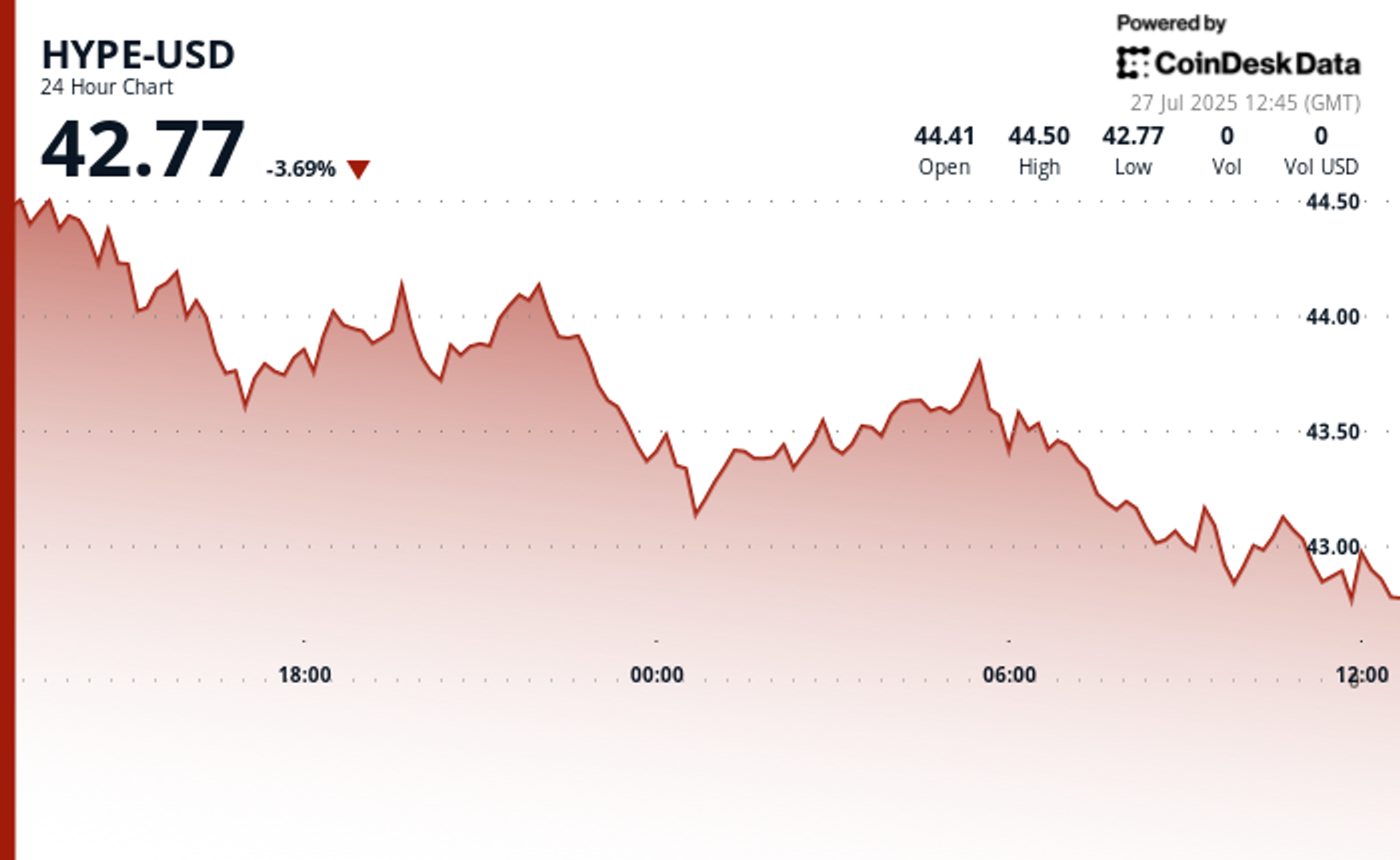

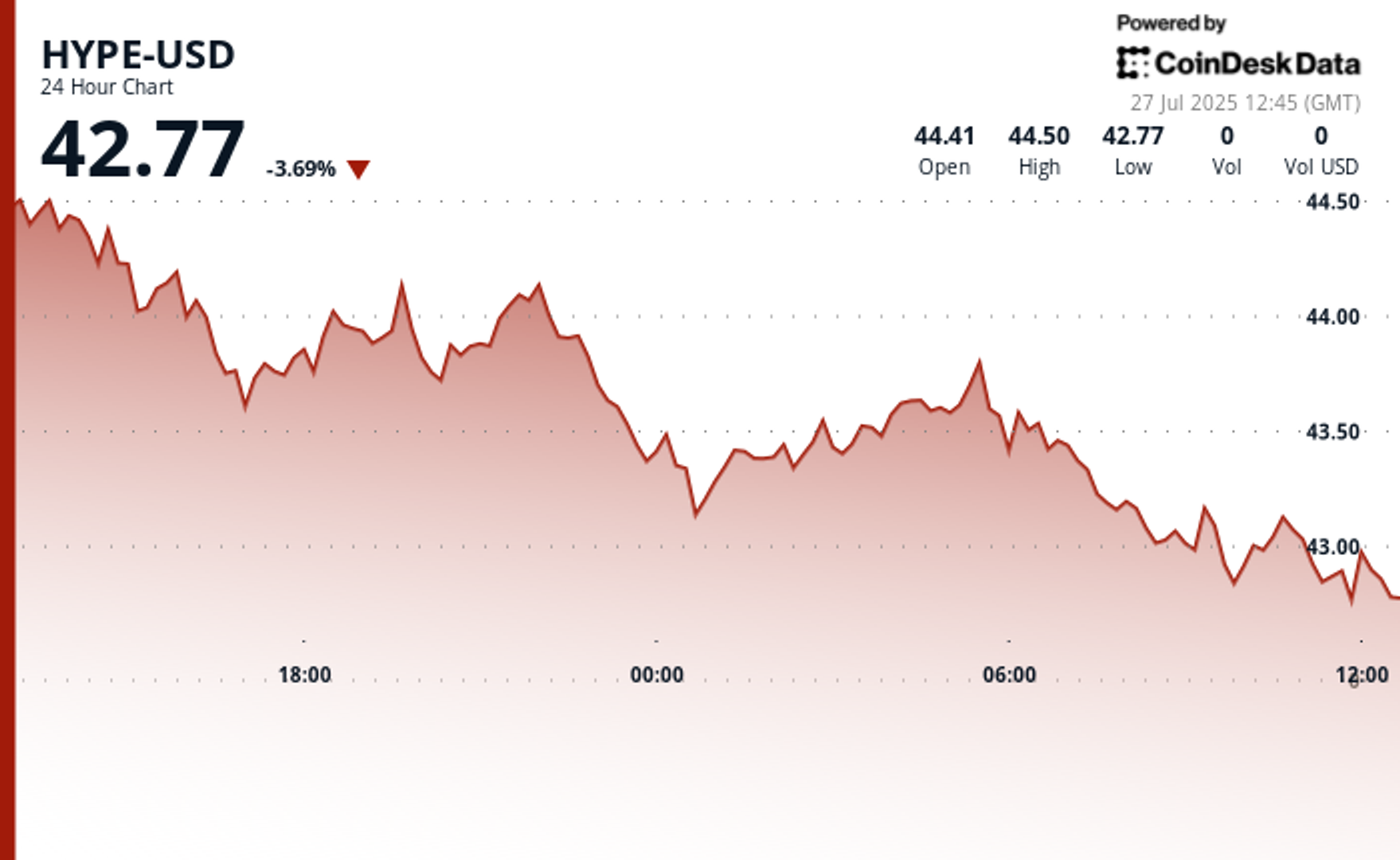

At the time of writing, YPE, which fell 3.69% over the past 24 hours, is trading at $42.77, according to Coindesk data.

Crypto analyst McKenna on Saturday suggested that hype could still be undervalued based on revenue metrics. He estimated that if the token is trading at the same valuation multiple (called revenue from SWPE, or sales weighted price), if it reaches the last market peak, the current 30-day average revenue means a fair price of $77. His analysis uses a ratio that compares market capitalization with subsequent platform revenues. This is a common method for both stock analysis and token analysis.

In contrast, “Altcoin Sherpa” brought attention early today. He praised the foundations of hype, including high user activity, reliable toconomics and powerful team executions, but he said that moving from $9 to $40 or more likely has exhausted short-term benefits. He said he has held a small staking position due to long-term exposure but has not actively accumulated at current prices. He suggested waiting for a more substantial pullback before increasing the allocation.

The two views show important tensions. Even with high income and institutional support, tokens like hype can be over-expanded in the short term, especially when driven by narrative momentum and speculative capital.

Institutional Altcoin bets are just beginning

Whether the hype continues from here or the cools continues, the creation of Hyperliquid Strategies Inc (HSI) represents a turning point in how a company’s cryptocurrency strategy is being implemented. Unlike previous models that focused on Bitcoin as a digital reserve asset, HSI is built around a single Altcoin that did not exist a year ago. Combining more than $888 million in tokens and cash commitments, this structure is similar to thematic crypto funds, but with public listings and institutional leadership.

If this approach proves successful, more companies could continue. We believe that we will define the next stage of digital finance to not only retain the crypto but also to take a token-focused position.