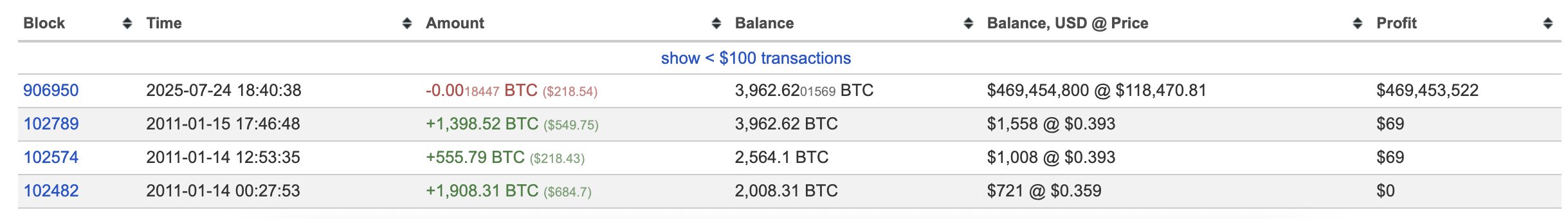

The 2011 Bitcoin Zilla suddenly came to life and ran 3,962 BTC. Here’s how much profit OG made on the ancient stack:

Bitcoin Zilla showed movement after 14.5 years of silence

In X’s post, the thrutin chain in chains pointed out that 14.5 years ago Bitcoin Zilla’s wallet finally broke today’s dormant. The wallet in question received 3,962 BTC in January 2011.

At the time, cryptocurrency was trading for around $0.37, so that would have only been around $1,460. After collecting this total, the investors’ addresses were completely cold.

By forgetting its existence or leaving the key behind, it could have been lost. This is generally the most likely reason behind a wallet that will remain dormant for a long period of time. An unthinkable explanation may be that silence corresponded to the deliberate hadling by investors.

In any case, the wallet finally showed activity early today, creating a test transaction of 0.0018 BTC.

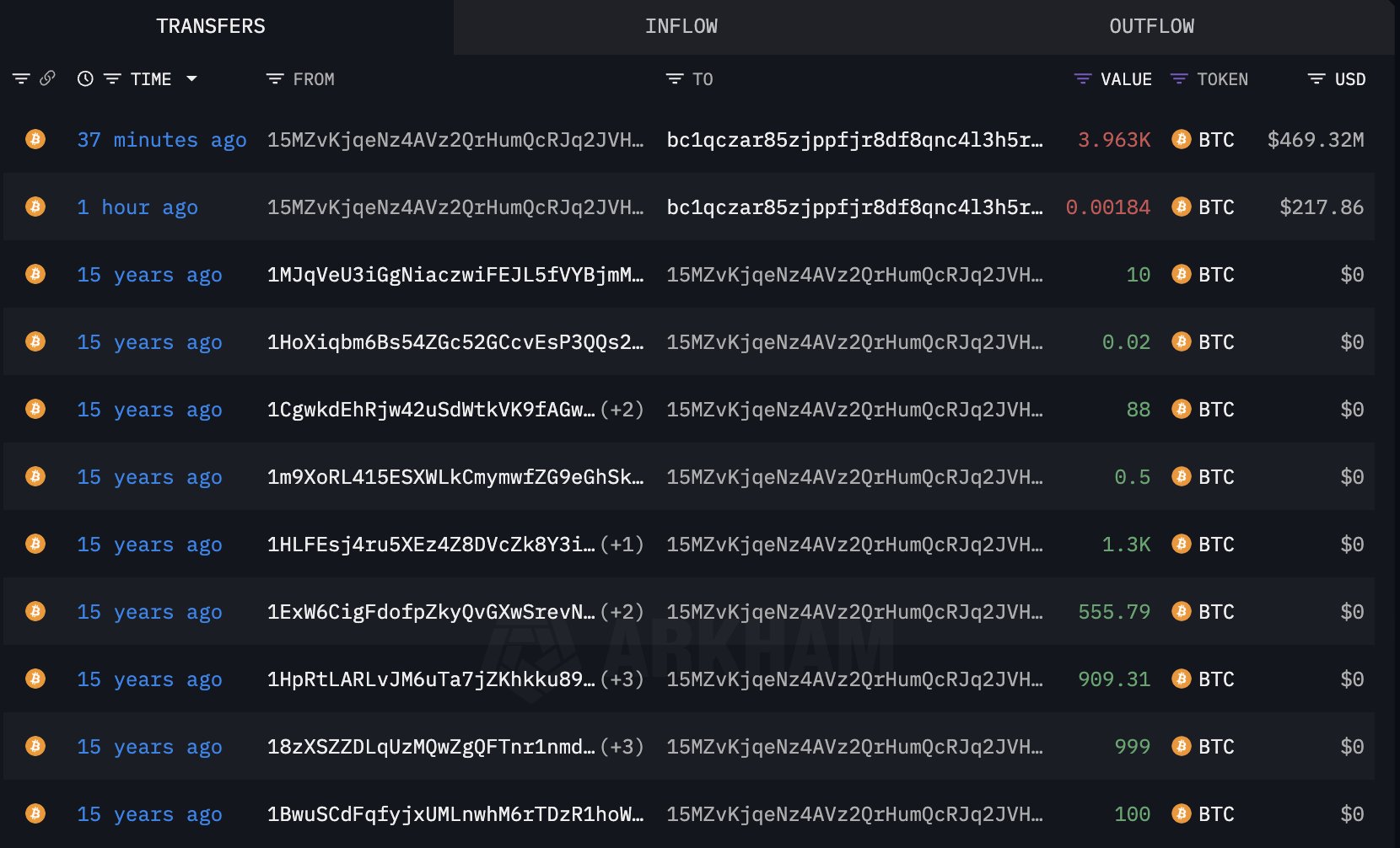

The transfer history of the whale | Source: @lookonchain on X

And now it’s completely empty and I’ve transferred the coin into a new wallet.

The latest transaction made by the ancient investor | Source: @lookonchain on X

At the time of this new transaction, the wallet’s 3,962 BTC stack was worth a whopping $469 million. The initial investment was only about $1,460, but this huge amount is virtually all profit.

Generally, when dormant wallets move coins, it is a sign that they plan to sell. If this is the case for the current address, then the problem is: Assuming that the wallet was actually lost, it could have been rediscovered now. So it may have been simply impossible to shift these coins up until now.

But in a scenario where Bitcoin wallets have been rediscovered previously or investors have never actually lost access, it may be because the current Bull Run Highs looked like a handy window for ultimately cashing out.

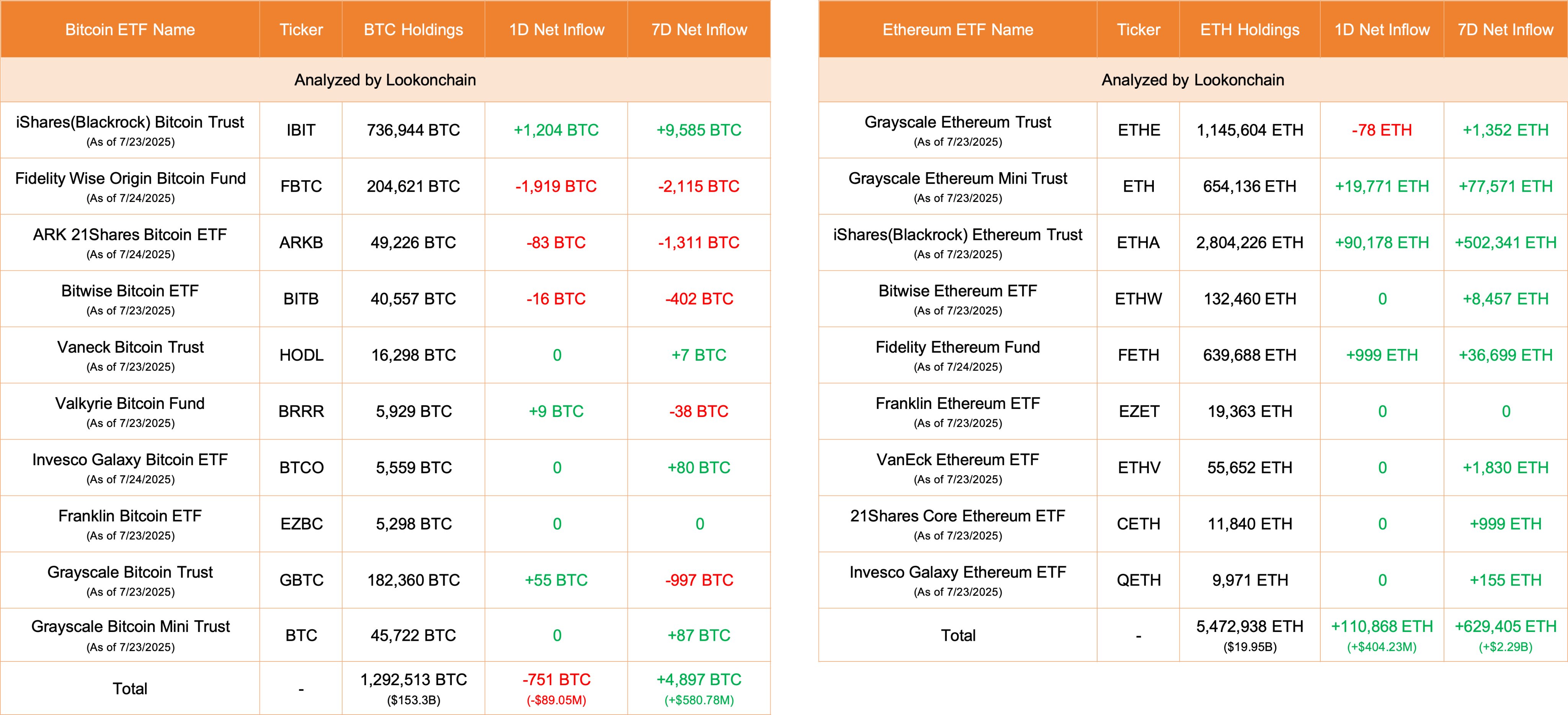

In another X post, LookonChain shared the latest inflow/outflow data for Bitcoin and Ethereum Exchange Trade Funds (ETFs).

Looks like the number one cryptocurrency observed ETF net outflows on July 24th | Source: @lookonchain on X

As mentioned above, the 7-day ETF Netflow is currently testing positive for both Bitcoin and Ethereum, while the daily Netflow prints negative values for the former. In total, 751 BTC ($89 million) left the ETF on the past day. Fidelity’s FBTC leads the outflow, with 1,919 BTC ($227 million) leaving the fund.

In contrast, ETH ETF saw a significant influx of 110,868 ($404 million) tokens in the same window.

BTC price

At the time of writing, Bitcoin has remained the same for a week, bringing it to around $118,900.

The trend in the BTC price over the last five days | Source: BTCUSDT on TradingView

Dall-E featured images, charts on tradingView.com

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.