Important takeouts:

- Bitcoin hits historic ATH at $122,604driven by institutional demand and ETF inflows.

- Former Binance CEO CZ warns that current ATH may soon look minorrecalls the rise in BTC from $1,000 in 2017.

- Spot the rise in Bitcoin ETF and global adoption Since early 2024, the price of BTC has been increased by more than 215%.

The surge in Bitcoin prices has rekindled bullish sentiment across the crypto world. On July 14, 2025, Bitcoin beat $122,000, hitting the highest ever high that could have been imagined just a few years ago. But as retailers celebrate, Binance founder Changpeng “CZ” Zhao offers a calming reminder. Today’s AT could be a footnote for tomorrow.

Read more: CZ Warning Bitcoin Seller: “Regret 77,000 is Real” – Why Long-term Charts Matter

Bitcoin is over $122,000: A New Era of Ass

Bitcoin surged past the $120,000 mark and climbed just as high $122,604 Monday, according to TradingView data. This shift has risen 3.5% within 24 hours, supported by a burgeoning volume, with the blow of institutional profits.

Historical growth and milestone indicators

With recent rises, BTC has become the fifth largest asset of global market capitalization, only after Apple, Microsoft, Nvidia and Gold. The market capitalization exceeds the current state $2.43 trillionpress beyond Amazon.

Additionally, daily volumes have increased significantly, up 94.2% from the previous day, to over $44 billion on exchanges such as Binance, KCEX and Coinw.

This latest breakout follows a trend observed since the SEC placed a mark of approval in early 2024 to find Bitcoin ETFs. Meanwhile, Bitcoin has skyrocketed over 215%, confirming the notion that traditional finance is embracing crypto.

CZ reflects: “This is just the beginning.”

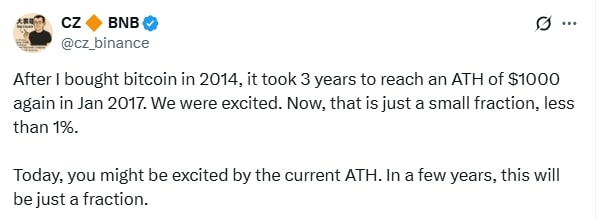

In the midst of excitement, Former Binance CEO CZ I reminded my 8.6 million followers on X (formerly Twitter) with the big picture in mind. Remember his personal history with CZ and Bitcoin I wrote it:

“After purchasing Bitcoin in 2014, it took me three years to reach another $1,000 ATH in January 2017. We were excited. Now it’s a small percentage, under 1%. Today, you’ll only be a few times in a few years.”

CZ’s postframe today’s highs are not the highest ever, but as another plateau where ALCM has risen. His belief in the BTC’s long-term outlook remains intact even after he rose to Binance’s CEO rank at the end of the year, facing a specific dispute with regulations at the end of the year.

Those who lived to see BTC develop from obscurity to global financial players. According to CZ, the excitement of around $122,000 could soon turn pale compared to future ratings.

Institutional demand and spot ETFs are fueled by gatherings

The recent stages of Bitcoin prices are more than just “speculation.” Much of the momentum is driven by the increased acceptance of Bitcoin as a facility-grade asset.

Large capital and asset managers have been continuing to add funds since the US Spot Bitcoin ETF received Go-Anead from the SEC in January 2024. These ETFs are subject to BTC in some cases to classic investors who shun Crypto assets, some with regulatory concerns.

This opened the BTC to retirement portfolios, donations and pension funds. And as the new class of long-term holders grew, overall volatility declined, helping Bitcoin attract the first dollar from its mainstream portfolio.

The percentage of BTC held by long-term holders is currently a record high of 69%. This is a development that matches CZ sentiment, and Humungous’s numbers prove that spot rate ratings are the early stages of Bitcoin’s global monetization journey.

Read more: Bitcoin hits new ATH. This makes sense for BTCBull and why could it be a potential crypto pre-sales?

Market sentiment and pullback concerns

Analysts warn that the rally has generated excessive enthusiasm.

The code’s fear and greedy index is currently 74, indicating a strong “greed.” Such measurements are usually followed by modest corrections, as they are usually over-zealous markets to overshoot before regaining themselves.

Still, long-term followers in the CZ type remain inevitable. For them, the limited supply of BTC, the distributed structure and increased awareness around the world means instantaneous volatility is not important. As CZ’s post suggests, prices could be pulled back, but the overall trajectory is rising.

Bitcoin location in global assets

The rest of the performance of Bitcoin prices will be a completely different ball game. It was then withdrawn as a macro asset likened to gold and as a hedge against cash devaluation and inflation.

Since 2024, several central banks in countries such as Nigeria, Turkey and Argentina have begun experimenting with BTC and Stablecoins as alternatives to local currencies for illness. These big picture shifts provide fertile ground for Bitcoin in the long run.

Additionally, sovereign adoption is potentially on the horizon. As El Salvador and the Central African Republic have already set out to test it as Bitcoin’s legal currency, there is growing speculation that the G20 will add BTC as a reserve asset before 2030.