Key takeout

- Bitcoin reached its new all-time high of $119,300 ahead of the key cryptographic debate.

- Future bills in Congress could have a major impact on crypto regulations and stubcoin issuance.

Please share this article

Bitcoin hit a new record high of $119,300 on Sunday, ahead of a week when bullish sentiment could potentially change the crypto industry’s game.

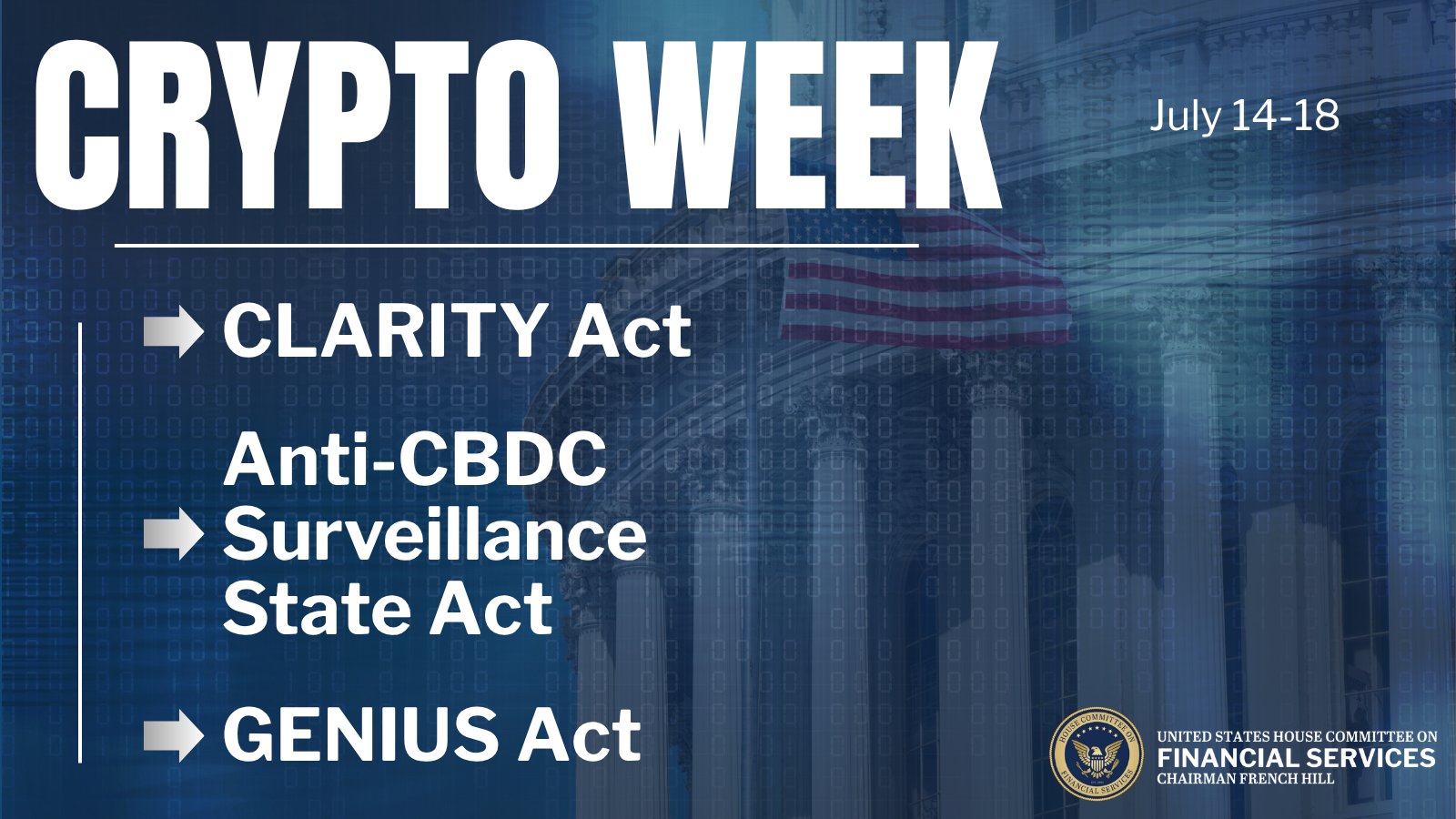

The U.S. House Financial Services Committee designates the week that begins July 14 as “crypto week,” during which lawmakers will discuss three important bills aimed at providing a clear regulatory framework for digital assets, stubcoin and blockchain technology.

The legislative package includes the Digital Asset Market Clarity Act. This grants the Commodity Futures Trading Commission’s exclusive surveillance scope to the Commodity Futures Trading Commission and provides exemptions from established blockchain networks.

Another bill, the Genius Act, allows private companies to issue Stablecoins with full cashbacking, but the anti-CBDC surveillance national law seeks to prevent the creation of a digital currency for the US central bank.

Bitcoin prices have risen 9.5% over the past week, increasing the previous year to 27%, according to TradingView data.

The latest rally, with Bitcoin surpassing $112,000 earlier this week, is supported by anticipated financial easing, a strong influx of spot Bitcoin ETFs and increased corporate recruitment.

Analysts believe BTC is at $130,000 before the year-end revision

According to John Glover, chief investment officer of Digital Asset Platform, Bitcoin’s latest rally set the stage for a potential final leg in the current multi-year bull cycle.

In a note shared with Crypto Briefing, Glover said Bitcoin’s recent move to a new all-time high is a clear signal that the next leg of the Bull Run is ongoing. He said the recent decline to $96,000 seemed to clear the path to continued benefits.

“We’ve finally infiltrated a new high, which confirms that the dip to $96,000 in late June filled the wave (ii) pullback (yellow line) within the larger wave 5 (orange line),” Glover explained.

“This isn’t changing the ultimate goal of around $136,000 to complete this bull run, but it could reduce the time it takes to complete. I previously looked for this in the first quarter of 2026, and now it appears that it’s likely to reach $136k by the end of the year,” the analyst said.

Glover predicted that the Bitcoin bull market could peak at the end of the year and move to $130,000, followed by a short-term revision, followed by a final rally of $136,000.

“The Wave (III) has finished nearly $130,000, so please correct your current levels and collect a $136K target until the end of this year,” he said. “This marks the conclusion of the five wave movements that have occurred over the past three years, which completes the ‘supercycle’ wave three.

As for what comes next, Glover believes that a healthy correction could follow after the Bull Run before Bitcoin resumes its upward trajectory.

He hopes Bitcoin will trace the $91,000 to $109,000 range and maintain long-term bullish momentum while providing potential re-entry points for investors.

Please share this article