Important takeouts:

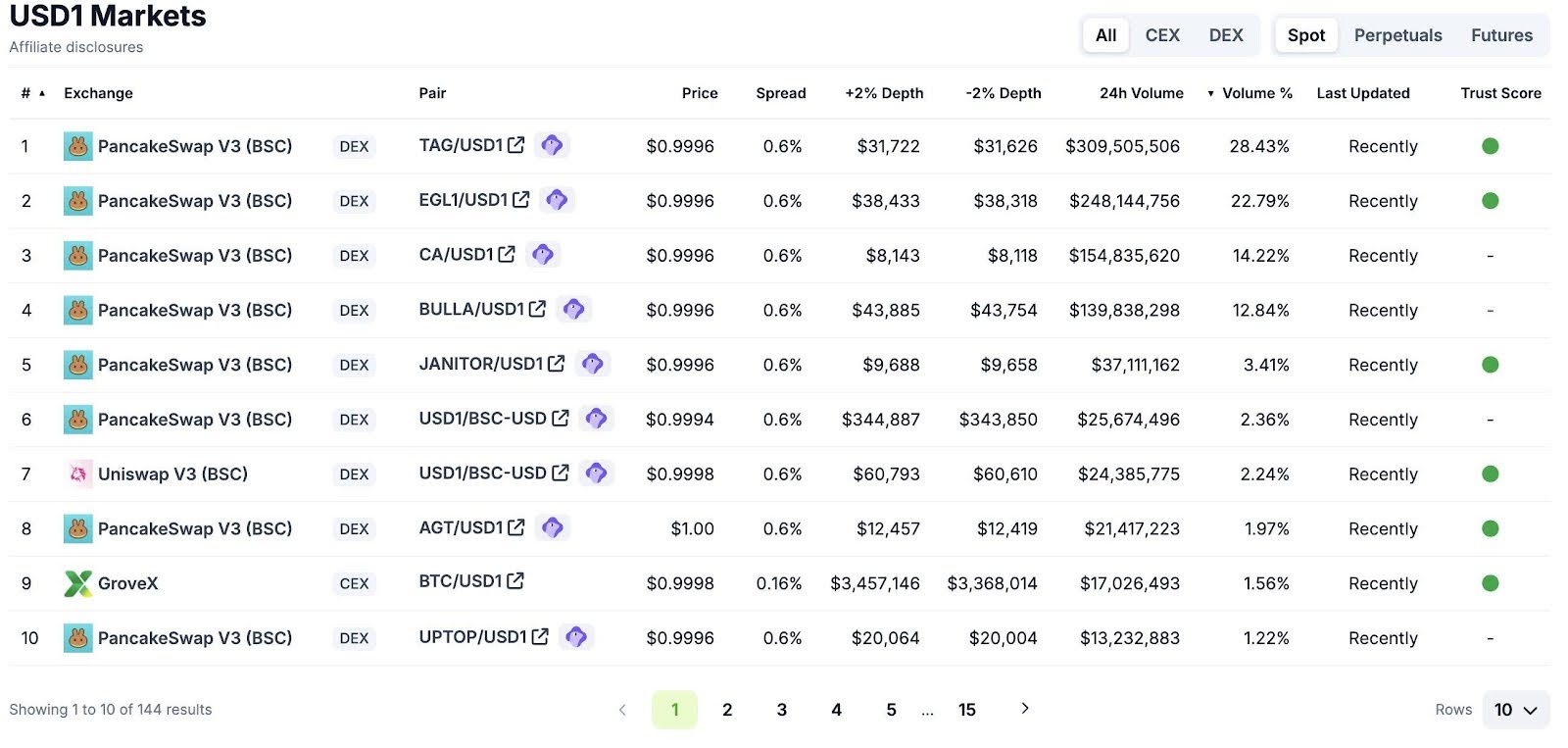

- WLFI $USD1, a stubcoin tied to Trump’s camp, has achieved $1.25 billion in daily trading volume

- The volume, nearly $991 million, comes from just 10 trading pairs, mostly Pancakeswap V3

- Market Observers point to rapid growth as a reliable threat to stable giants like USDT

The crypto market has witnessed an unexpected breakout. WLFI $USD1, an idiot imposed in dollars sponsored by an entity related to former US President Donald Trump 24-hour volume total of $1.25 billion. These spikes didn’t just raise eyebrows. This notifies top stub coins that include USDT.

The rise of WLFI meteors: from quiet launches to market Discruptor

USD1 is not the average stubcoin. It was launched without much fanfare and now, because of what is happening in the market, it is now a subject of intense interest. Based on on-chain data, the 24-hour volume of tokens surged to $1.25 billion on June 29, 2025, bringing about $991 million from the first 10 trading pairs.

Much of the liquidity is poured into the PancakesWap V3 of Binance Smart Chain (BSC), which currently serves as the WLFI primary ecosystem. Analysts believe this is a strategic play to quickly increase user participation using BSC’s low fees and deep liquidity.

What is even more noteworthy is that WLFI was able to achieve this volume with minimal exposure from CEX. Most volumes come from Defi applications, suggesting an increase in demand for steady coins in decentralized finance and the possibility of frustration with the way legacy players like USDT and USDC have been doing their own.

Read more: Despite portfolio losses, World Liberty Financial invests $4 million in Avax and MNT

A token supported by Trump? Political Association Unpacking

WLFI has not come explicitly from Donald Trump or his campaign, but its brand and supporters are a direct sloop line into his political foundation. Promoting Stablecoin is a crypto influencer associated with helping Trump run in 2024. WLFI is rumoured to be supported by donors and supporters from within Trump’s circle.

These appear to be sold to lean meat, which eats retail investors and politically active traders. It’s not very similar to the humorous rise of so-called tokens of memes like Magazines and Trump Coins, but unlike those highly volatile meme coins, WLFI is constructed in theory to give it theoretically when it comes to perceived trust and usefulness.

The Trump Association is certainly a hot topic, but the interest of WLFI’s liquidity and technological development is what makes people interested.

Read more: Trump’s World Liberty Financial introduces USD1 stablecoin backed by the US Treasury Department

Stablecoin Market Dynamics: WLFI vs. The Titans

Can WLFI challenge USDT domination?

Tether (USDT) and Circle’s USDC have long been Stablecoin Stars, USDT has led the Defi volume, and USDC is the choice of compliance and institutional use. But newcomers like WLFI have revealed market demand for other options.

WLFI’s $1.25 billion volume day puts it in the race to gain top position in the central standard coin market, at least in the short term. For comparison:

- USDT usually records between $5-7 billion each day, which includes Hundreds of trading pairs are found on many exchanges

- WLFI achieved Over 1.7% of the daily volume of USDT in one dayNo support from major central exchanges such as Binance and Coinbase

The rapid movement within WLFI DEFI could indicate that users are experimenting as a hyperfluid alternative for swapping, yield agriculture and collateral.

On-chain metrics suggest organic growth

On-chain data shows that WLFI liquidity pools have acquired tens of thousands of unique wallet addresses, meaning that the authentic community of individual users is different from bots and wash trade initiatives.

Important numbers:

- Over 17,000 active wallets in WLFI trading pairs in the last 24 hours

- A $350 million WLFI was trapped in Defi, spreading primarily to BSC and Ethereum Bridges

- Stablecoin is loyal to the US dollar within ±0.1% and is a solid performance metric for new tokens

These statistics also increase the reliability of WLFI as a long-term operation. For a few skeptics, the promotional trick may simply cause surges, but volume, PEG, and user interactions remain in good condition for sustainable growth.

Regulation questions are approaching

Despite the rapid expansion, the legal status of WLFI is unknown. And given that it is a token of the Dollar Family, which is primarily used in Defi, it can attract the attention of US regulators, especially if its supporters include politicians and donors from major campaigns.

Regulators have recently stepped up scrutiny of stubcoins, particularly those that have grown rapidly and have not fully disclosed their reserves. WLFI claims to be 100% hedged with cash equivalent goods, but has yet to look at audited finances.

If WLFI plans to expand and potentially promote transactions in centralized exchanges, regulators are necessary to provide clarity and transparency.

Amidst increasing volumes, media exposure and rebellious momentum, WLFI has reached a pivotal inflection point.