Digital Asset Platform Bakkt Holdings Inc. has filed a shelving registration with the U.S. Securities and Exchange Commission (SEC) to raise up to $1 billion.

The company says the funds could be used to support new Bitcoin and digital asset investment strategies. This is a major change for the company.

Bakkt, published and supported by Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, may sell a mix of common stock, preferred stock, debt certificates and warrants.

The funds raised can be used for general corporate purposes or to purchase Bitcoin for the Ministry of Finance.

“We may use excess cash, revenue from future stock or debt financing, or other sources of capital to acquire Bitcoin or other digital assets.” The company said in its SEC filing.

Shelf registration filed on June 26th allows BAKKT to provide these securities at any time if necessary. This gives you the flexibility to quickly raise funds without submitting new documents every time you sell your securities.

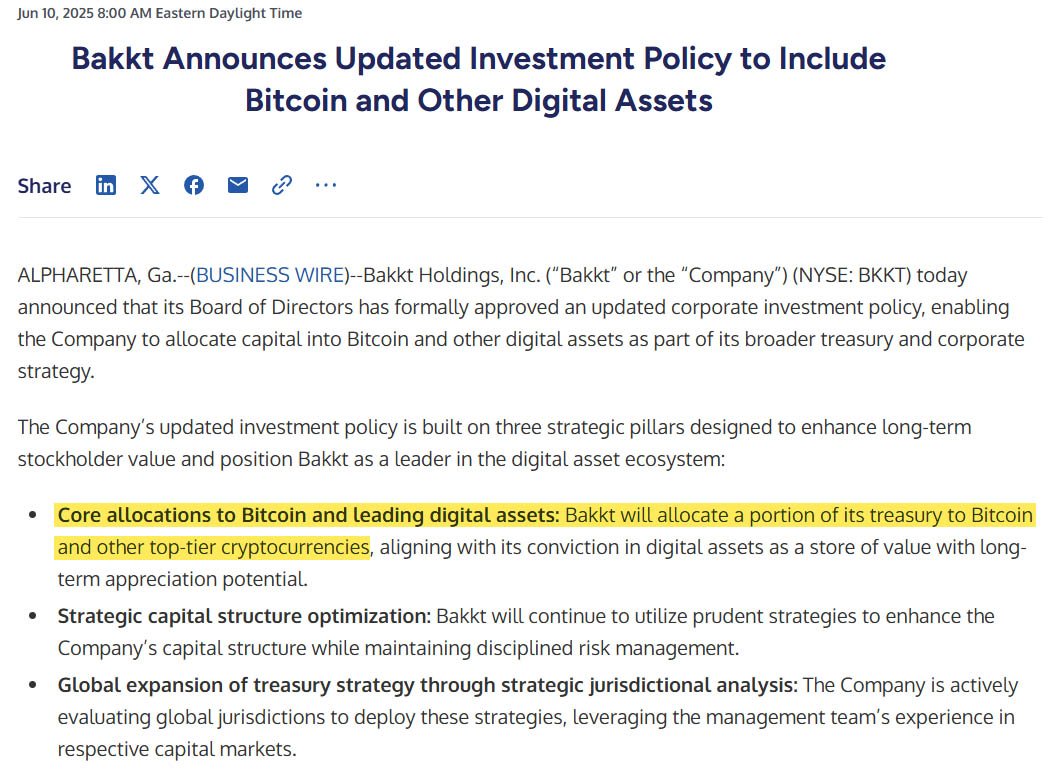

This follows a major decision by our board of directors that approved the investment policy updated on June 10th. This new policy allows companies to include Bitcoin and other digital assets as part of their broader financial and corporate strategy.

Bakkt has not yet bought Bitcoin, but the company says it is ready for the right moment.

The company said it is based on the amount of digital assets it purchases, market conditions, capital market response, the company’s financial performance and other strategic priorities.

Founded in 2018, Bakkt originally provided physically set Bitcoin futures. Over the years, it has also attempted tokenized loyalty rewards and digital asset management services, but these efforts have not gained much traction.

Currently, the company has established itself as a “pure play crypto infrastructure company” with the aim of international expansion and digital financial management.

“This initiative is intended to support BAKKT’s transformation into a purely play crypto infrastructure company.” said Akshay Naheta, co-CEO of Bakkt.

“We believe this multifaceted approach reflects our belief in the future of digital assets and our vision for BAKKT as a leader in the world of internationally and programmable money.”

The company’s leadership also mentioned new global opportunities, particularly in Asia, where countries such as Singapore and Hong Kong have more regulatory clarity and liquidity in the digital assets sector.

“Bakkt’s jurisdictional flexible strategy is well positioned to succeed in Asia,” he said. said Charmaine Tam of Hex Trust. He said markets like Hong Kong and Singapore have clear regulations, deep liquidity and a mature financial system, making them perfect for digital asset play for their institutions.

Despite the big plans, Bakkt is still struggling financially. The company confirmed in its application that it has a “restricted operating history” and a “history of operating losses.”

They also lost large recent clients, including Bank of America and Webull, who refused to renew their contract.

This raised questions about the long-term viability of the company.